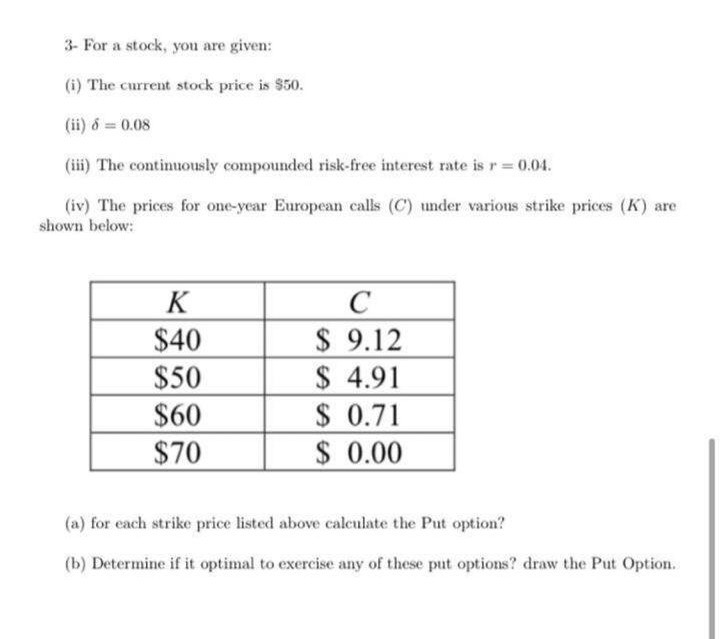

Question: 3- For a stock, you are given: (i) The current stock price is $50. (ii) 8 = 0.08 (iii) The continuously compounded risk-free interest rate

3- For a stock, you are given: (i) The current stock price is $50. (ii) 8 = 0.08 (iii) The continuously compounded risk-free interest rate is r=0.04. (iv) The prices for one-year European calls (C) under various strike prices (K) are shown below: $40 $50 $60 $70 $ 9.12 S 4.91 $ 0.71 $ 0.00 (a) for each strike price listed above calculate the Put option? (b) Determine if it optimal to exercise any of these put options? draw the Put Option

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock