Question: 3. Consider the information in the table below regarding securities K and L: Price Expected dividend Expected ex-dividend price Standard Correlation with Security today in

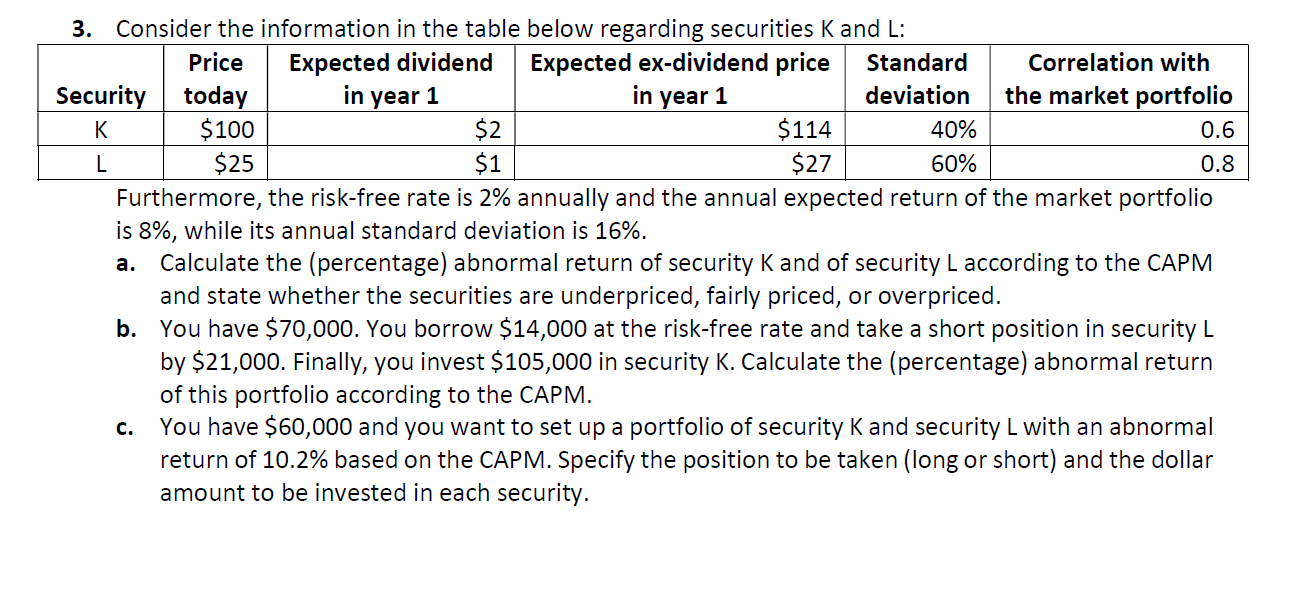

3. Consider the information in the table below regarding securities K and L: Price Expected dividend Expected ex-dividend price Standard Correlation with Security today in year 1 in year 1 deviation the market portfolio K $100 $2 $114 40% 0.6 L $25 $1 $27 60% 0.8 Furthermore, the risk-free rate is 2% annually and the annual expected return of the market portfolio is 8%, while its annual standard deviation is 16%. Calculate the (percentage) abnormal return of security K and of security L according to the CAPM and state whether the securities are underpriced, fairly priced, or overpriced. b. You have $70,000. You borrow $14,000 at the risk-free rate and take a short position in security L by $21,000. Finally, you invest $105,000 in security K. Calculate the (percentage) abnormal return of this portfolio according to the CAPM. You have $60,000 and you want to set up a portfolio of security K and security L with an abnormal return of 10.2% based on the CAPM. Specify the position to be taken (long or short) and the dollar amount to be invested in each security. a. C. 3. Consider the information in the table below regarding securities K and L: Price Expected dividend Expected ex-dividend price Standard Correlation with Security today in year 1 in year 1 deviation the market portfolio K $100 $2 $114 40% 0.6 L $25 $1 $27 60% 0.8 Furthermore, the risk-free rate is 2% annually and the annual expected return of the market portfolio is 8%, while its annual standard deviation is 16%. Calculate the (percentage) abnormal return of security K and of security L according to the CAPM and state whether the securities are underpriced, fairly priced, or overpriced. b. You have $70,000. You borrow $14,000 at the risk-free rate and take a short position in security L by $21,000. Finally, you invest $105,000 in security K. Calculate the (percentage) abnormal return of this portfolio according to the CAPM. You have $60,000 and you want to set up a portfolio of security K and security L with an abnormal return of 10.2% based on the CAPM. Specify the position to be taken (long or short) and the dollar amount to be invested in each security. a. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts