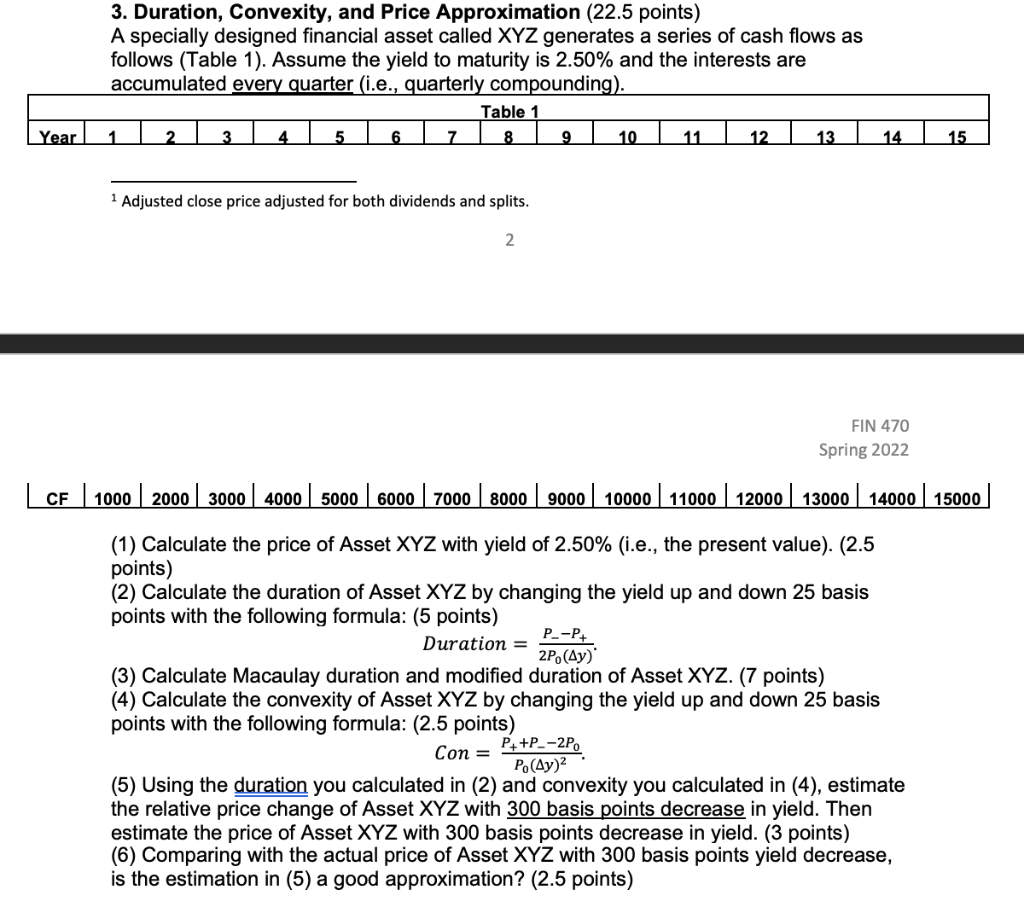

Question: 3. Duration, Convexity, and Price Approximation (22.5 points) A specially designed financial asset called XYZ generates a series of cash flows as follows (Table 1).

3. Duration, Convexity, and Price Approximation (22.5 points) A specially designed financial asset called XYZ generates a series of cash flows as follows (Table 1). Assume the yield to maturity is 2.50% and the interests are accumulated every quarter (i.e., quarterly compounding). Table 1 2 3 4 5 6 7 8 9 10 11 12 13 Year 1 14 15 1 Adjusted close price adjusted for both dividends and splits. 2 FIN 470 Spring 2022 | CF 1000 | 2000 | 3000 | 4000 | 5000 | 6000 | 7000 8000 9000 10000 | 11000 12000 | 13000 | 14000 | 15000 | (1) Calculate the price of Asset XYZ with yield of 2.50% (i.e., the present value). (2.5 points) (2) Calculate the duration of Asset XYZ by changing the yield up and down 25 basis points with the following formula: (5 points) P.-P+ Duration = 2P.(Ay)" (3) Calculate Macaulay duration and modified duration of Asset XYZ. (7 points) (4) Calculate the convexity of Asset XYZ by changing the yield up and down 25 basis points with the following formula: (2.5 points) Con = P++P_-2P P.(Ay)2 (5) Using the duration you calculated in (2) and convexity you calculated in (4), estimate the relative price change of Asset XYZ with 300 basis points decrease in yield. Then estimate the price of Asset XYZ with 300 basis points decrease in yield. (3 points) (6) Comparing with the actual price of Asset XYZ with 300 basis points yield decrease, is the estimation in (5) a good approximation? (2.5 points) 3. Duration, Convexity, and Price Approximation (22.5 points) A specially designed financial asset called XYZ generates a series of cash flows as follows (Table 1). Assume the yield to maturity is 2.50% and the interests are accumulated every quarter (i.e., quarterly compounding). Table 1 2 3 4 5 6 7 8 9 10 11 12 13 Year 1 14 15 1 Adjusted close price adjusted for both dividends and splits. 2 FIN 470 Spring 2022 | CF 1000 | 2000 | 3000 | 4000 | 5000 | 6000 | 7000 8000 9000 10000 | 11000 12000 | 13000 | 14000 | 15000 | (1) Calculate the price of Asset XYZ with yield of 2.50% (i.e., the present value). (2.5 points) (2) Calculate the duration of Asset XYZ by changing the yield up and down 25 basis points with the following formula: (5 points) P.-P+ Duration = 2P.(Ay)" (3) Calculate Macaulay duration and modified duration of Asset XYZ. (7 points) (4) Calculate the convexity of Asset XYZ by changing the yield up and down 25 basis points with the following formula: (2.5 points) Con = P++P_-2P P.(Ay)2 (5) Using the duration you calculated in (2) and convexity you calculated in (4), estimate the relative price change of Asset XYZ with 300 basis points decrease in yield. Then estimate the price of Asset XYZ with 300 basis points decrease in yield. (3 points) (6) Comparing with the actual price of Asset XYZ with 300 basis points yield decrease, is the estimation in (5) a good approximation? (2.5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts