Question: 3. In this question, let a, b e {0, 1, 2, ...,8,9} be given by a 8 b 7 Consider a binomial model with the

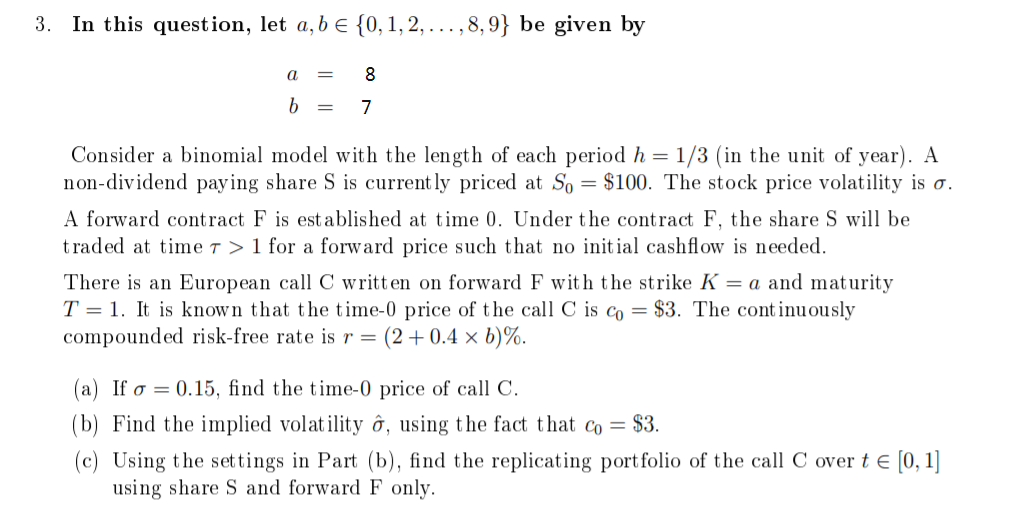

3. In this question, let a, b e {0, 1, 2, ...,8,9} be given by a 8 b 7 Consider a binomial model with the length of each period h = 1/3 (in the unit of year). A non-dividend paying share S is currently priced at So = $100. The stock price volatility is o. A forward contract F is established at time 0. Under the contract F, the share S will be traded at time t > 1 for a forward price such that no initial cashflow is needed. There is an European call C written on forward F with the strike K = a and maturity T = 1. It is known that the time-0 price of the call C is co = $3. The continuously compounded risk-free rate is r = (2+0.4 x b)%. (a) If o = 0.15, find the time-0 price of call C. (b) Find the implied volatility , using the fact that co = $3. Using the settings in Part (b), find the replicating portfolio of the call C over te [0, 1] using share S and forward F only. 3. In this question, let a, b e {0, 1, 2, ...,8,9} be given by a 8 b 7 Consider a binomial model with the length of each period h = 1/3 (in the unit of year). A non-dividend paying share S is currently priced at So = $100. The stock price volatility is o. A forward contract F is established at time 0. Under the contract F, the share S will be traded at time t > 1 for a forward price such that no initial cashflow is needed. There is an European call C written on forward F with the strike K = a and maturity T = 1. It is known that the time-0 price of the call C is co = $3. The continuously compounded risk-free rate is r = (2+0.4 x b)%. (a) If o = 0.15, find the time-0 price of call C. (b) Find the implied volatility , using the fact that co = $3. Using the settings in Part (b), find the replicating portfolio of the call C over te [0, 1] using share S and forward F only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts