Question: 3 Dividends in the Binomial Model II (20 points) Now, let's look at put options in the binomial model with dividends. We again have three

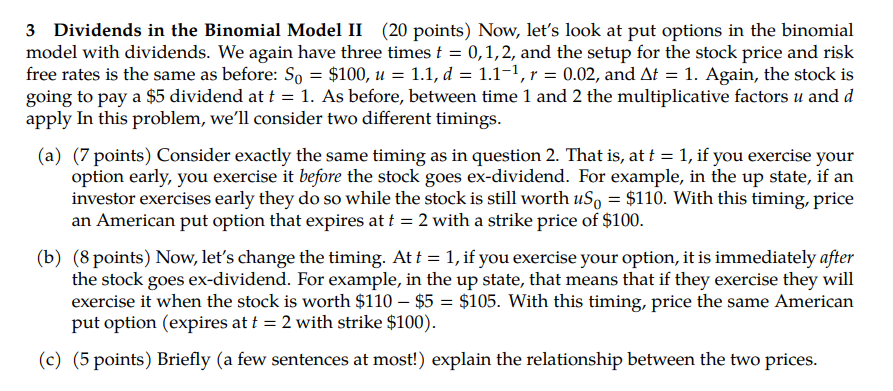

3 Dividends in the Binomial Model II (20 points) Now, let's look at put options in the binomial model with dividends. We again have three times t=0,1,2, and the setup for the stock price and risk free rates is the same as before: S0=$100,u=1.1,d=1.11,r=0.02, and t=1. Again, the stock is going to pay a $5 dividend at t=1. As before, between time 1 and 2 the multiplicative factors u and d apply In this problem, we'll consider two different timings. (a) (7 points) Consider exactly the same timing as in question 2. That is, at t=1, if you exercise your option early, you exercise it before the stock goes ex-dividend. For example, in the up state, if an investor exercises early they do so while the stock is still worth uS0=$110. With this timing, price an American put option that expires at t=2 with a strike price of $100. (b) (8 points) Now, let's change the timing. At t=1, if you exercise your option, it is immediately after the stock goes ex-dividend. For example, in the up state, that means that if they exercise they will exercise it when the stock is worth $110$5=$105. With this timing, price the same American put option (expires at t=2 with strike $100 ). (c) (5 points) Briefly (a few sentences at most!) explain the relationship between the two prices. 3 Dividends in the Binomial Model II (20 points) Now, let's look at put options in the binomial model with dividends. We again have three times t=0,1,2, and the setup for the stock price and risk free rates is the same as before: S0=$100,u=1.1,d=1.11,r=0.02, and t=1. Again, the stock is going to pay a $5 dividend at t=1. As before, between time 1 and 2 the multiplicative factors u and d apply In this problem, we'll consider two different timings. (a) (7 points) Consider exactly the same timing as in question 2. That is, at t=1, if you exercise your option early, you exercise it before the stock goes ex-dividend. For example, in the up state, if an investor exercises early they do so while the stock is still worth uS0=$110. With this timing, price an American put option that expires at t=2 with a strike price of $100. (b) (8 points) Now, let's change the timing. At t=1, if you exercise your option, it is immediately after the stock goes ex-dividend. For example, in the up state, that means that if they exercise they will exercise it when the stock is worth $110$5=$105. With this timing, price the same American put option (expires at t=2 with strike $100 ). (c) (5 points) Briefly (a few sentences at most!) explain the relationship between the two prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts