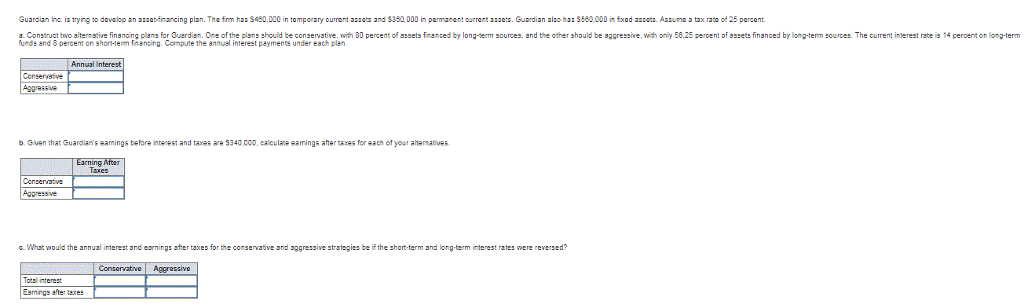

Question: 3 Guardian inc. is trying to develop an asset-financing plan. The firm has $480,000 in temporary current assets and $380,000 in current assets. Guardian also

3

3

Guardian inc. is trying to develop an asset-financing plan. The firm has $480,000 in temporary current assets and $380,000 in current assets. Guardian also has $560,000 in fixed assets. Assume a tax rate of 25 percent. a. Construct two alternative financing plans for Guardian. One of the plans should be conservative, with BD percent of assets, of financed by long-term sources, and the other should be aggressive, with only 56.25 percent of assets financed by long-term sources. The current interest rate is 14 percent on long-term fund and 8 percent on short-term financing. Compute the annual interest payments under each plan. b Given that Guardian's earning before and taxes are $340,000, calculate earnings after taxes for each of your alternatives c. What would the annual interest are earnings after taxes for the conservative and aggressive strategies be if the short-term and long-term interest rates were reserved

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts