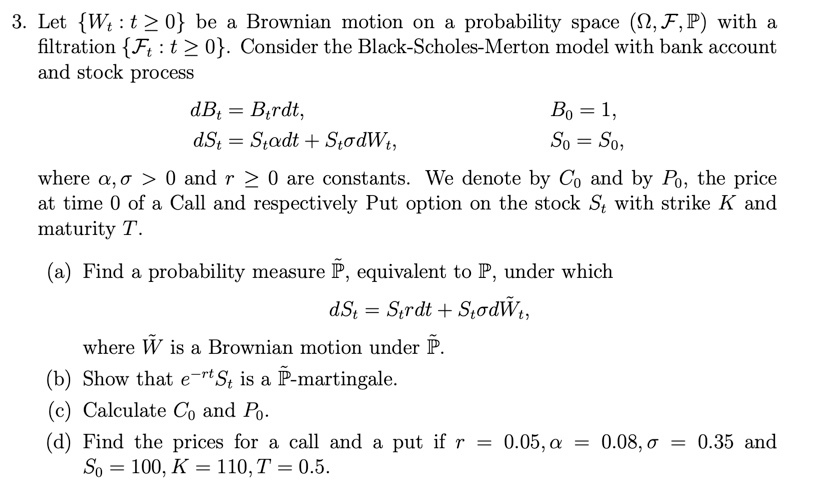

Question: 3. Let {W:t>0} be a Brownian motion on a probability space (12, F,P) with a filtration {Ft:t>0}. Consider the Black-Scholes-Merton model with bank account and

3. Let {W:t>0} be a Brownian motion on a probability space (12, F,P) with a filtration {Ft:t>0}. Consider the Black-Scholes-Merton model with bank account and stock process dB, = Birdt, Bo = 1, dSt = Stadt + StodWt, So = So, where a,o > 0 and r > 0 are constants. We denote by Co and by Po, the price at time 0 of a Call and respectively Put option on the stock S4 with strike K and maturity T. (a) Find a probability measure P, equivalent to P, under which dS4 = Serdt + ScodWt, where W is a Brownian motion under P. (b) Show that e-rt St is a P-martingale. (c) Calculate Co and Po. (d) Find the prices for a call and a put if r = 0.05, a = 0.08,0 = 0.35 and So = 100, K = 110, T = 0.5. 3. Let {W:t>0} be a Brownian motion on a probability space (12, F,P) with a filtration {Ft:t>0}. Consider the Black-Scholes-Merton model with bank account and stock process dB, = Birdt, Bo = 1, dSt = Stadt + StodWt, So = So, where a,o > 0 and r > 0 are constants. We denote by Co and by Po, the price at time 0 of a Call and respectively Put option on the stock S4 with strike K and maturity T. (a) Find a probability measure P, equivalent to P, under which dS4 = Serdt + ScodWt, where W is a Brownian motion under P. (b) Show that e-rt St is a P-martingale. (c) Calculate Co and Po. (d) Find the prices for a call and a put if r = 0.05, a = 0.08,0 = 0.35 and So = 100, K = 110, T = 0.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts