Question: Consider the swap indication schedule shown in the table below. Two parties, A and B, arrange a plain anill intrest rat swap, with the bank

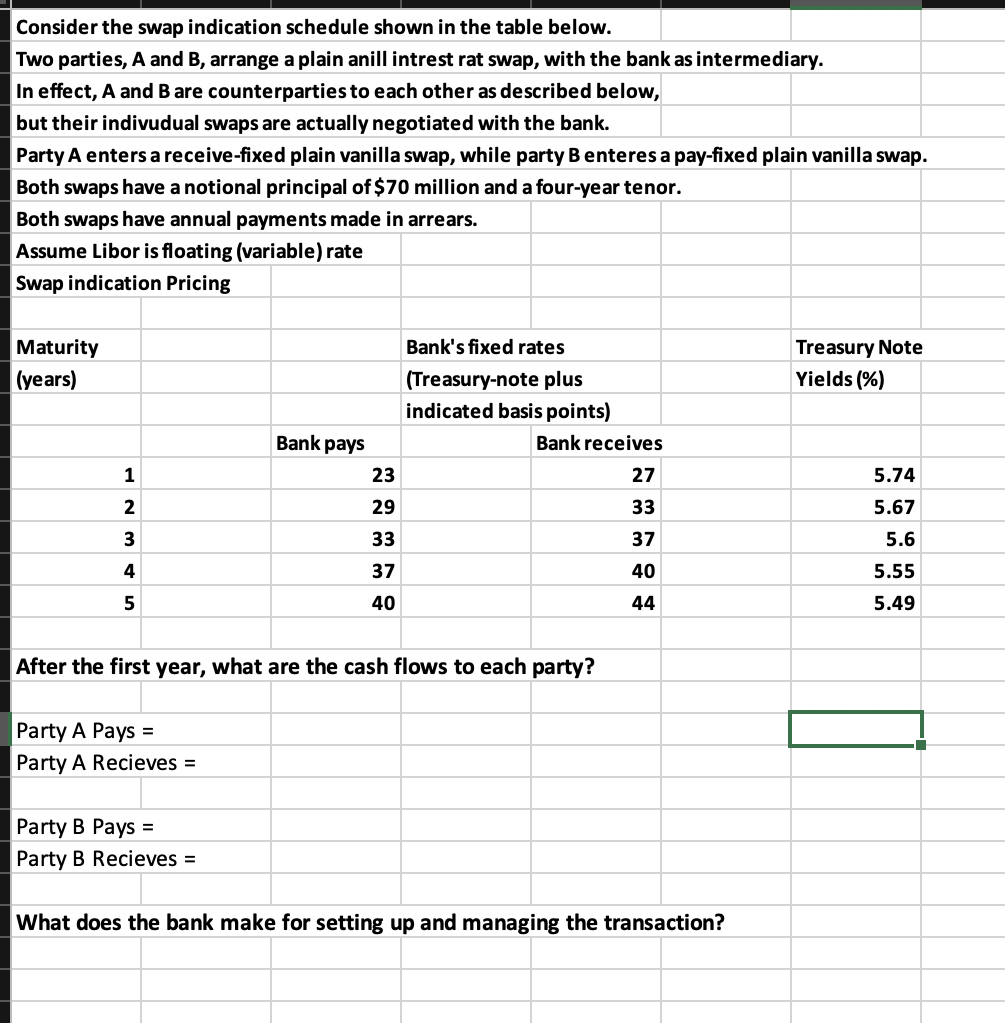

Consider the swap indication schedule shown in the table below. Two parties, A and B, arrange a plain anill intrest rat swap, with the bank as intermediary. In effect, A and B are counterparties to each other as described below, but their indivudual swaps are actually negotiated with the bank. Party A enters a receive-fixed plain vanilla swap, while party B enteres a pay-fixed plain vanilla swap. Both swaps have a notional principal of $ 70 million and a four-year tenor. Both swaps have annual payments made in arrears. Assume Libor is floating (variable) rate Swap indication Pricing Maturity (years) Treasury Note Yields (%) Bank's fixed rates (Treasury-note plus indicated basis points) Bank receives Bank pays 1 23 27 5.74 2 29 33 5.67 3 33 37 5.6 Nm in 4 37 40 5.55 5 40 44 5.49 After the first year, what are the cash flows to each party? Party A Pays = Party A Recieves = Party B Pays = Party B Recieves = What does the bank make for setting up and managing the transaction? Consider the swap indication schedule shown in the table below. Two parties, A and B, arrange a plain anill intrest rat swap, with the bank as intermediary. In effect, A and B are counterparties to each other as described below, but their indivudual swaps are actually negotiated with the bank. Party A enters a receive-fixed plain vanilla swap, while party B enteres a pay-fixed plain vanilla swap. Both swaps have a notional principal of $ 70 million and a four-year tenor. Both swaps have annual payments made in arrears. Assume Libor is floating (variable) rate Swap indication Pricing Maturity (years) Treasury Note Yields (%) Bank's fixed rates (Treasury-note plus indicated basis points) Bank receives Bank pays 1 23 27 5.74 2 29 33 5.67 3 33 37 5.6 Nm in 4 37 40 5.55 5 40 44 5.49 After the first year, what are the cash flows to each party? Party A Pays = Party A Recieves = Party B Pays = Party B Recieves = What does the bank make for setting up and managing the transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts