Question: 3. Let us consider a market where there are two risky assets A and B and a risk free asset. Both risky assets have the

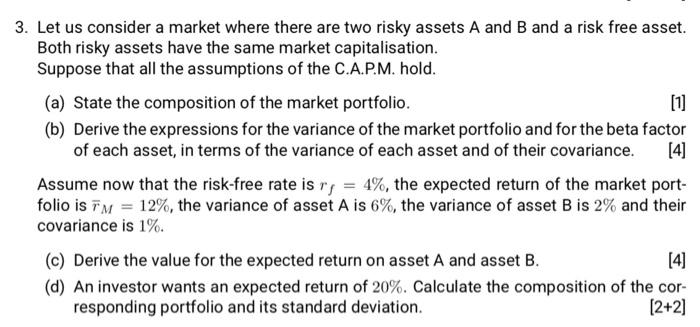

3. Let us consider a market where there are two risky assets A and B and a risk free asset. Both risky assets have the same market capitalisation. Suppose that all the assumptions of the C.A.P.M. hold. (a) State the composition of the market portfolio. [1] (b) Derive the expressions for the variance of the market portfolio and for the beta factor of each asset, in terms of the variance of each asset and of their covariance. [4] Assume now that the risk-free rate is rs = 4%, the expected return of the market port- folio is im = 12%, the variance of asset A is 6%, the variance of asset B is 2% and their covariance is 1%. (c) Derive the value for the expected return on asset A and asset B. [4] (d) An investor wants an expected return of 20%. Calculate the composition of the cor- responding portfolio and its standard deviation. (2+2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts