Question: 3. Hedging translation exposure with forward contracts 1. 2. STEP: 2 of 2 Suppose that Warner Co is a U.S.-based MNC with a major subsidiary

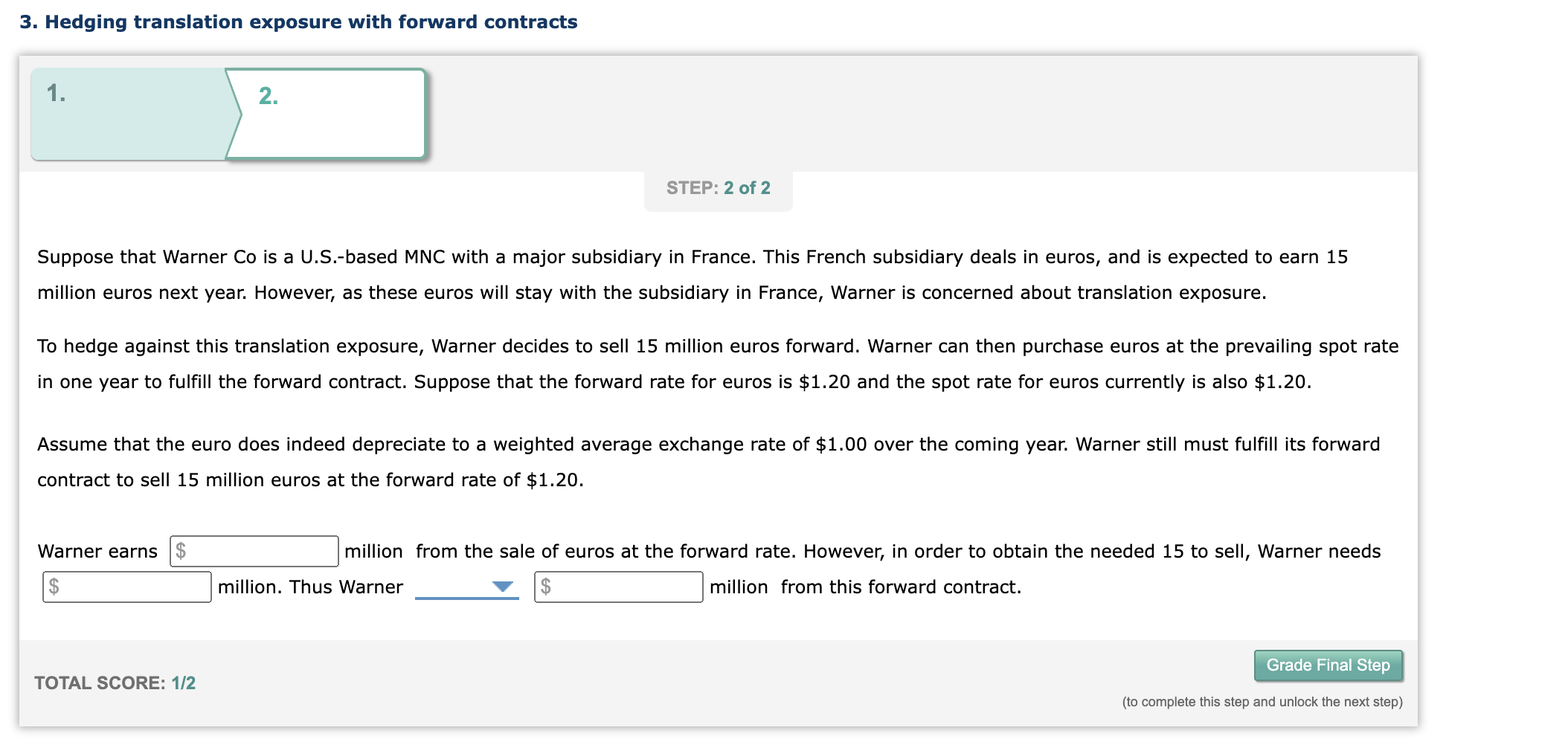

3. Hedging translation exposure with forward contracts 1. 2. STEP: 2 of 2 Suppose that Warner Co is a U.S.-based MNC with a major subsidiary in France. This French subsidiary deals in euros, and is expected to earn 15 million euros next year. However, as these euros will stay with the subsidiary in France, Warner is concerned about translation exposure. To hedge against this translation exposure, Warner decides to sell 15 million euros forward. Warner can then purchase euros at the prevailing spot rate in one year to fulfill the forward contract. Suppose that the forward rate for euros is $1.20 and the spot rate for euros currently is also $1.20. Assume that the euro does indeed depreciate to a weighted average exchange rate of $1.00 over the coming year. Warner still must fulfill its forward contract to sell 15 million euros at the forward rate of $1.20. Warner earns $ million from the sale of euros at the forward rate. However, in order to obtain the needed 15 to sell, Warner needs million. Thus Warner $ million from this forward contract. Grade Final Step TOTAL SCORE: 1/2 (to complete this step and unlock the next step)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts