Question: 3. Excel Problem 3: Consider a project with the below cash flows: 0 1 2 3 -$17,000 16,000 14,000 12,000 4 10,000 5 8,000 6

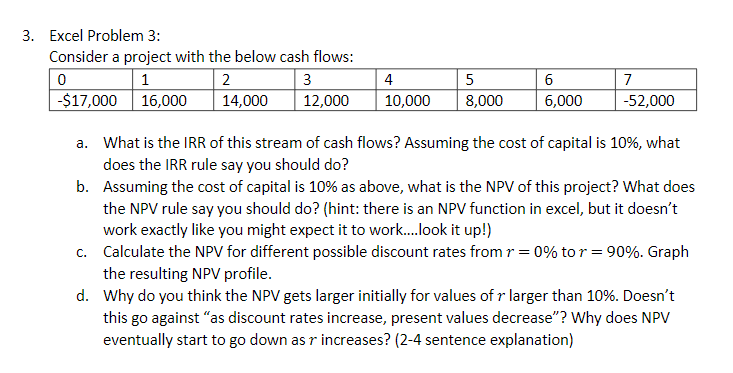

3. Excel Problem 3: Consider a project with the below cash flows: 0 1 2 3 -$17,000 16,000 14,000 12,000 4 10,000 5 8,000 6 6,000 7 -52,000 a. What is the IRR of this stream of cash flows? Assuming the cost of capital is 10%, what does the IRR rule say you should do? b. Assuming the cost of capital is 10% as above, what is the NPV of this project? What does the NPV rule say you should do? (hint: there is an NPV function in excel, but it doesn't work exactly like you might expect it to work....look it up!) C. Calculate the NPV for different possible discount rates from r=0% tor= 90%. Graph the resulting NPV profile. d. Why do you think the NPV gets larger initially for values of r larger than 10%. Doesn't this go against as discount rates increase, present values decrease"? Why does NPV eventually start to go down as r increases? (2-4 sentence explanation)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts