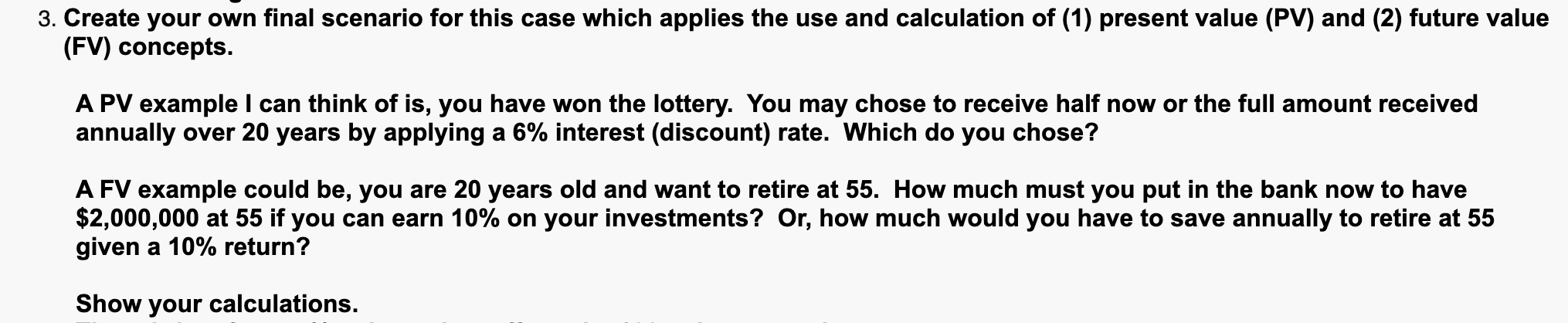

Question: 3. Create your own final scenario for this case which applies the use and calculation of (1) present value (PV) and (2) future value (FV)

3. Create your own final scenario for this case which applies the use and calculation of (1) present value (PV) and (2) future value (FV) concepts. A PV example I can think of is, you have won the lottery. You may chose to receive half now or the full amount received annually over 20 years by applying a 6% interest (discount) rate. Which do you chose? A FV example could be, you are 20 years old and want to retire at 55. How much must you put in the bank now to have $2,000,000 at 55 if you can earn 10% on your investments? Or, how much would you have to save annually to retire at 55 given a 10% return? Show your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts