Question: 3. is not +/- 172173.37 need the correct answer 4. is not +/- 158746.65 need the correct answer asked this earlier it was incorrect, thank

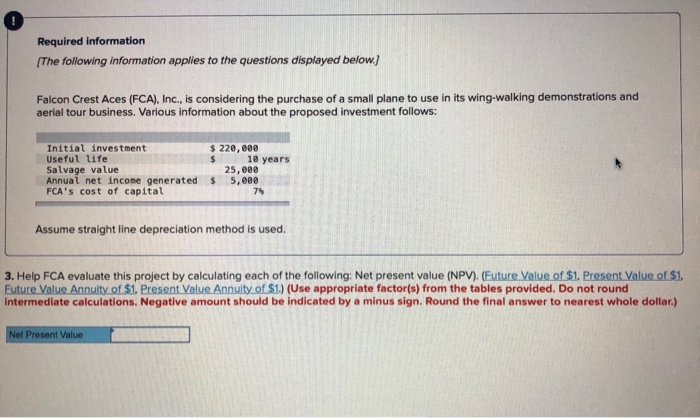

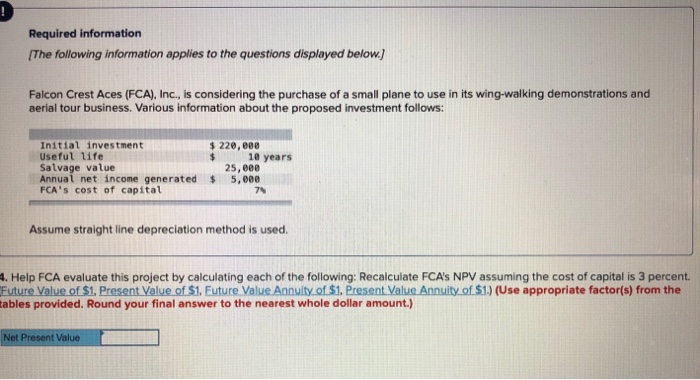

Required information The following information applies to the questions displayed below.) Falcon Crest Aces (FCA), Inc., is considering the purchase of a small plane to use in its wing-walking demonstrations and aerial tour business. Various information about the proposed investment follows: Initial investment $ 220,000 Useful life 10 years Salvage value 25,000 Annual net income generated $ 5,000 FCA's cost of capital Assume straight line depreciation method is used. 3. Help FCA evaluate this project by calculating each of the following: Net present value (NPV). (Future Value of $1. Present Value of $1, Future Value Annuity of $1. Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar.) Net Present Value Required information (The following information applies to the questions displayed below) Falcon Crest Aces (FCA), Inc., is considering the purchase of a small plane to use in its wing-walking demonstrations and aerial tour business. Various information about the proposed investment follows: Initial investment $ 220,000 Useful life $ 10 years Salvage value 25, eee Annual net income generated $ 5,000 FCA's cost of capital Assume straight line depreciation method is used. 4. Help FCA evaluate this project by calculating each of the following: Recalculate FCA's NPV assuming the cost of capital is 3 percent. Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Round your final answer to the nearest whole dollar amount.) Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts