Question: 3 Let t = 0 be the current time. At t = 1, the economy can be one of the following three possible growth rates,

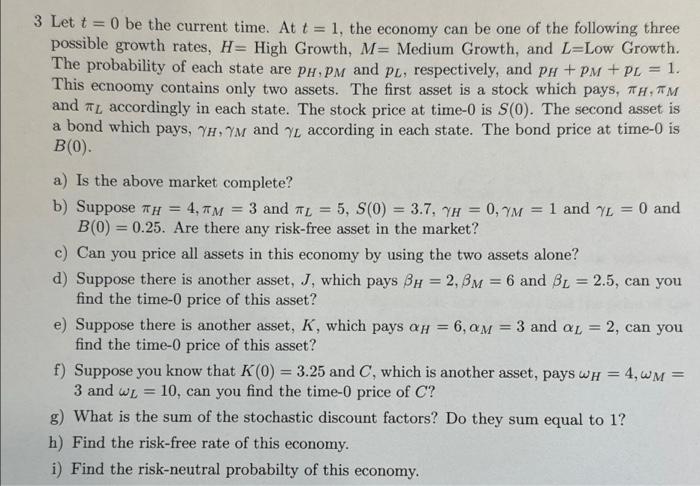

3 Let t=0 be the current time. At t=1, the economy can be one of the following three possible growth rates, H= High Growth, M= Medium Growth, and L= Low Growth. The probability of each state are pH,pM and pL, respectively, and pH+pM+pL=1. This ecnoomy contains only two assets. The first asset is a stock which pays, H,M and L accordingly in each state. The stock price at time- 0 is S(0). The second asset is a bond which pays, H,M and L according in each state. The bond price at time- 0 is B(0). a) Is the above market complete? b) Suppose H=4,M=3 and L=5,S(0)=3.7,H=0,M=1 and L=0 and B(0)=0.25. Are there any risk-free asset in the market? c) Can you price all assets in this economy by using the two assets alone? d) Suppose there is another asset, J, which pays H=2,M=6 and L=2.5, can you find the time- 0 price of this asset? e) Suppose there is another asset, K, which pays H=6,M=3 and L=2, can you find the time- 0 price of this asset? f) Suppose you know that K(0)=3.25 and C, which is another asset, pays H=4,M= 3 and L=10, can you find the time- 0 price of C ? g) What is the sum of the stochastic discount factors? Do they sum equal to 1 ? h) Find the risk-free rate of this economy. i) Find the risk-neutral probabilty of this economy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts