Question: 3. Future again You are a construction operator and are bidding to build a road to do so you will need 100,000 tons of granite

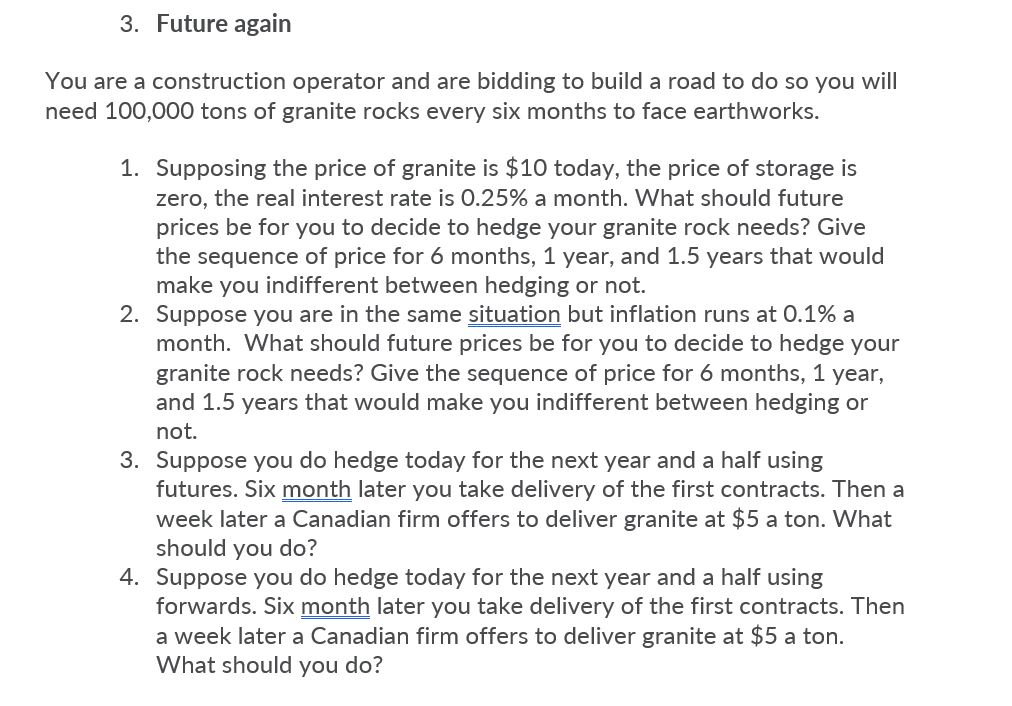

3. Future again You are a construction operator and are bidding to build a road to do so you will need 100,000 tons of granite rocks every six months to face earthworks. 1. Supposing the price of granite is $10 today, the price of storage is zero, the real interest rate is 0.25% a month. What should future prices be for you to decide to hedge your granite rock needs? Give the sequence of price for 6 months, 1 year, and 1.5 years that would make you indifferent between hedging or not. 2. Suppose you are in the same situation but inflation runs at 0.1% a month. What should future prices be for you to decide to hedge your granite rock needs? Give the sequence of price for 6 months, 1 year, and 1.5 years that would make you indifferent between hedging or not. 3. Suppose you do hedge today for the next year and a half using futures. Six month later you take delivery of the first contracts. Then a week later a Canadian firm offers to deliver granite at $5 a ton. What should you do? 4. Suppose you do hedge today for the next year and a half using forwards. Six month later you take delivery of the first contracts. Then a week later a Canadian firm offers to deliver granite at $5 a ton. What should you do

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts