Question: Use Macauly's Duration Price Approximation formula for this. Before a change in interest rates, your bond has the following characteristics: present value of $5,557.56, Duration

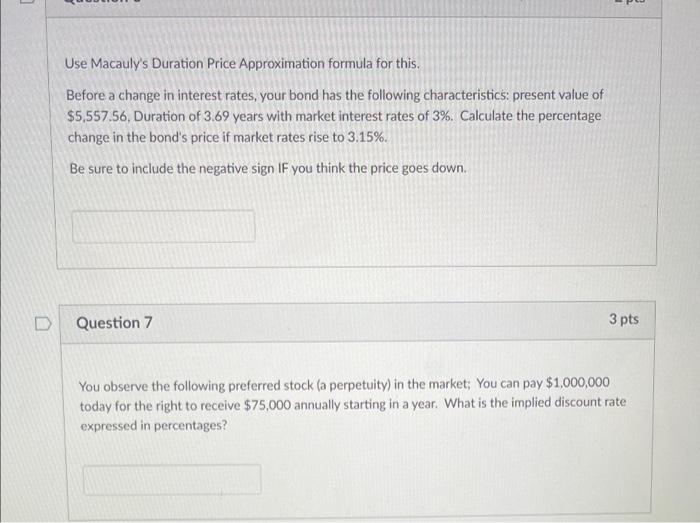

Use Macauly's Duration Price Approximation formula for this. Before a change in interest rates, your bond has the following characteristics: present value of $5,557.56, Duration of 3.69 years with market interest rates of 3%. Calculate the percentage change in the bond's price if market rates rise to 3.15%. Be sure to include the negative sign IF you think the price goes down. D Question 7 3 pts You observe the following preferred stock (a perpetuity) in the market: You can pay $1,000,000 today for the right to receive $75,000 annually starting in a year. What is the implied discount rate expressed in percentages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts