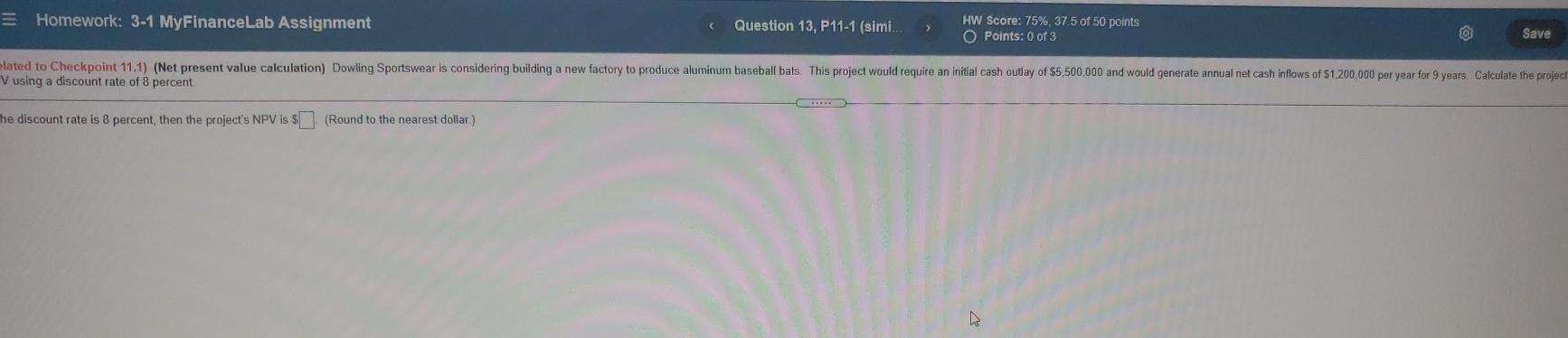

Question: 3 Homework: 3-1 MyFinanceLab Assignment Question 13, P11-1 (simi. HW Score: 75%, 37.5 of 50 points O Points: 0 of 3 Save elated to Checkpoint

3 Homework: 3-1 MyFinanceLab Assignment Question 13, P11-1 (simi. HW Score: 75%, 37.5 of 50 points O Points: 0 of 3 Save elated to Checkpoint 11.1) (Net present value calculation) Dowling Sportswear is considering building a new factory to produce aluminum baseball bats. This project would require an initial cash outlay of $5,500,000 and would generate annual net cash inflows of $1,200,000 per year for 9 years. Calculate the project V using a discount rate of 8 percent. he discount rate is 8 percent, then the project's NPV is $(Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts