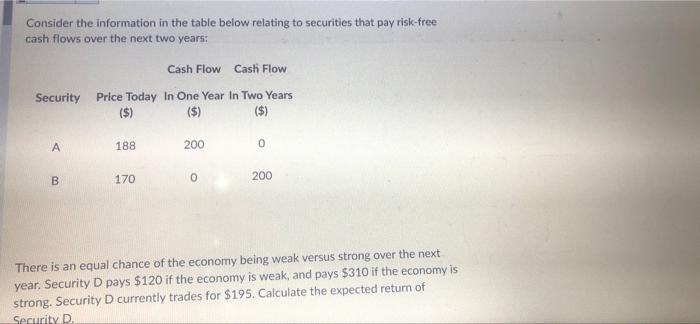

Question: Consider the information in the table below relating to securities that pay risk-free cash flows over the next two years: Security Price Today ($) A

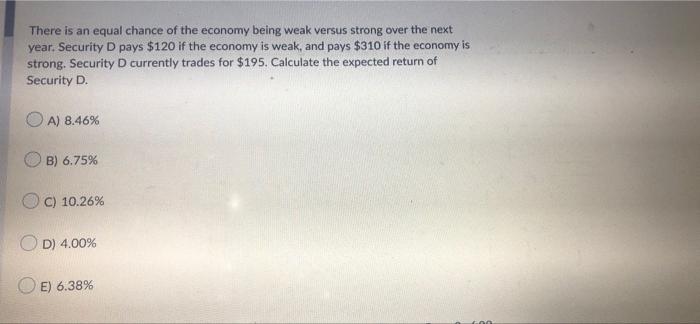

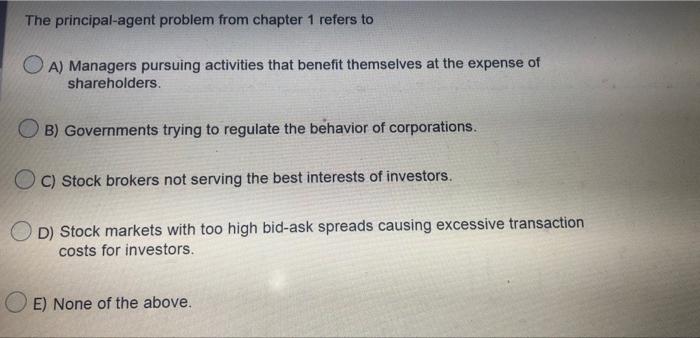

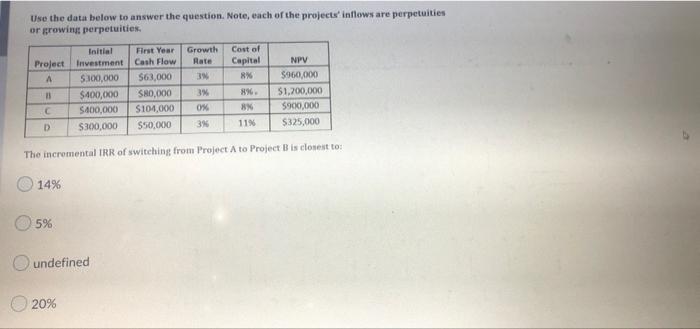

Consider the information in the table below relating to securities that pay risk-free cash flows over the next two years: Security Price Today ($) A B 188 170 Cash Flow Cash Flow In One Year In Two Years ($) ($) 200 0 0 200 There is an equal chance of the economy being weak versus strong over the next year. Security D pays $120 if the economy is weak, and pays $310 if the economy is strong. Security D currently trades for $195. Calculate the expected return of Security D. There is an equal chance of the economy being weak versus strong over the next year. Security D pays $120 if the economy is weak, and pays $310 if the economy is strong. Security D currently trades for $195. Calculate the expected return of Security D. A) 8.46% B) 6.75% C) 10.26% OD) 4.00% E) 6.38% 600 The principal-agent problem from chapter 1 refers to A) Managers pursuing activities that benefit themselves at the expense of shareholders. B) Governments trying to regulate the behavior of corporations. OC) Stock brokers not serving the best interests of investors. D) Stock markets with too high bid-ask spreads causing excessive transaction costs for investors. E) None of the above. Use the data below to answer the question. Note, each of the projects' inflows are perpetuities or growing perpetuities. Initial Project Investment A $300,000 11 C D 14% 5% $400,000 $400,000 $300,000 undefined 20% First Year Cash Flow $63,000 $80,000 $104,000 $50,000 Growth Rate 3% 3% 0% 3% The incremental IRR of switching from Project A to Project B is closest to: Cost of Capital 8% 89. 8% 11% NPV $960,000 $1,200,000 $900,000 $325,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts