Question: 3. Consider the same problem as question 2. But now suppose that the utility function has a constant absolute risk aversion coefficient: El-e- In addition,

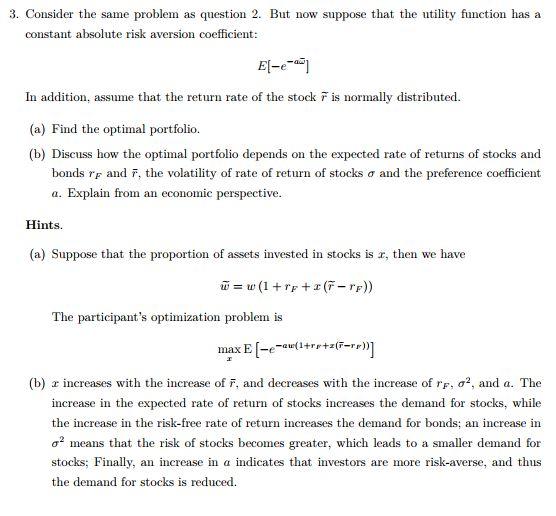

3. Consider the same problem as question 2. But now suppose that the utility function has a constant absolute risk aversion coefficient: El-e- In addition, assume that the return rate of the stock F is normally distributed. (a) Find the optimal portfolio. (b) Discuss how the optimal portfolio depends on the expected rate of returns of stocks and bonds rp and 7, the volatility of rate of return of stocks a and the preference coefficient a. Explain from an economic perspective. Hints. (a) Suppose that the proportion of assets invested in stocks is 1, then we have w = w(1+rp +27 - rp) The participant's optimization problem is max E (-e-aw(1+re+(=rr) (b) z increases with the increase of F, and decreases with the increase of rp, o2, and a. The increase in the expected rate of return of stocks increases the demand for stocks, while the increase in the risk-free rate of return increases the demand for bonds; an increase in on? means that the risk of stocks becomes greater, which leads to a smaller demand for stocks; Finally, an increase in a indicates that investors are more risk-averse, and thus the demand for stocks is reduced. 3. Consider the same problem as question 2. But now suppose that the utility function has a constant absolute risk aversion coefficient: El-e- In addition, assume that the return rate of the stock F is normally distributed. (a) Find the optimal portfolio. (b) Discuss how the optimal portfolio depends on the expected rate of returns of stocks and bonds rp and 7, the volatility of rate of return of stocks a and the preference coefficient a. Explain from an economic perspective. Hints. (a) Suppose that the proportion of assets invested in stocks is 1, then we have w = w(1+rp +27 - rp) The participant's optimization problem is max E (-e-aw(1+re+(=rr) (b) z increases with the increase of F, and decreases with the increase of rp, o2, and a. The increase in the expected rate of return of stocks increases the demand for stocks, while the increase in the risk-free rate of return increases the demand for bonds; an increase in on? means that the risk of stocks becomes greater, which leads to a smaller demand for stocks; Finally, an increase in a indicates that investors are more risk-averse, and thus the demand for stocks is reduced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts