Question: 3. Excel Question. (2 points) This question requires data collection. You can use http://finance.yahoo.com to find the numbers. Please note the date on which you

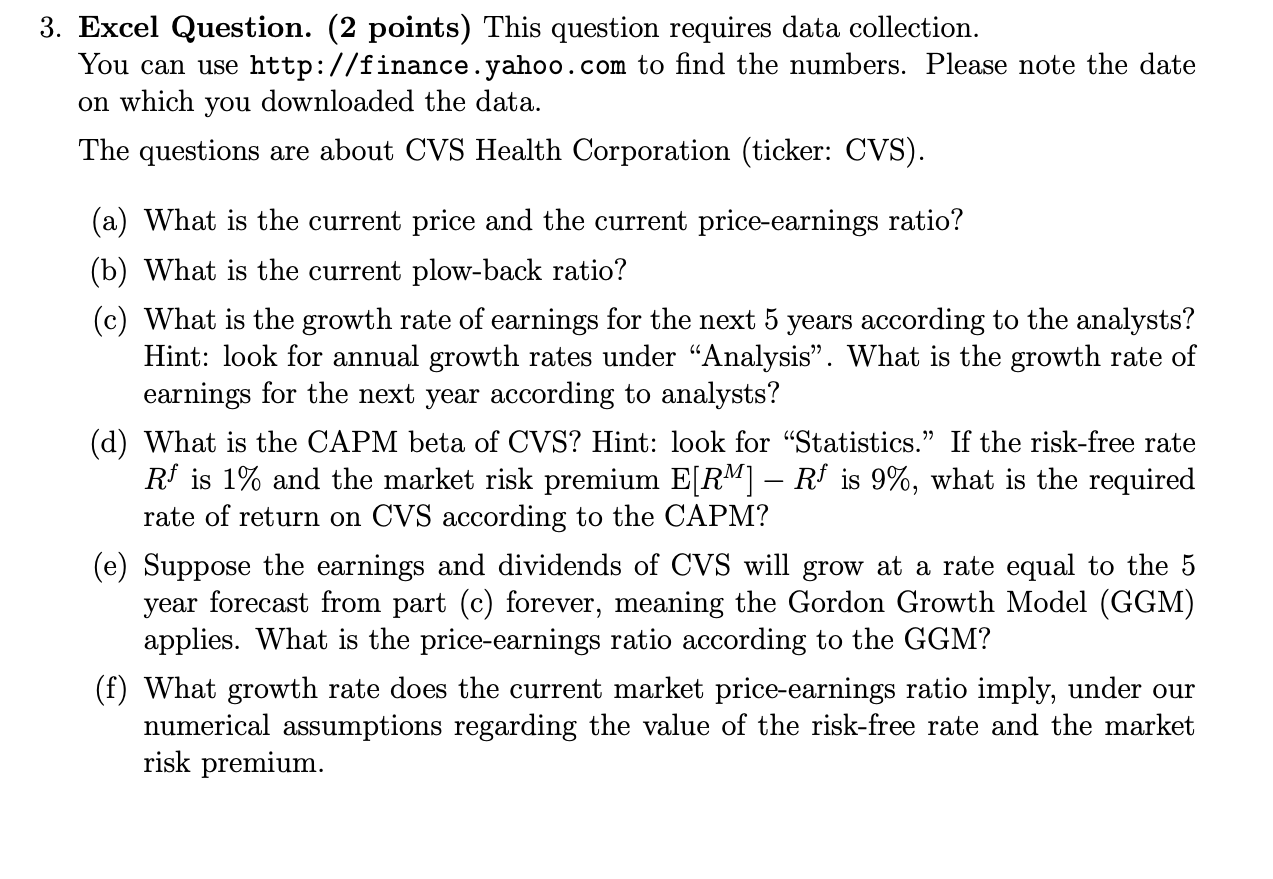

3. Excel Question. (2 points) This question requires data collection. You can use http://finance.yahoo.com to find the numbers. Please note the date on which you downloaded the data. The questions are about CVS Health Corporation (ticker: CVS). (a) What is the current price and the current price-earnings ratio? (b) What is the current plow-back ratio? (c) What is the growth rate of earnings for the next 5 years according to the analysts? Hint: look for annual growth rates under Analysis. What is the growth rate of earnings for the next year according to analysts? (d) What is the CAPM beta of CVS? Hint: look for Statistics. If the risk-free rate Rf is 1% and the market risk premium E[RM] Rf is 9%, what is the required rate of return on CVS according to the CAPM? (e) Suppose the earnings and dividends of CVS will grow at a rate equal to the 5 year forecast from part (c) forever, meaning the Gordon Growth Model (GGM) applies. What is the price-earnings ratio according to the GGM? (f) What growth rate does the current market price-earnings ratio imply, under our numerical assumptions regarding the value of the risk-free rate and the market risk premium. 3. Excel Question. (2 points) This question requires data collection. You can use http://finance.yahoo.com to find the numbers. Please note the date on which you downloaded the data. The questions are about CVS Health Corporation (ticker: CVS). (a) What is the current price and the current price-earnings ratio? (b) What is the current plow-back ratio? (c) What is the growth rate of earnings for the next 5 years according to the analysts? Hint: look for annual growth rates under Analysis. What is the growth rate of earnings for the next year according to analysts? (d) What is the CAPM beta of CVS? Hint: look for Statistics. If the risk-free rate Rf is 1% and the market risk premium E[RM] Rf is 9%, what is the required rate of return on CVS according to the CAPM? (e) Suppose the earnings and dividends of CVS will grow at a rate equal to the 5 year forecast from part (c) forever, meaning the Gordon Growth Model (GGM) applies. What is the price-earnings ratio according to the GGM? (f) What growth rate does the current market price-earnings ratio imply, under our numerical assumptions regarding the value of the risk-free rate and the market risk premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts