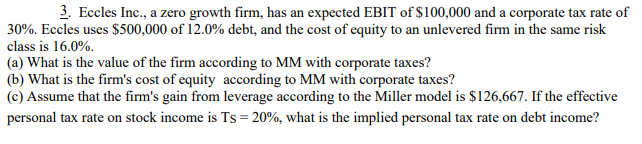

Question: 3. Eccles Inc., a zero growth firm, has an expected EBIT of $100,000 and a corporate tax rate of 30%. Eccles uses $500,000 of 12.0%

3. Eccles Inc., a zero growth firm, has an expected EBIT of $100,000 and a corporate tax rate of 30%. Eccles uses $500,000 of 12.0% debt, and the cost of equity to an unlevered firm in the same risk class is 16.0%. (a) What is the value of the firm according to MM with corporate taxes? (b) What is the firm's cost of equity according to MM with corporate taxes? (c) Assume that the firm's gain from leverage according to the Miller model is $126,667. If the effective personal tax rate on stock income is Ts = 20%, what is the implied personal tax rate on debt income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock