Question: 3. In Black-Scholes framework (continuous time) and under the risk-neutral probability, the stock price follows a lognormal distribution: S(T) = Soer-8-r/2)T +/Tz where Z is

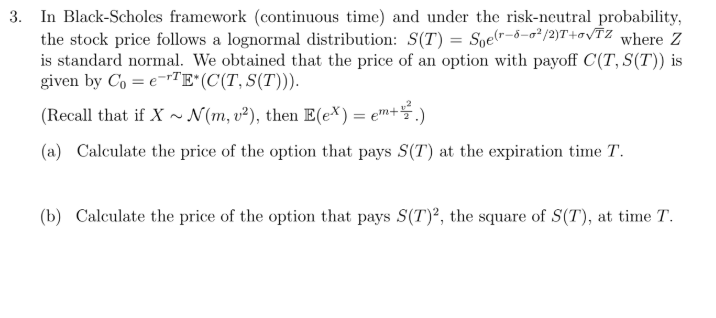

3. In Black-Scholes framework (continuous time) and under the risk-neutral probability, the stock price follows a lognormal distribution: S(T) = Soer-8-r/2)T +/Tz where Z is standard normal. We obtained that the price of an option with payoff C(T, S(T)) is given by Co = e-TE*(C(T, S(T))). (Recall that if X ~ N(m, v2), then E(ex) = m+.) (a) Calculate the price of the option that pays S(T) at the expiration time T. (b) Calculate the price of the option that pays S(T)2, the square of S(T), at time T. 3. In Black-Scholes framework (continuous time) and under the risk-neutral probability, the stock price follows a lognormal distribution: S(T) = Soer-8-r/2)T +/Tz where Z is standard normal. We obtained that the price of an option with payoff C(T, S(T)) is given by Co = e-TE*(C(T, S(T))). (Recall that if X ~ N(m, v2), then E(ex) = m+.) (a) Calculate the price of the option that pays S(T) at the expiration time T. (b) Calculate the price of the option that pays S(T)2, the square of S(T), at time T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts