Question: Pregunta 10 Sin responder an Punta como 5.00 Marcar pregunta 7 Calculate the yield-to-call for Katumba's 6% coupon, 12-year bond callable in 5 years at

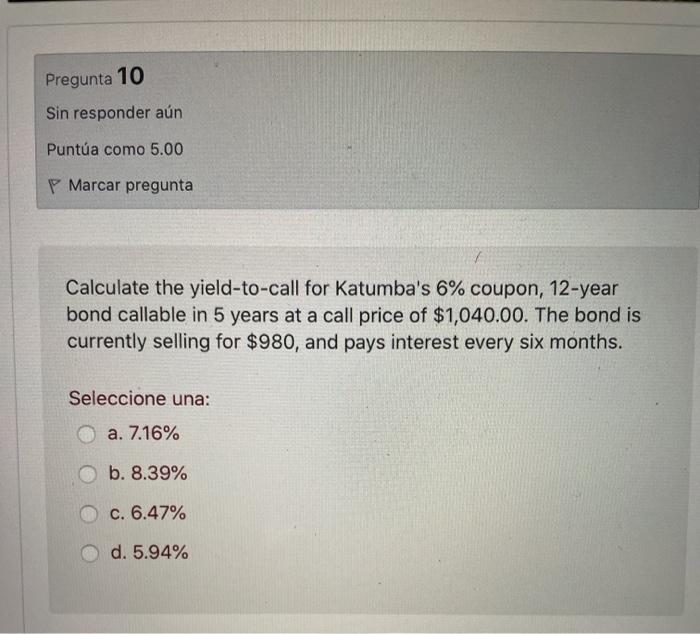

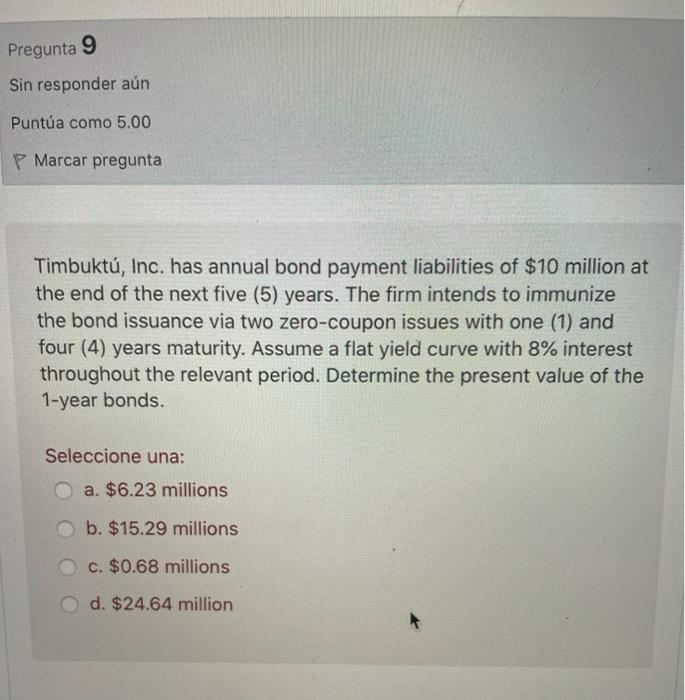

Pregunta 10 Sin responder an Punta como 5.00 Marcar pregunta 7 Calculate the yield-to-call for Katumba's 6% coupon, 12-year bond callable in 5 years at a call price of $1,040.00. The bond is currently selling for $980, and pays interest every six months. Seleccione una: a. 7.16% b. 8.39% c. 6.47% d. 5.94% Pregunta 9 Sin responder an Punta como 5.00 Marcar pregunta Timbukt, Inc. has annual bond payment liabilities of $10 million at the end of the next five (5) years. The firm intends to immunize the bond issuance via two zero-coupon issues with one (1) and four (4) years maturity. Assume a flat yield curve with 8% interest throughout the relevant period. Determine the present value of the 1-year bonds. Seleccione una: a. $6.23 millions b. $15.29 millions c. $0.68 millions d. $24.64 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts