Question: 3. Given the following information and that contained in Problems 2 and 3, construct a forecast balance sheet as of June 30, 20X2, for the

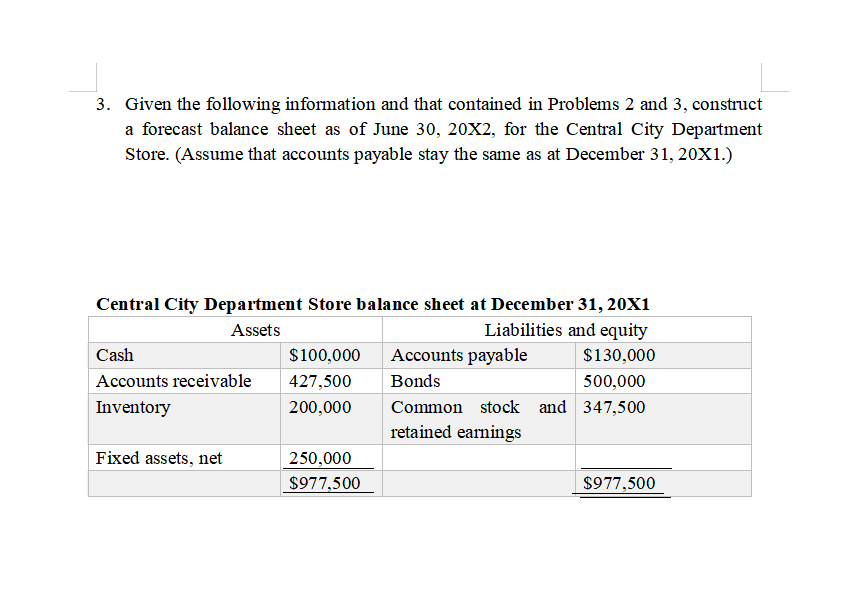

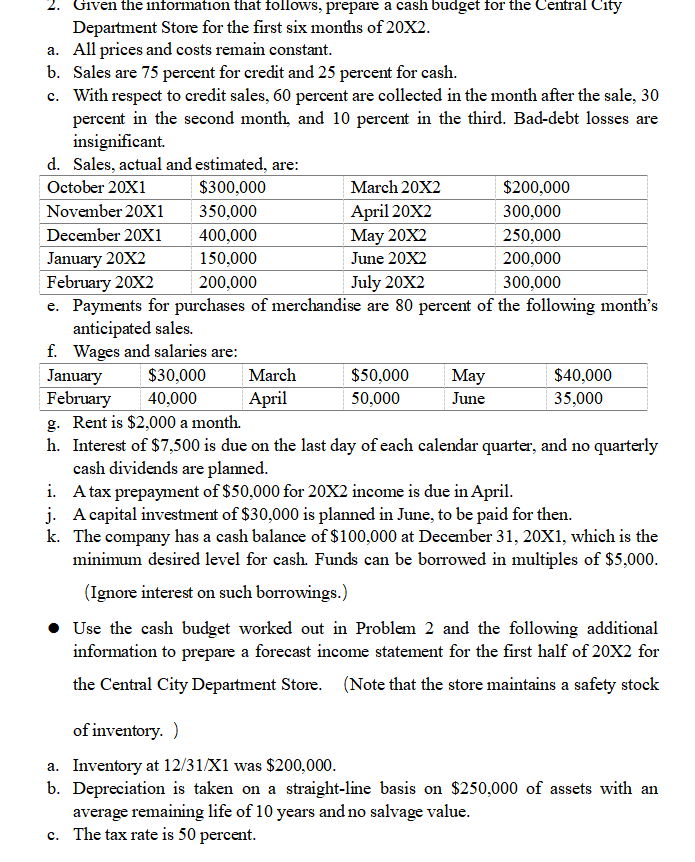

3. Given the following information and that contained in Problems 2 and 3, construct a forecast balance sheet as of June 30, 20X2, for the Central City Department Store.(Assume that accounts payable stay the same as at December 31, 20X1.) Central City Department Store balance sheet at December 31, 20X1 Assets Liabilities and equity Cash $100,000 Accounts payable $130,000 Accounts receivable 427,500 Bonds 500,000 Inventory 200,000 Common stock and 347,500 retained earnings Fixed assets, net 250,000 $977,500 $977,500 2. Given the information that follows, prepare a cash budget for the Central City Department Store for the first six months of 20X2. a. All prices and costs remain constant. b. Sales are 75 percent for credit and 25 percent for cash. c. With respect to credit sales, 60 percent are collected in the month after the sale, 30 percent in the second month, and 10 percent in the third. Bad-debt losses are insignificant d. Sales, actual and estimated, are: October 20X1 $300,000 March 20X2 $200,000 November 20X1 350,000 April 20X2 300,000 December 20X1 400,000 May 20X2 250,000 January 20X2 150,000 June 20X2 200,000 February 20X2 200,000 July 20X2 300,000 e. Payments for purchases of merchandise are 80 percent of the following month's anticipated sales. f. Wages and salaries are: January $30,000 March $50,000 May $40,000 February 40,000 April 50,000 June 35,000 g. Rent is $2,000 a month. h. Interest of $7,500 is due on the last day of each calendar quarter, and no quarterly cash dividends are plamed. i. A tax prepayment of $50,000 for 20X2 income is due in April. j. A capital investment of $30,000 is planned in June, to be paid for then. k. The company has a cash balance of $100,000 at December 31, 20X1, which is the minimum desired level for cash. Funds can be borrowed in multiples of $5,000. (Ignore interest on such borrowings.) Use the cash budget worked out in Problem 2 and the following additional information to prepare a forecast income statement for the first half of 20X2 for the Central City Department Store. (Note that the store maintains a safety stock a. of inventory.) a. Inventory at 12/31/X1 was $200,000. b. Depreciation is taken on a straight-line basis on $250,000 of assets with an average remaining life of 10 years and no salvage value. c. The tax rate is 50 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts