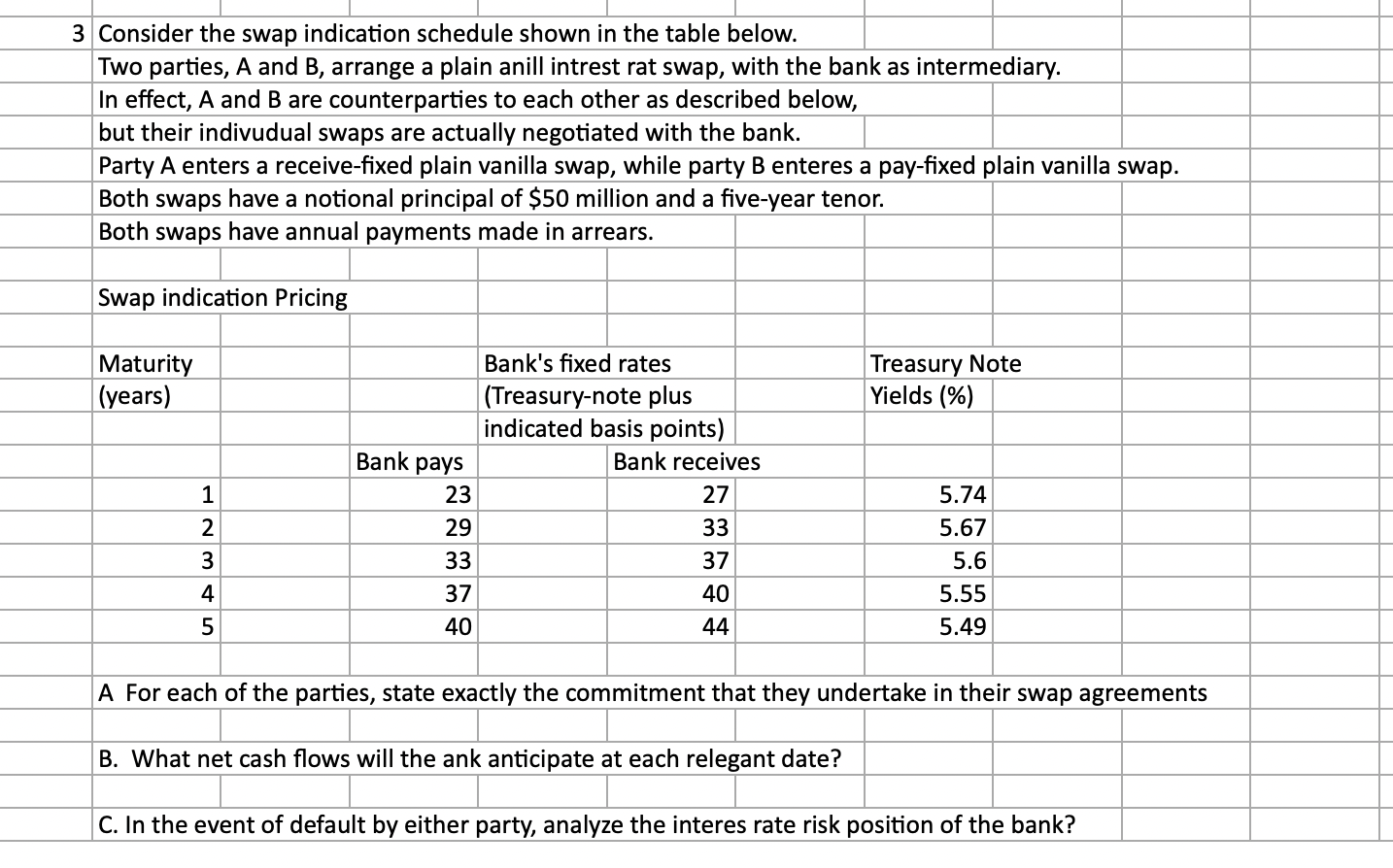

Question: 3 Consider the swap indication schedule shown in the table below. Two parties, A and B, arrange a plain anill intrest rat swap, with the

3 Consider the swap indication schedule shown in the table below. Two parties, A and B, arrange a plain anill intrest rat swap, with the bank as intermediary. In effect, A and B are counterparties to each other as described below, but their indivudual swaps are actually negotiated with the bank. Party A enters a receive-fixed plain vanilla swap, while party B enteres a pay-fixed plain vanilla swap. Both swaps have a notional principal of $50 million and a five-year tenor. Both swaps have annual payments made in arrears. Swap indication Pricing Maturity (years) Treasury Note Yields (%) Bank pays 1 Bank's fixed rates (Treasury-note plus indicated basis points) Bank receives 23 27 29 33 33 37 37 40 40 44 2 U AWNA 3 5.74 5.67 5.6 5.55 5.49 4 5 A For each of the parties, state exactly the commitment that they undertake in their swap agreements B. What net cash flows will the ank anticipate at each relegant date? C. In the event of default by either party, analyze the interes rate risk position of the bank? 3 Consider the swap indication schedule shown in the table below. Two parties, A and B, arrange a plain anill intrest rat swap, with the bank as intermediary. In effect, A and B are counterparties to each other as described below, but their indivudual swaps are actually negotiated with the bank. Party A enters a receive-fixed plain vanilla swap, while party B enteres a pay-fixed plain vanilla swap. Both swaps have a notional principal of $50 million and a five-year tenor. Both swaps have annual payments made in arrears. Swap indication Pricing Maturity (years) Treasury Note Yields (%) Bank pays 1 Bank's fixed rates (Treasury-note plus indicated basis points) Bank receives 23 27 29 33 33 37 37 40 40 44 2 U AWNA 3 5.74 5.67 5.6 5.55 5.49 4 5 A For each of the parties, state exactly the commitment that they undertake in their swap agreements B. What net cash flows will the ank anticipate at each relegant date? C. In the event of default by either party, analyze the interes rate risk position of the bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts