Question: 3. Consider the two (excess return) index model regression results for A and B: RA=3%+0.7Rm+eA RB=-2%+1.2 Rm+eB om=20%, R?A=0.20, R?B=0.12 Required: (i) What is the

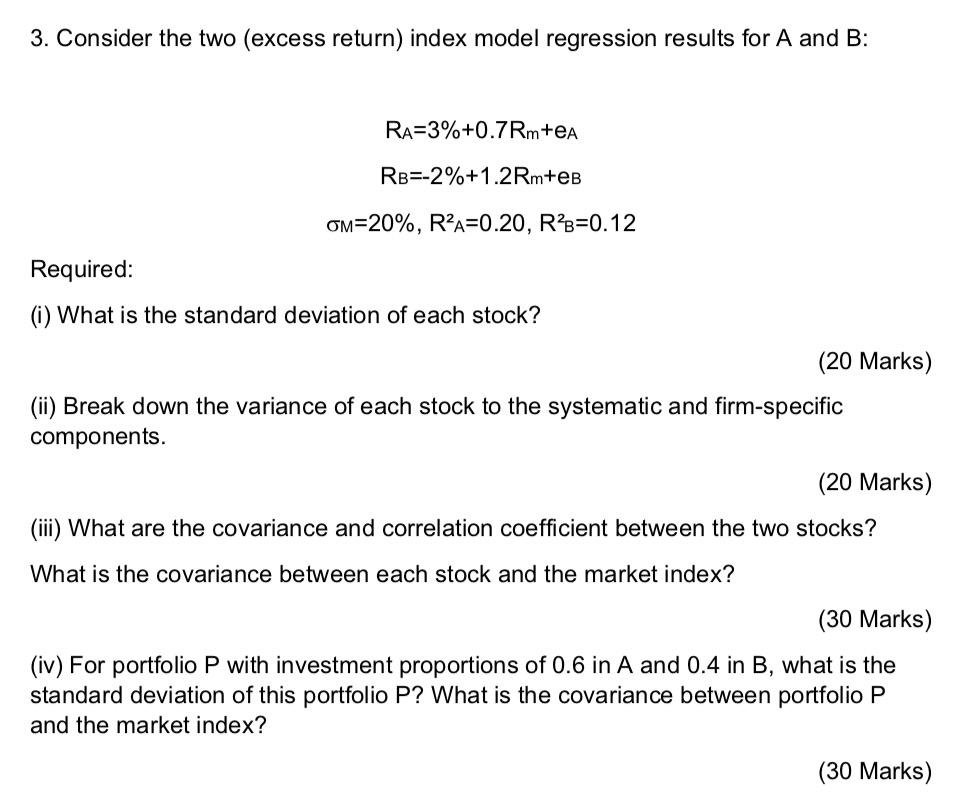

3. Consider the two (excess return) index model regression results for A and B: RA=3%+0.7Rm+eA RB=-2%+1.2 Rm+eB om=20%, R?A=0.20, R?B=0.12 Required: (i) What is the standard deviation of each stock? (20 Marks) (ii) Break down the variance of each stock to the systematic and firm-specific components. (20 Marks) (iii) What are the covariance and correlation coefficient between the two stocks? What is the covariance between each stock and the market index? (30 Marks) (iv) For portfolio P with investment proportions of 0.6 in A and 0.4 in B, what is the standard deviation of this portfolio P? What is the covariance between portfolio P and the market index? (30 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts