Question: Assignment 10: Problem 10 Previous Problem Problem List Next Problem (1 point) A company issues 11 year bonds to gain capital to expand their business.

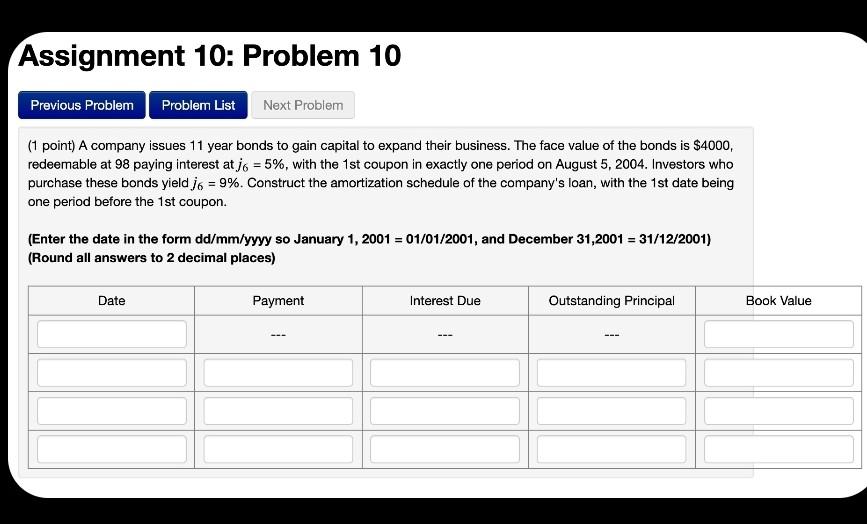

Assignment 10: Problem 10 Previous Problem Problem List Next Problem (1 point) A company issues 11 year bonds to gain capital to expand their business. The face value of the bonds is $4000, redeemable at 98 paying interest at j6 = 5%, with the 1st coupon in exactly one period on August 5, 2004. Investors who purchase these bonds yield j6 = 9%. Construct the amortization schedule of the company's loan, with the 1st date being one period before the 1st coupon. (Enter the date in the form dd/mm/yyyy so January 1, 2001 = 01/01/2001, and December 31,2001 = 31/12/2001) (Round all answers to 2 decimal places) Date Payment Interest Due Outstanding Principal Book Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts