Question: L7.17 4. (8 marks) Consider a filtered probability space (12, F, {F}}t>0,P), and let {W}tzo be a Brow- nian motion. Let a stock price be

L7.17

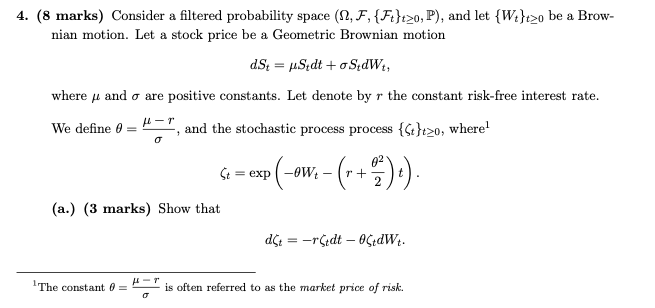

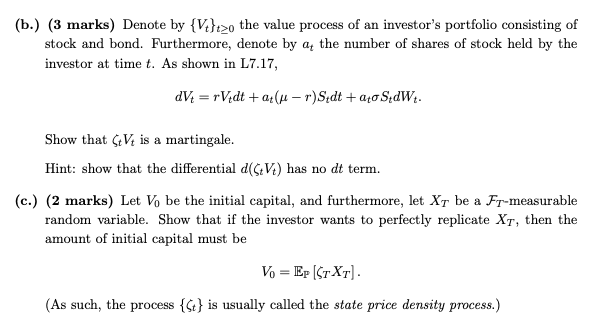

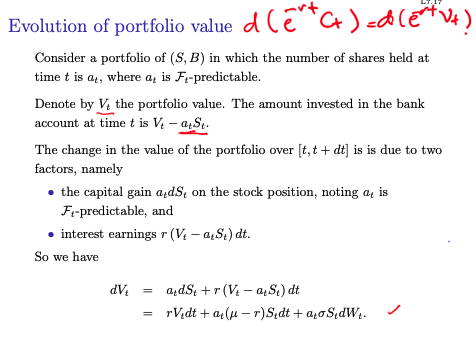

4. (8 marks) Consider a filtered probability space (12, F, {F}}t>0,P), and let {W}tzo be a Brow- nian motion. Let a stock price be a Geometric Brownian motion dS = Sedt +oS.dWt; where we and o are positive constants. Let denote by r the constant risk-free interest rate. We define 0 = and the stochastic process process {St}t20, where! 0 Ct = exp (-0w (-+)). (a.) (3 marks) Show that du = -r(idt - 050W. The constant = is often referred to as the market price of risk. (b.) (3 marks) Denote by {V1}>o the value process of an investor's portfolio consisting of stock and bond. Furthermore, denote by at the number of shares of stock held by the investor at time t. As shown in L7.17, dV1 =rVidt + a[(u r)Sedt + ato SidWt. Show that GV is a martingale. Hint: show that the differential d(GVt) has no dt term. (c.) (2 marks) Let Vo be the initial capital, and furthermore, let Xbe a Fr-measurable random variable. Show that if the investor wants to perfectly replicate XT, then the amount of initial capital must be V = Ep (CTXT) (As such, the process {St} is usually called the state price density process.) Evolution of portfolio value d cut ct) ed leat vt) Consider a portfolio of (S,B) in which the number of shares held at time t is at, where ac is Fi-predictable. Denote by V4 the portfolio value. The amount invested in the bank account at time t is Vi - St. The change in the value of the portfolio over [t,t + dt] is is due to two factors, namely the capital gain ads on the stock position, noting Q4 is Ft-predictable, and interest earnings r (V. - St) dt. So we have DV: adS, +r(V4 - Q Se) dt rVidt+a:( r)Sdt + OSW. 4. (8 marks) Consider a filtered probability space (12, F, {F}}t>0,P), and let {W}tzo be a Brow- nian motion. Let a stock price be a Geometric Brownian motion dS = Sedt +oS.dWt; where we and o are positive constants. Let denote by r the constant risk-free interest rate. We define 0 = and the stochastic process process {St}t20, where! 0 Ct = exp (-0w (-+)). (a.) (3 marks) Show that du = -r(idt - 050W. The constant = is often referred to as the market price of risk. (b.) (3 marks) Denote by {V1}>o the value process of an investor's portfolio consisting of stock and bond. Furthermore, denote by at the number of shares of stock held by the investor at time t. As shown in L7.17, dV1 =rVidt + a[(u r)Sedt + ato SidWt. Show that GV is a martingale. Hint: show that the differential d(GVt) has no dt term. (c.) (2 marks) Let Vo be the initial capital, and furthermore, let Xbe a Fr-measurable random variable. Show that if the investor wants to perfectly replicate XT, then the amount of initial capital must be V = Ep (CTXT) (As such, the process {St} is usually called the state price density process.) Evolution of portfolio value d cut ct) ed leat vt) Consider a portfolio of (S,B) in which the number of shares held at time t is at, where ac is Fi-predictable. Denote by V4 the portfolio value. The amount invested in the bank account at time t is Vi - St. The change in the value of the portfolio over [t,t + dt] is is due to two factors, namely the capital gain ads on the stock position, noting Q4 is Ft-predictable, and interest earnings r (V. - St) dt. So we have DV: adS, +r(V4 - Q Se) dt rVidt+a:( r)Sdt + OSW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts