Question: 3. Excel Question. This question asks you to look at the historical performance of small stocks and value stocks. The necessary data can be found

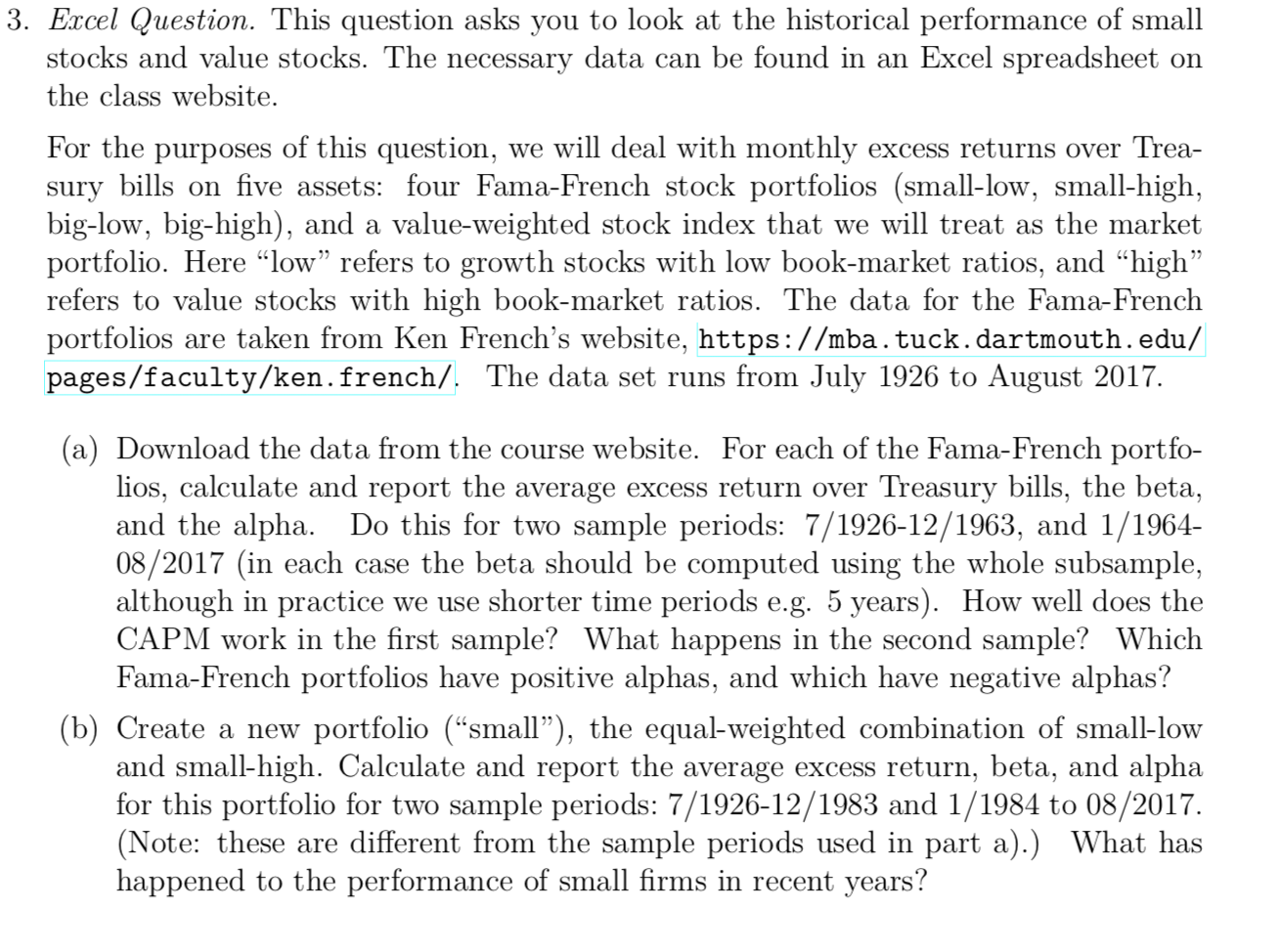

3. Excel Question. This question asks you to look at the historical performance of small stocks and value stocks. The necessary data can be found in an Excel spreadsheet on the class website. For the purposes of this question, we will deal with monthly excess returns over Trea- sury bills on five assets: four Fama-French stock portfolios (small-low, small-high, big-low, big-high), and a value-weighted stock index that we will treat as the market portfolio. Here low refers to growth stocks with low book-market ratios, and high refers to value stocks with high book-market ratios. The data for the Fama-French portfolios are taken from Ken French's website, https://mba. tuck. dartmouth.edu/ pages/faculty/ken.french/. The data set runs from July 1926 to August 2017. (a) Download the data from the course website. For each of the Fama-French portfo- lios, calculate and report the average excess return over Treasury bills, the beta, and the alpha. Do this for two sample periods: 7/1926-12/1963, and 1/1964- 08/2017 (in each case the beta should be computed using the whole subsample, although in practice we use shorter time periods e.g. 5 years). How well does the CAPM work in the first sample? What happens in the second sample? Which Fama-French portfolios have positive alphas, and which have negative alphas? (b) Create a new portfolio (small), the equal-weighted combination of small-low and small-high. Calculate and report the average excess return, beta, and alpha for this portfolio for two sample periods: 7/1926-12/1983 and 1/1984 to 08/2017. (Note: these are different from the sample periods used in part a).) What has happened to the performance of small firms in recent years? 3. Excel Question. This question asks you to look at the historical performance of small stocks and value stocks. The necessary data can be found in an Excel spreadsheet on the class website. For the purposes of this question, we will deal with monthly excess returns over Trea- sury bills on five assets: four Fama-French stock portfolios (small-low, small-high, big-low, big-high), and a value-weighted stock index that we will treat as the market portfolio. Here low refers to growth stocks with low book-market ratios, and high refers to value stocks with high book-market ratios. The data for the Fama-French portfolios are taken from Ken French's website, https://mba. tuck. dartmouth.edu/ pages/faculty/ken.french/. The data set runs from July 1926 to August 2017. (a) Download the data from the course website. For each of the Fama-French portfo- lios, calculate and report the average excess return over Treasury bills, the beta, and the alpha. Do this for two sample periods: 7/1926-12/1963, and 1/1964- 08/2017 (in each case the beta should be computed using the whole subsample, although in practice we use shorter time periods e.g. 5 years). How well does the CAPM work in the first sample? What happens in the second sample? Which Fama-French portfolios have positive alphas, and which have negative alphas? (b) Create a new portfolio (small), the equal-weighted combination of small-low and small-high. Calculate and report the average excess return, beta, and alpha for this portfolio for two sample periods: 7/1926-12/1983 and 1/1984 to 08/2017. (Note: these are different from the sample periods used in part a).) What has happened to the performance of small firms in recent years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts