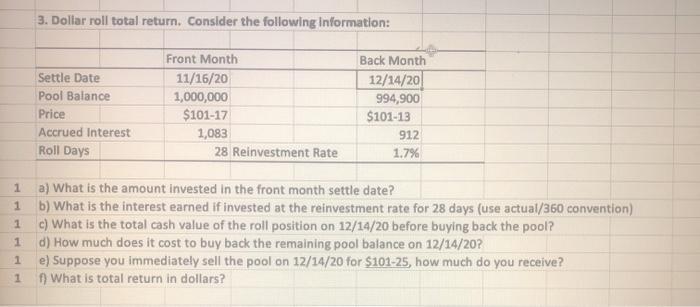

Question: 3. Dollar roll total return. Consider the following Information: Settle Date Pool Balance Price Accrued Interest Roll Days Front Month 11/16/20 1,000,000 $101-17 1,083 28

3. Dollar roll total return. Consider the following Information: Settle Date Pool Balance Price Accrued Interest Roll Days Front Month 11/16/20 1,000,000 $101-17 1,083 28 Reinvestment Rate Back Month 12/14/20 994,900 $101-13 912 1.7% 1 1 1 1 1 1 a) What is the amount invested in the front month settle date? b) What is the interest earned if invested at the reinvestment rate for 28 days (use actual/360 convention) c) What is the total cash value of the roll position on 12/14/20 before buying back the pool? d) How much does it cost to buy back the remaining pool balance on 12/14/20? e) Suppose you immediately sell the pool on 12/14/20 for $101-25, how much do you receive? ) What is total return in dollars? 3. Dollar roll total return. Consider the following Information: Settle Date Pool Balance Price Accrued Interest Roll Days Front Month 11/16/20 1,000,000 $101-17 1,083 28 Reinvestment Rate Back Month 12/14/20 994,900 $101-13 912 1.7% 1 1 1 1 1 1 a) What is the amount invested in the front month settle date? b) What is the interest earned if invested at the reinvestment rate for 28 days (use actual/360 convention) c) What is the total cash value of the roll position on 12/14/20 before buying back the pool? d) How much does it cost to buy back the remaining pool balance on 12/14/20? e) Suppose you immediately sell the pool on 12/14/20 for $101-25, how much do you receive? ) What is total return in dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts