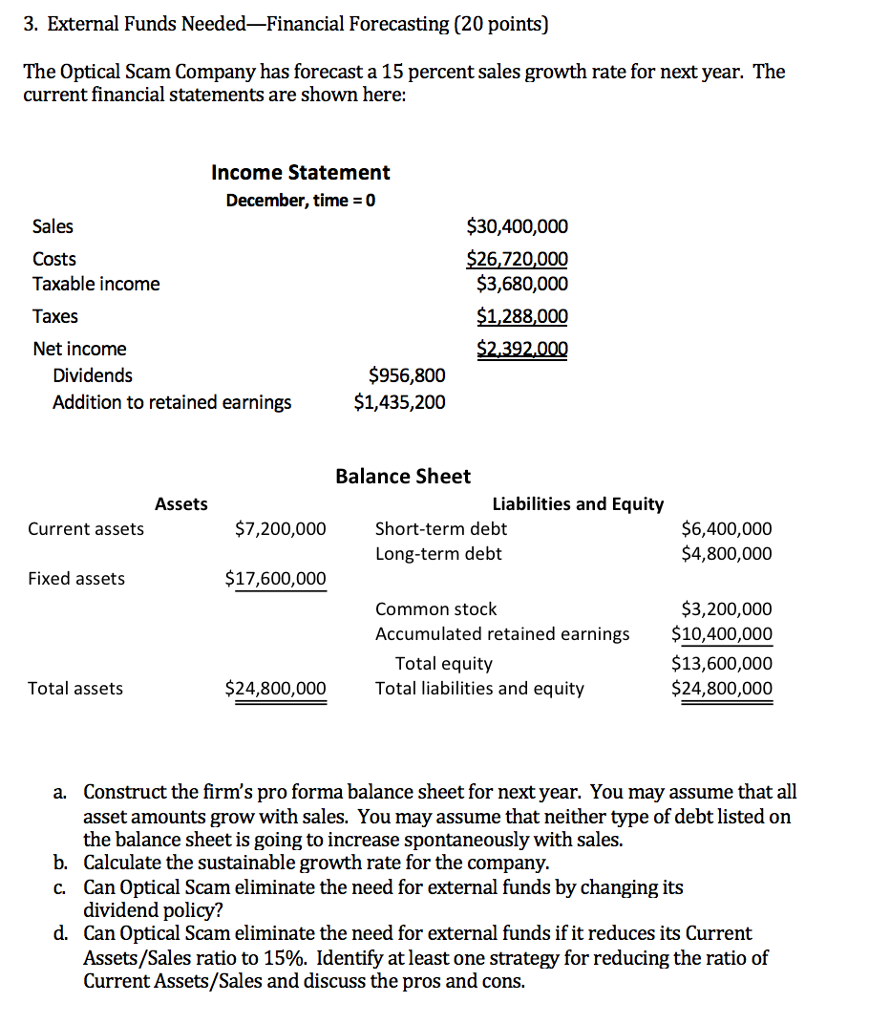

Question: 3, External Funds Needed-Financial Forecasting (20 points) The Optical Scam Company has forecast a 15 percent sales growth rate for next year. The current financial

3, External Funds Needed-Financial Forecasting (20 points) The Optical Scam Company has forecast a 15 percent sales growth rate for next year. The current financial statements are shown here: Income Statement December, time = 0 Sales Costs Taxable income Taxes Net income $30,400,000 $26,720,000 $3,680,000 $1,288,000 Dividends Addition to retained earnings $956,800 $1,435,200 Balance Sheet Assets Liabilities and Equity $7,200,000 Short-term debt Long-term debt $6,400,000 S4,800,000 Current assets Fixed assets $17,600,000 $3,200,000 $10,400,000 $13,600,000 24,800,000 Common stock Accumulated retained earnings Total equity Total liabilities and equity Total assets $24,800,000 Construct the firm's pro forma balance sheet for next year. You may assume that all asset amounts grow with sales. You may assume that neither type of debt listed on the balance sheet is going to increase spontaneously with sales. Calculate the sustainable growth rate for the company. Can Optical Scam eliminate the need for external funds by changing its dividend policy? Can Optical Scam eliminate the need for external funds if it reduces its Current Assets/Sales ratio to 15%. Identify at least one strategy for reducing the ratio of Current Assets/Sales and discuss the pros and cons. a. b. c. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts