Question: Please help! Asap. Question 1 1 pts MeadWestvaco Corp issues a 6 percent coupon bond with 22 years maturity, $1,000 face (par) value, and semi-annual

Please help! Asap.

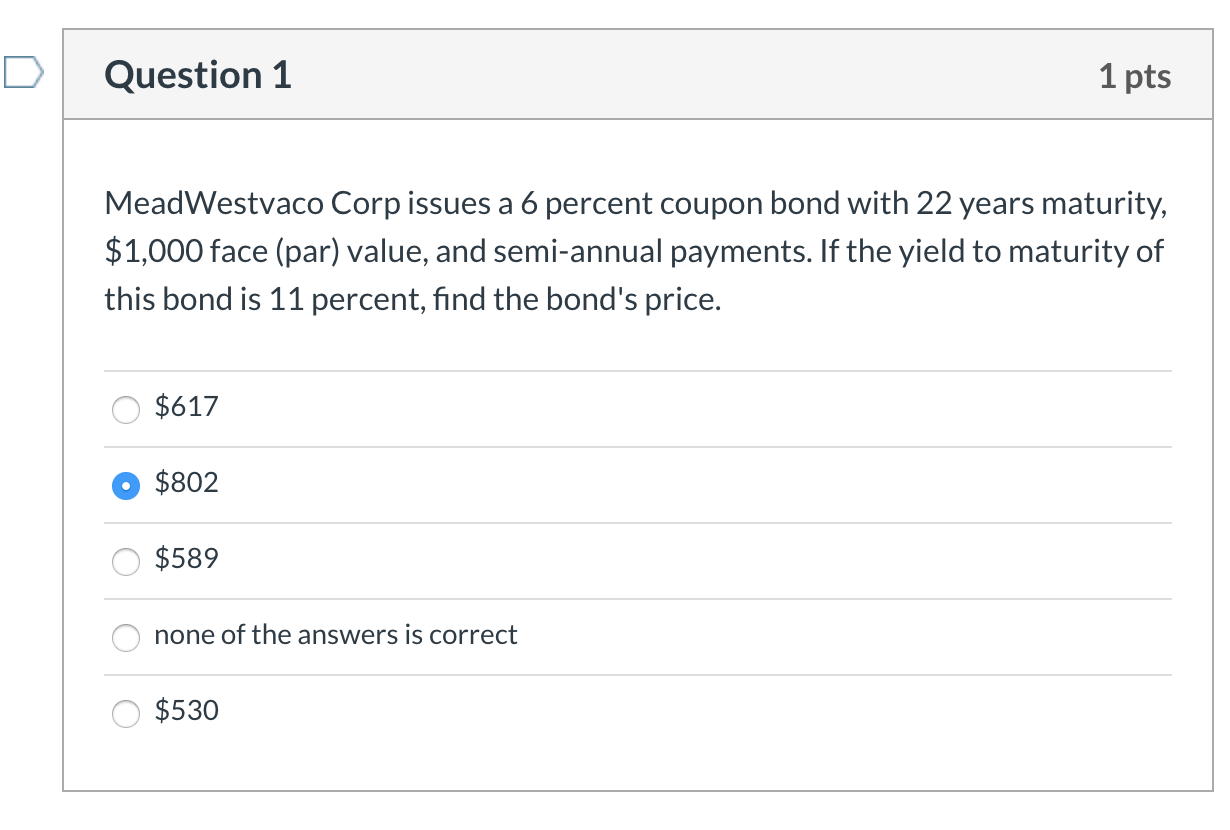

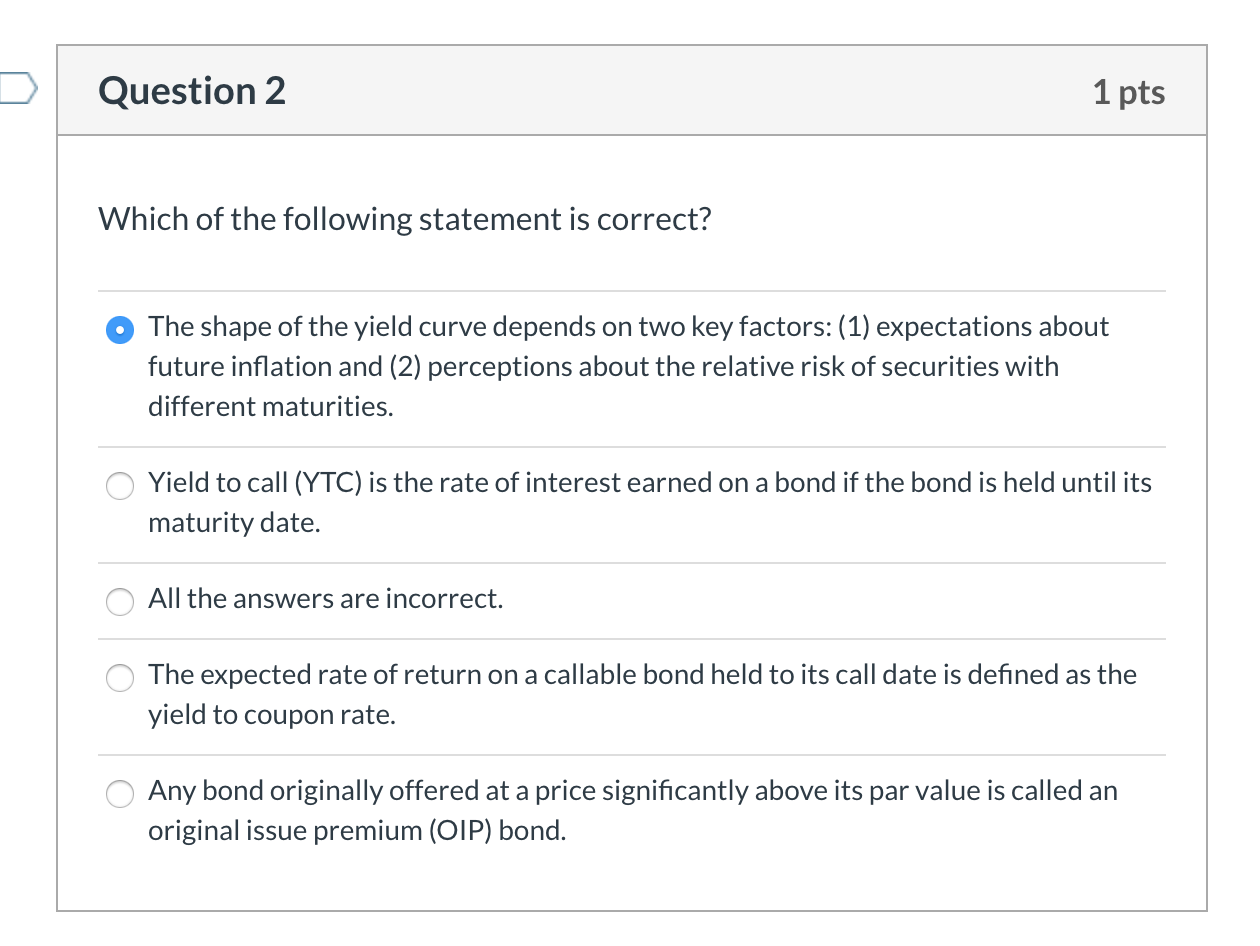

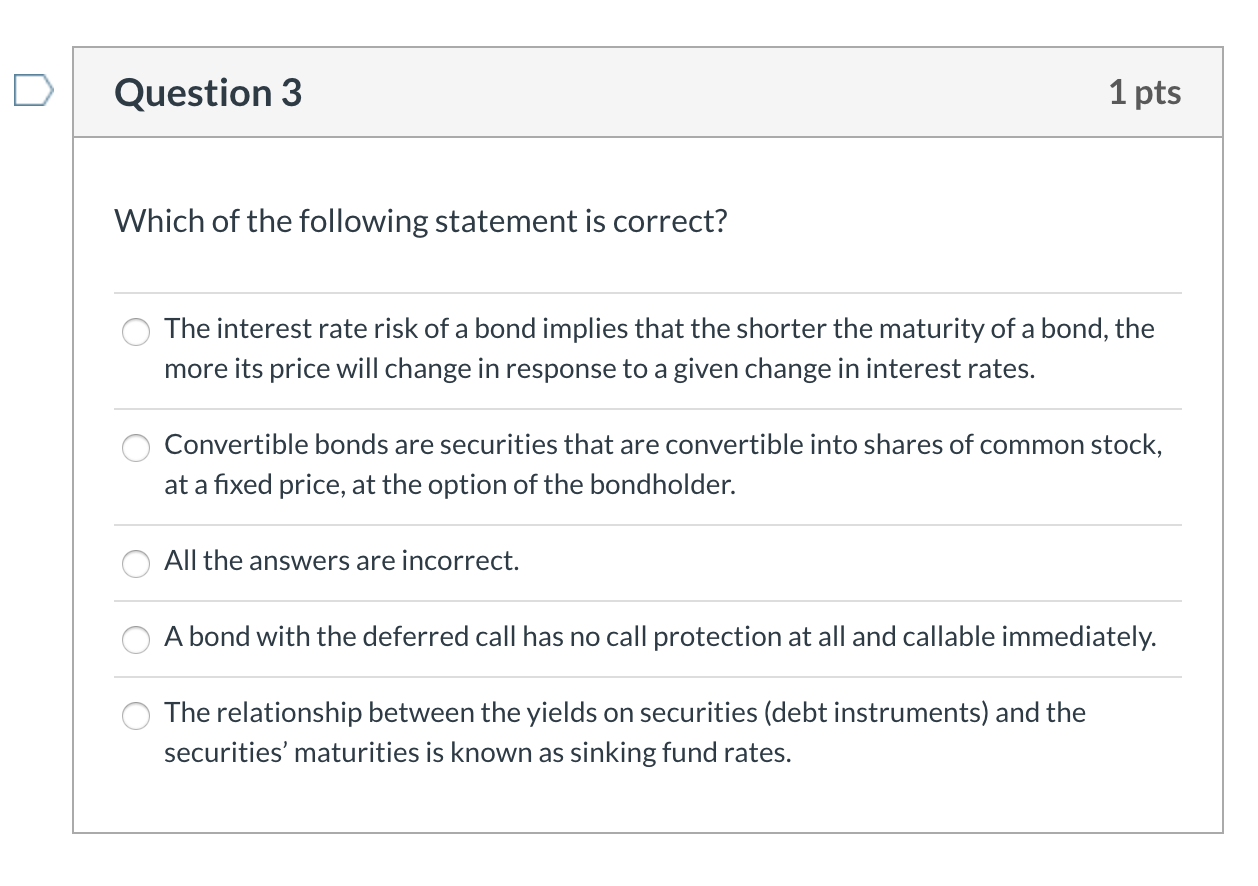

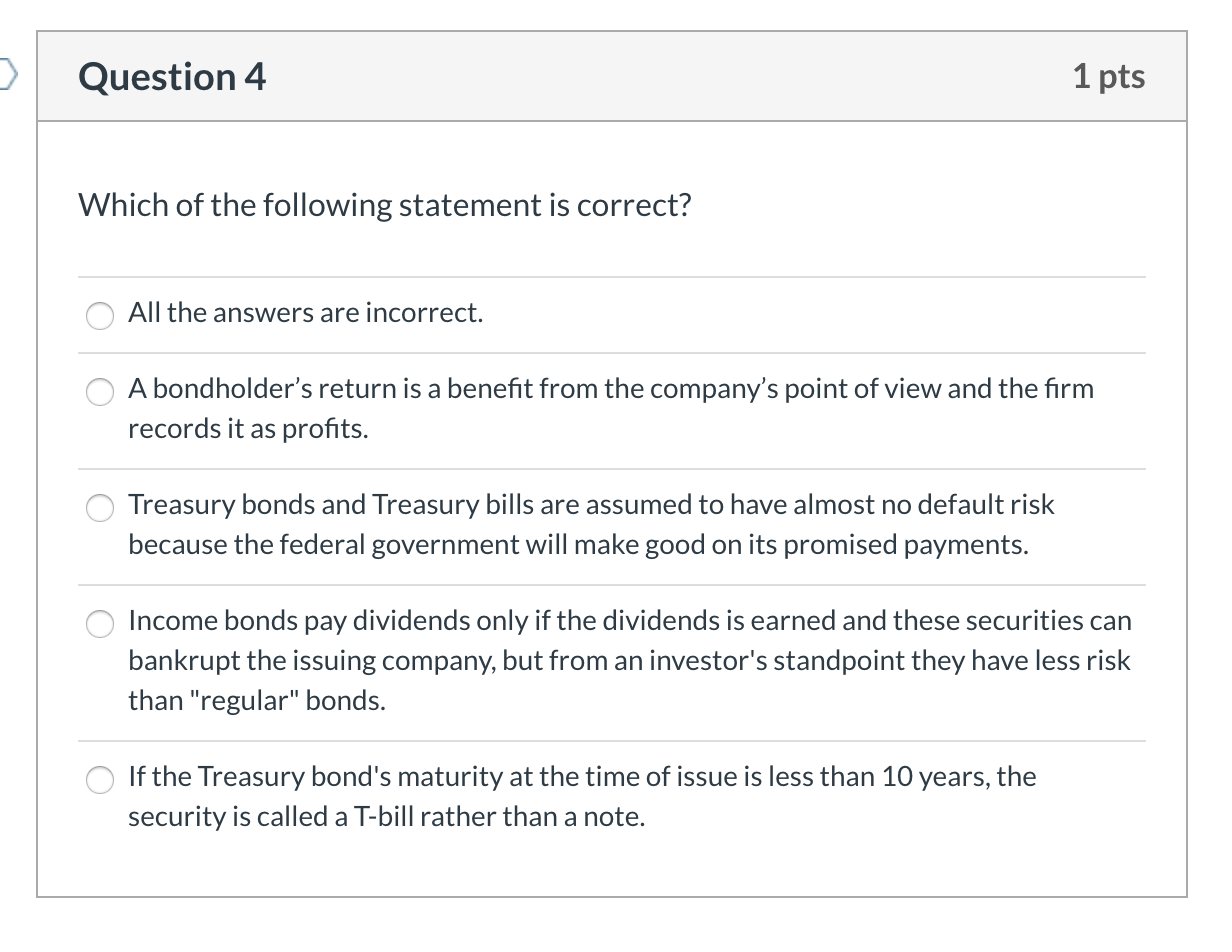

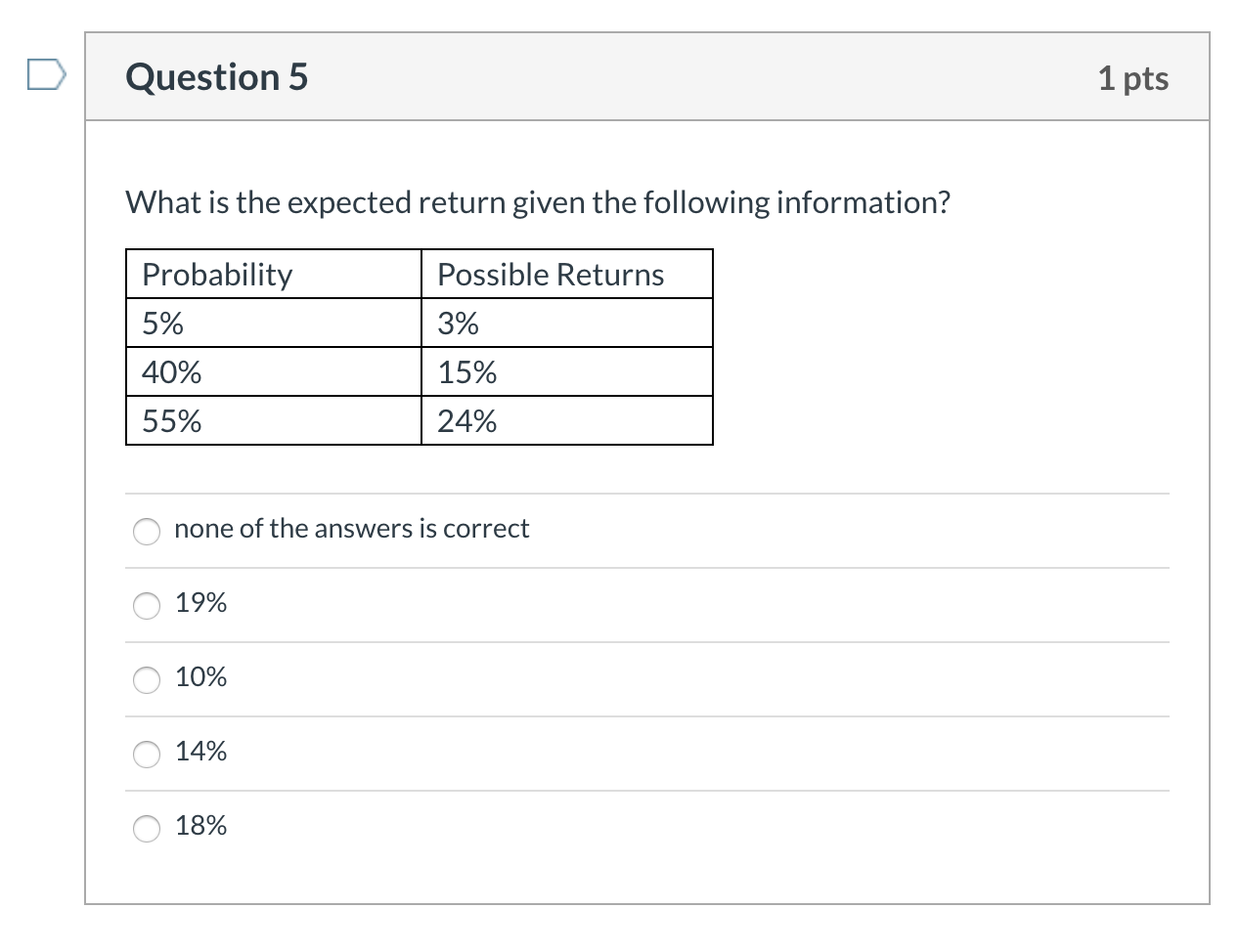

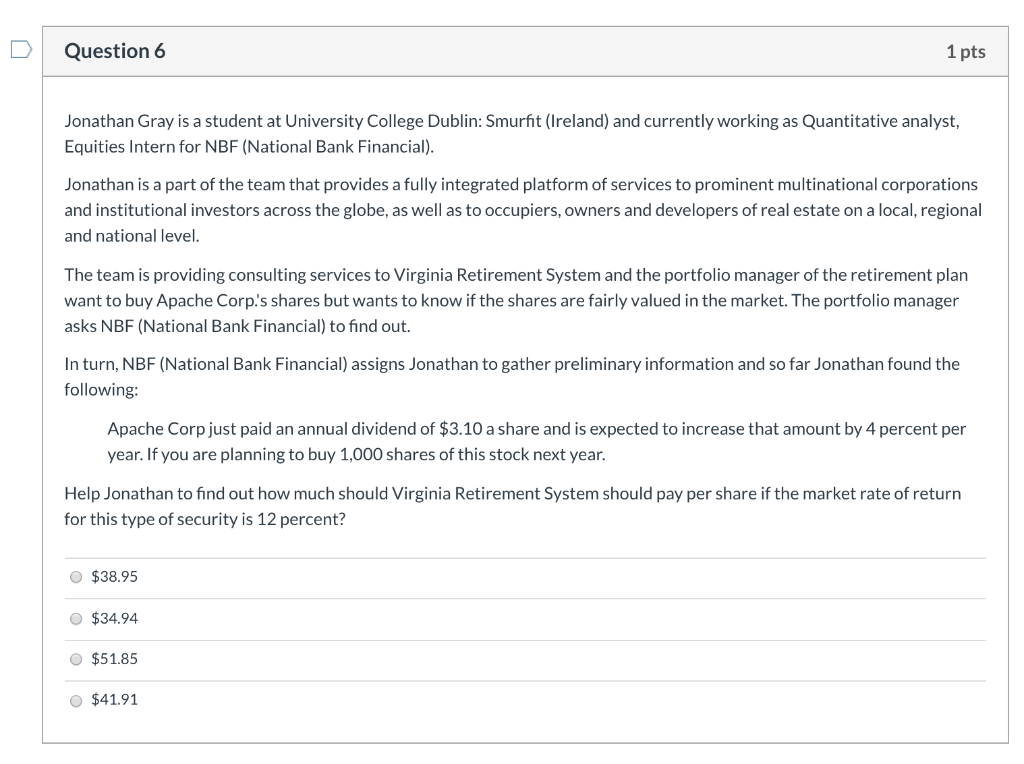

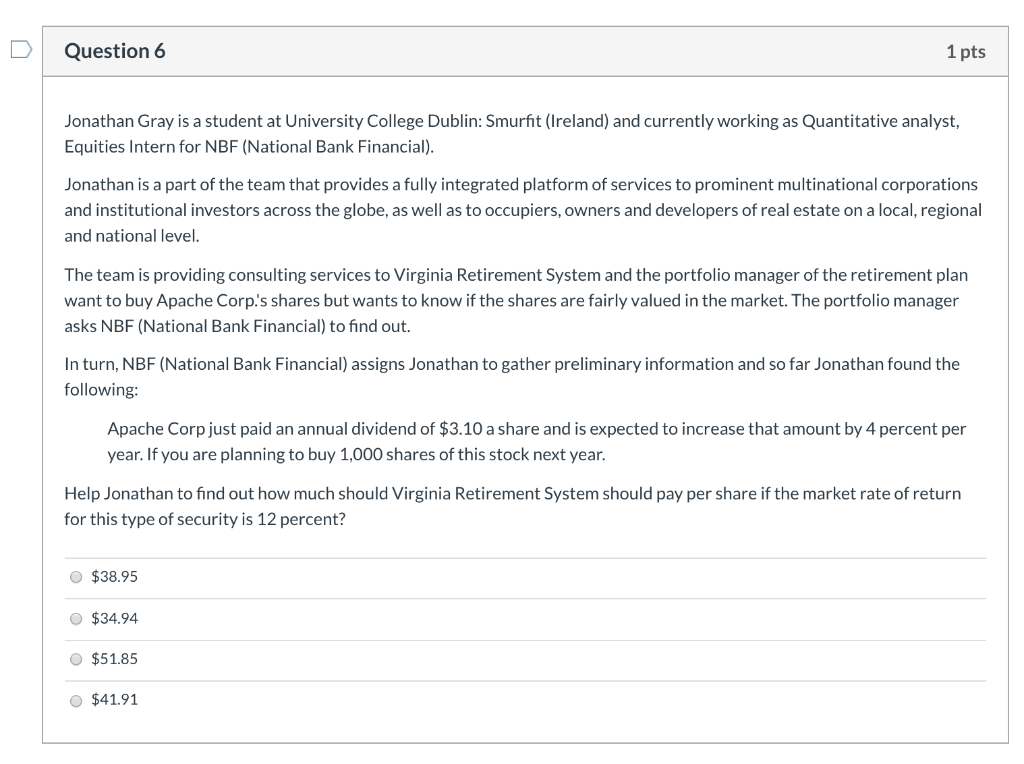

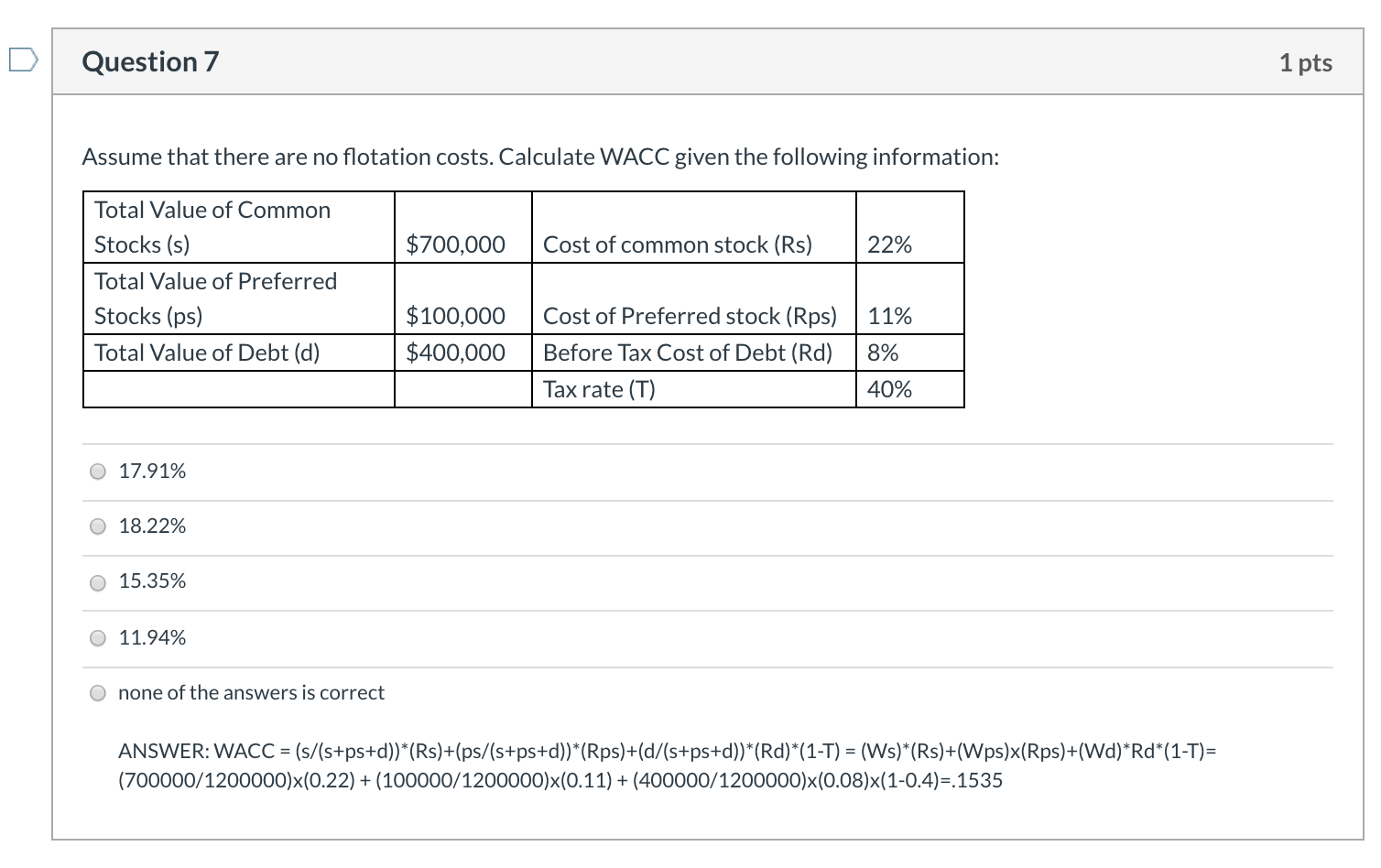

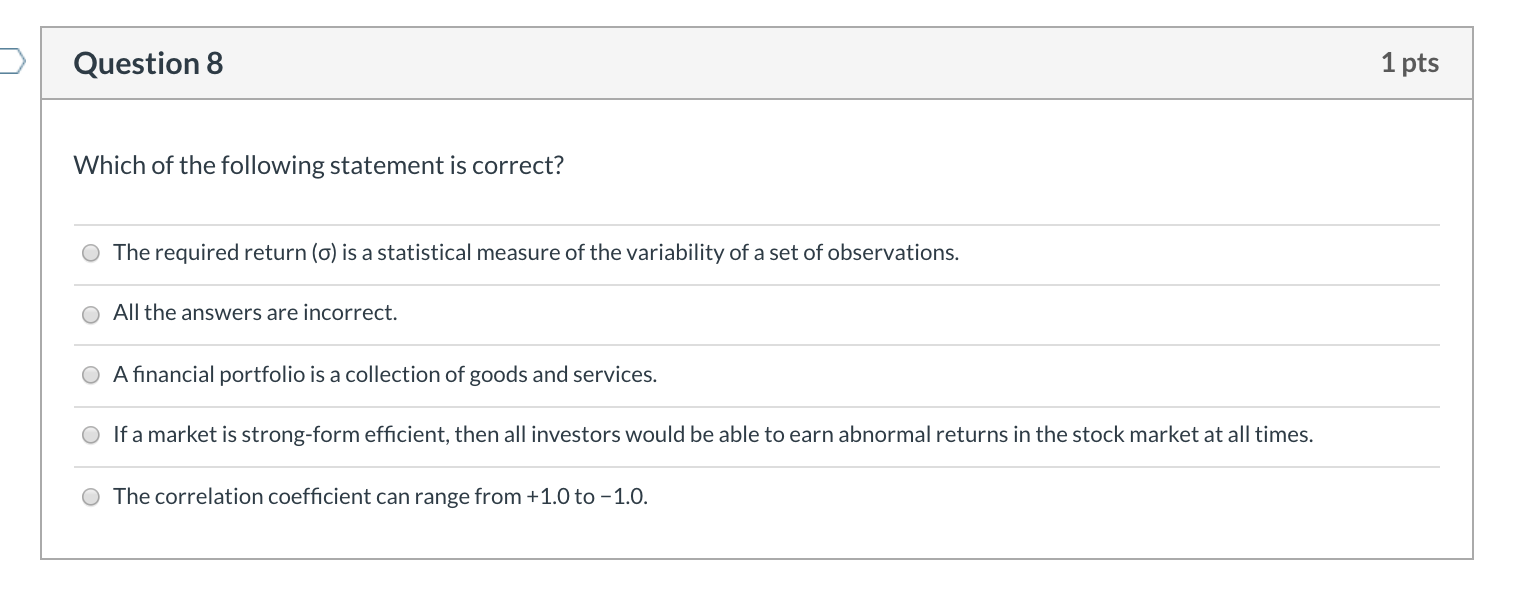

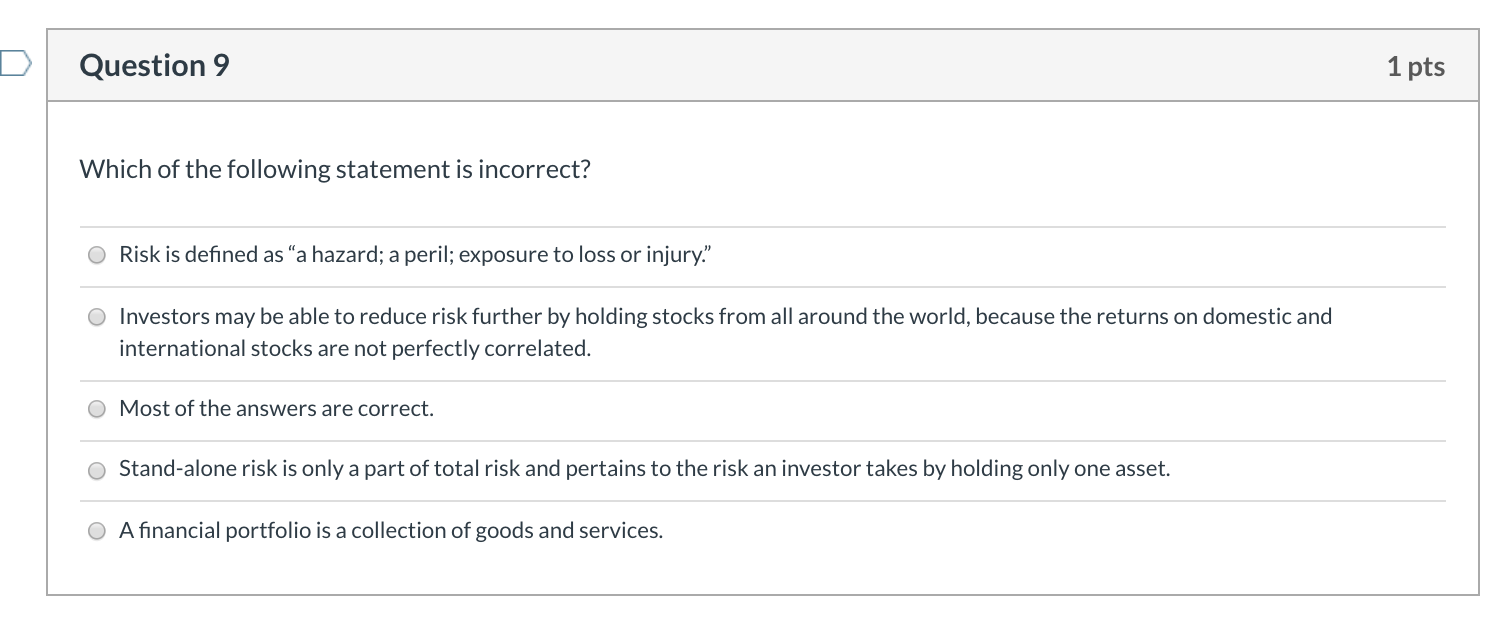

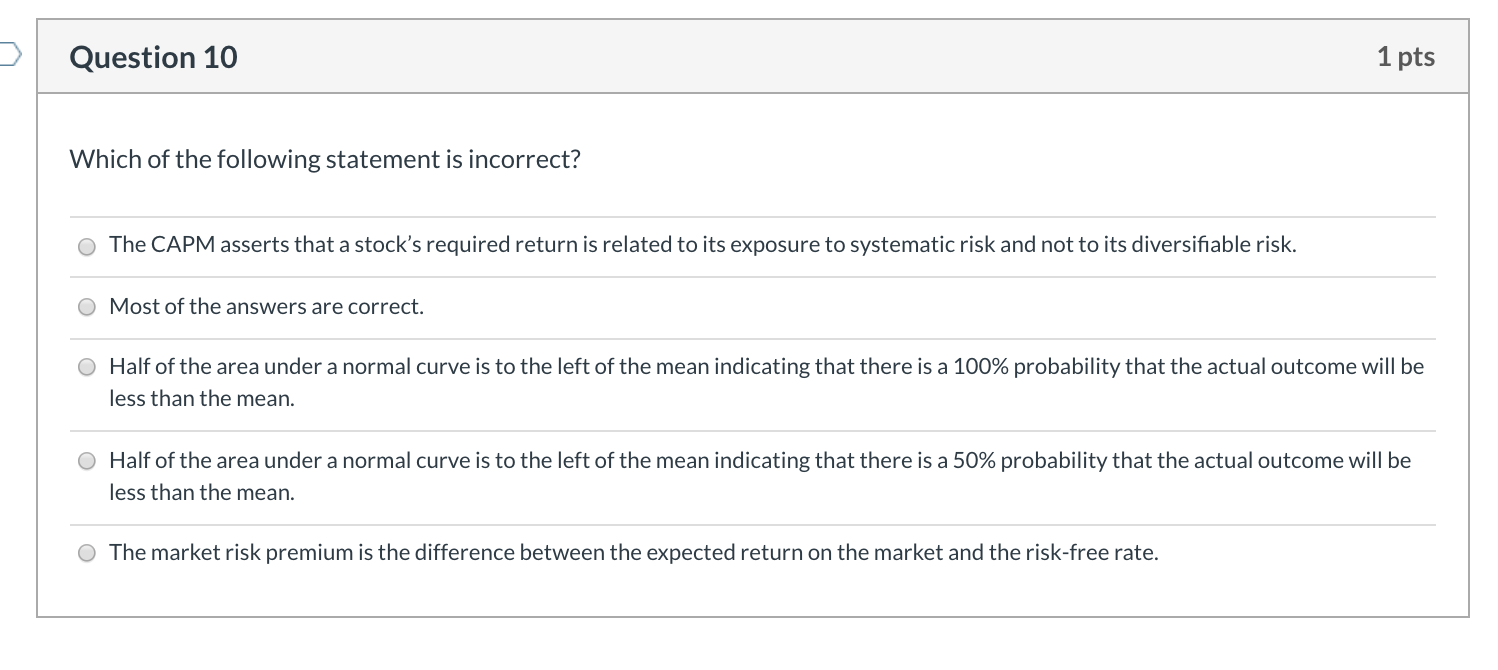

Question 1 1 pts MeadWestvaco Corp issues a 6 percent coupon bond with 22 years maturity, $1,000 face (par) value, and semi-annual payments. If the yield to maturity of this bond is 11 percent, find the bond's price. 0 $617 $802 0 $589 O none of the answers is correct O $530 Question 2 1 pts Which of the following statement is correct? O The shape of the yield curve depends on two key factors: (1) expectations about future inflation and (2) perceptions about the relative risk of securities with different maturities. Yield to call (YTC) is the rate of interest earned on a bond if the bond is held until its maturity date. O All the answers are incorrect. O The expected rate of return on a callable bond held to its call date is defined as the yield to coupon rate. Any bond originally offered at a price significantly above its par value is called an original issue premium (OIP) bond. Question 3 1 pts Which of the following statement is correct? The interest rate risk of a bond implies that the shorter the maturity of a bond, the more its price will change in response to a given change in interest rates. O Convertible bonds are securities that are convertible into shares of common stock, at a fixed price, at the option of the bondholder. O All the answers are incorrect. O A bond with the deferred call has no call protection at all and callable immediately. o The relationship between the yields on securities (debt instruments) and the securities' maturities is known as sinking fund rates. Question 4 1 pts Which of the following statement is correct? O All the answers are incorrect. O A bondholder's return is a benefit from the company's point of view and the firm records it as profits. O Treasury bonds and Treasury bills are assumed to have almost no default risk because the federal government will make good on its promised payments. O Income bonds pay dividends only if the dividends is earned and these securities can bankrupt the issuing company, but from an investor's standpoint they have less risk than "regular" bonds. O If the Treasury bond's maturity at the time of issue is less than 10 years, the security is called a T-bill rather than a note. Question 5 1 pts What is the expected return given the following information? Probability 5% 40% 55% Possible Returns 3% 15% 24% O none of the answers is correct O 19% O 10% O O 14% O O 18% Question 6 1 pts Jonathan Gray is a student at University College Dublin: Smurfit (Ireland) and currently working as Quantitative analyst, Equities Intern for NBF (National Bank Financial). Jonathan is a part of the team that provides a fully integrated platform of services to prominent multinational corporations and institutional investors across the globe, as well as to occupiers, owners and developers of real estate on a local, regional and national level. The team is providing consulting services to Virginia Retirement System and the portfolio manager of the retirement plan want to buy Apache Corp.'s shares but wants to know if the shares are fairly valued in the market. The portfolio manager asks NBF (National Bank Financial) to find out. In turn, NBF (National Bank Financial) assigns Jonathan to gather preliminary information and so far Jonathan found the following: Apache Corp just paid an annual dividend of $3.10 a share and is expected to increase that amount by 4 percent per year. If you are planning to buy 1,000 shares of this stock next year. Help Jonathan to find out how much should Virginia Retirement System should pay per share if the market rate of return for this type of security is 12 percent? $38.95 $34.94 $51.85 $41.91 Question 6 1 pts Jonathan Gray is a student at University College Dublin: Smurfit (Ireland) and currently working as Quantitative analyst, Equities Intern for NBF (National Bank Financial). Jonathan is a part of the team that provides a fully integrated platform of services to prominent multinational corporations and institutional investors across the globe, as well as to occupiers, owners and developers of real estate on a local, regional and national level. The team is providing consulting services to Virginia Retirement System and the portfolio manager of the retirement plan want to buy Apache Corp.'s shares but wants to know if the shares are fairly valued in the market. The portfolio manager asks NBF (National Bank Financial) to find out. In turn, NBF (National Bank Financial) assigns Jonathan to gather preliminary information and so far Jonathan found the following: Apache Corp just paid an annual dividend of $3.10 a share and is expected to increase that amount by 4 percent per year. If you are planning to buy 1,000 shares of this stock next year. Help Jonathan to find out how much should Virginia Retirement System should pay per share if the market rate of return for this type of security is 12 percent? $38.95 $34.94 $51.85 $41.91 Question 7 1 pts Assume that there are no flotation costs. Calculate WACC given the following information: $700,000 Cost of common stock (Rs) 22% Total Value of Common Stocks (s) Total Value of Preferred Stocks (ps) Total Value of Debt (d) $100,000 $400,000 Cost of Preferred stock (Rps) Before Tax Cost of Debt (Rd) Tax rate (T) 11% 8% 40% O 17.91% 18.22% 15.35% O 11.94% O none of the answers is correct ANSWER: WACC = (s/(s+ps+d))*(Rs)+(ps/(s+ps+d))*(Rps)+(d/(s+ps+d))*(Rd)*(1-T) = (Ws)*(Rs)+(Wps)x(Rps)+(Wd)*Rd*(1-T)= (700000/1200000)x(0.22) + (100000/1200000)x(0.11) + (400000/1200000)x(0.08)x(1-0.4)=.1535 Question 8 1 pts Which of the following statement is correct? O The required return (o) is a statistical measure of the variability of a set of observations. All the answers are incorrect. O A financial portfolio is a collection of goods and services. O If a market is strong-form efficient, then all investors would be able to earn abnormal returns in the stock market at all times. The correlation coefficient can range from +1.0 to -1.0. Question 9 1 pts Which of the following statement is incorrect? O Risk is defined as "a hazard; a peril; exposure to loss or injury." O Investors may be able to reduce risk further by holding stocks from all around the world, because the returns on domestic and international stocks are not perfectly correlated. Most of the answers are correct. O Stand-alone risk is only a part of total risk and pertains to the risk an investor takes by holding only one asset. O A financial portfolio is a collection of goods and services. Question 10 1 pts Which of the following statement is incorrect? o The CAPM asserts that a stock's required return is related to its exposure to systematic risk and not to its diversifiable risk. O Most of the answers are correct. O Half of the area under a normal curve is to the left of the mean indicating that there is a 100% probability that the actual outcome will be less than the mean. O Half of the area under a normal curve is to the left of the mean indicating that there is a 50% probability that the actual outcome will be less than the mean. O The market risk premium is the difference between the expected return on the market and the risk-free rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts