Question: 3. Estimating the inputs using the Black-5choles option pricing model in the optlon analysis of the investment timing option Option analysis involves gathering significant amounts

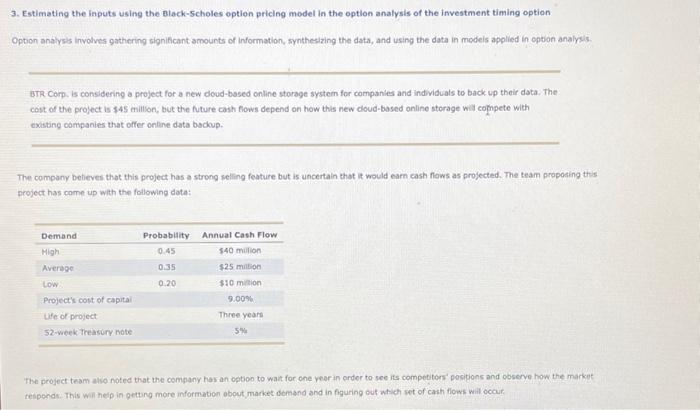

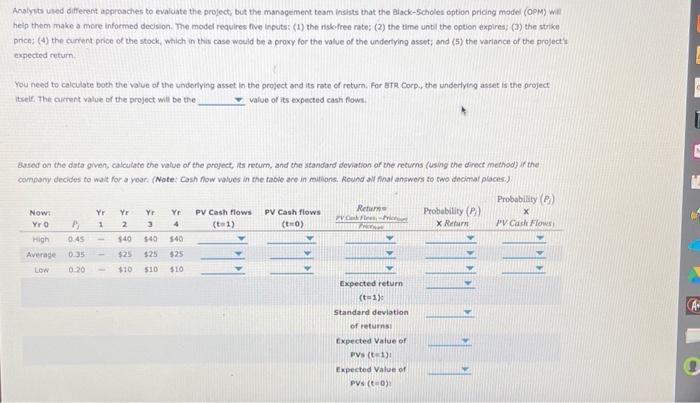

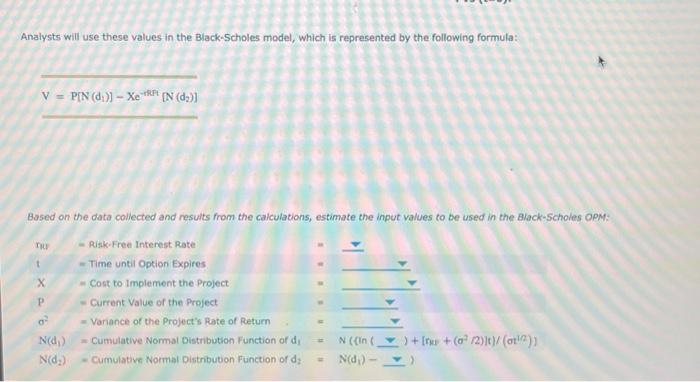

3. Estimating the inputs using the Black-5choles option pricing model in the optlon analysis of the investment timing option Option analysis involves gathering significant amounts of information, syntheslzing the data, and using the data in modeis applied in option analyils BTR Corp. is considering a project for a new doud-based online storage system for companies and individuals to back up their data. The cost of the project is $45 anilion, but the future cash flows depend on how this new doud-based anline storage will compete with existing corvpacies that offer online data bocoup. The compary betieves that this project has a strong selling feature but is uncertain that it would earn cash flaws as projected. The team proposing this project has come up with the following dota: The peoject team alio noted that the company has an option to wait for one yeor in erder to see its compebitors' positions and observe how the market respends: This will help in getang more information obout market obmand and in figuring out which set of casti flows wil occur. Analyts uled different approsches to evaluate the project, but the mansgement tesm insists that the alack-Scholet option pricing model (OeM) wit heip them make a mere informed decision. The model requires five inputs: (1) the risk-free rate: (2) the time unt the option expires; (3) the strike price) (4) the current price of the stock, which in this case would be a proxy for the value of the underlying asset; and (5) the variance of the projectl cispected return. You need to calculate both the value of the underlying asset in the project snd its rate of return. For Efra Corp. the snderlying asset is the project itself, The currest value of the project will be the value of its expected cash flows. Bared on the data given, calculate che vahue of the project, its return, and the standard deviation af the returns (wsing the cirect method) if the company decides to wat for a yoar. (Note: Cash flow watues in the tabie are in mitiors. Rcund alf final answers to two decimal places.). Analysts will use these values in the Black-Scholes model, which is represented by the following formula: V=P[N(d1)]Xetrift[N(d2)] Based on the data collected and results from the calculations, estimate the input values to be used in the Black-Scholes OPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts