Question: Let's add some dividends to the binomial model. We will have three times t = 0, 1, 2. Time periods are of length At

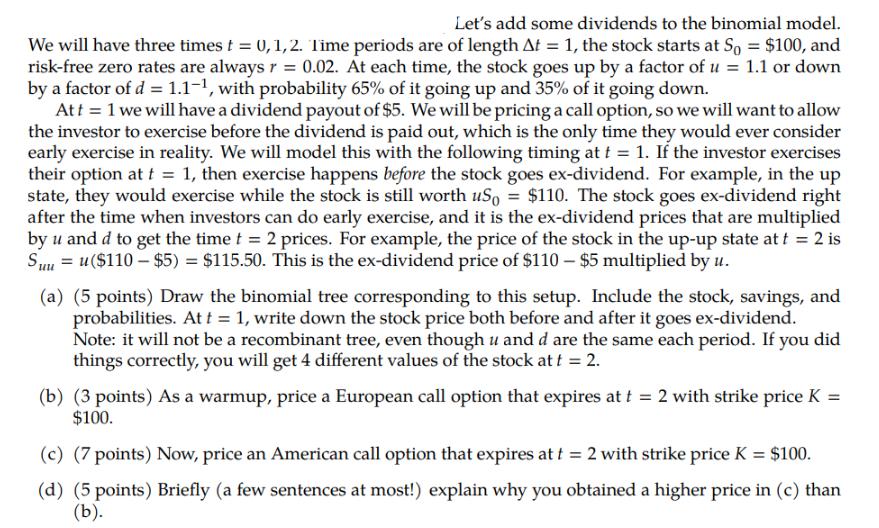

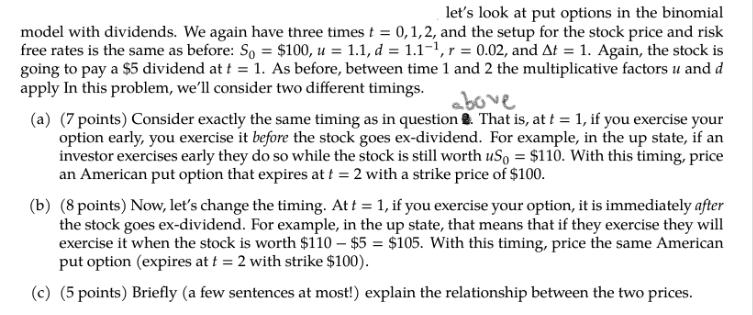

Let's add some dividends to the binomial model. We will have three times t = 0, 1, 2. Time periods are of length At = 1, the stock starts at So = $100, and risk-free zero rates are always r = 0.02. At each time, the stock goes up by a factor of u = 1.1 or down by a factor of d = 1.1-1, with probability 65% of it going up and 35% of it going down. Att = 1 we will have a dividend payout of $5. We will be pricing a call option, so we will want to allow the investor to exercise before the dividend is paid out, which is the only time they would ever consider early exercise in reality. We will model this with the following timing at t = 1. If the investor exercises their option at t = 1, then exercise happens before the stock goes ex-dividend. For example, in the up state, they would exercise while the stock is still worth uSo = $110. The stock goes ex-dividend right after the time when investors can do early exercise, and it is the ex-dividend prices that are multiplied by u and d to get the time t = 2 prices. For example, the price of the stock in the up-up state at t = 2 is Suu = u($110 - $5) = $115.50. This is the ex-dividend price of $110 - $5 multiplied by u. (a) (5 points) Draw the binomial tree corresponding to this setup. Include the stock, savings, and probabilities. At t = 1, write down the stock price both before and after it goes ex-dividend. Note: it will not be a recombinant tree, even though u and d are the same each period. If you did things correctly, you will get 4 different values of the stock at t = 2. (b) (3 points) As a warmup, price a European call option that expires at t = 2 with strike price K = $100. (c) (7 points) Now, price an American call option that expires at t = 2 with strike price K = $100. (d) (5 points) Briefly (a few sentences at most!) explain why you obtained a higher price in (c) than (b). let's look at put options in the binomial model with dividends. We again have three times t = 0, 1, 2, and the setup for the stock price and risk free rates is the same as before: So = $100, u = 1.1, d = 1.1-1, r=0.02, and At = 1. Again, the stock is going to pay a $5 dividend at t = 1. As before, between time 1 and 2 the multiplicative factors u and d apply In this problem, we'll consider two different timings. above (a) (7 points) Consider exactly the same timing as in question. That is, at t = 1, if you exercise your option early, you exercise it before the stock goes ex-dividend. For example, in the up state, if an investor exercises early they do so while the stock is still worth uSo = $110. With this timing, price an American put option that expires at t = 2 with a strike price of $100. (b) (8 points) Now, let's change the timing. At t = 1, if you exercise your option, it is immediately after the stock goes ex-dividend. For example, in the up state, that means that if they exercise they will exercise it when the stock is worth $110 - $5 = $105. With this timing, price the same American put option (expires at t = 2 with strike $100). (c) (5 points) Briefly (a few sentences at most!) explain the relationship between the two prices.

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

SOLUTION a Binomial Tree The binomial tree for this setup is shown below t S savings prob stock 0 10... View full answer

Get step-by-step solutions from verified subject matter experts