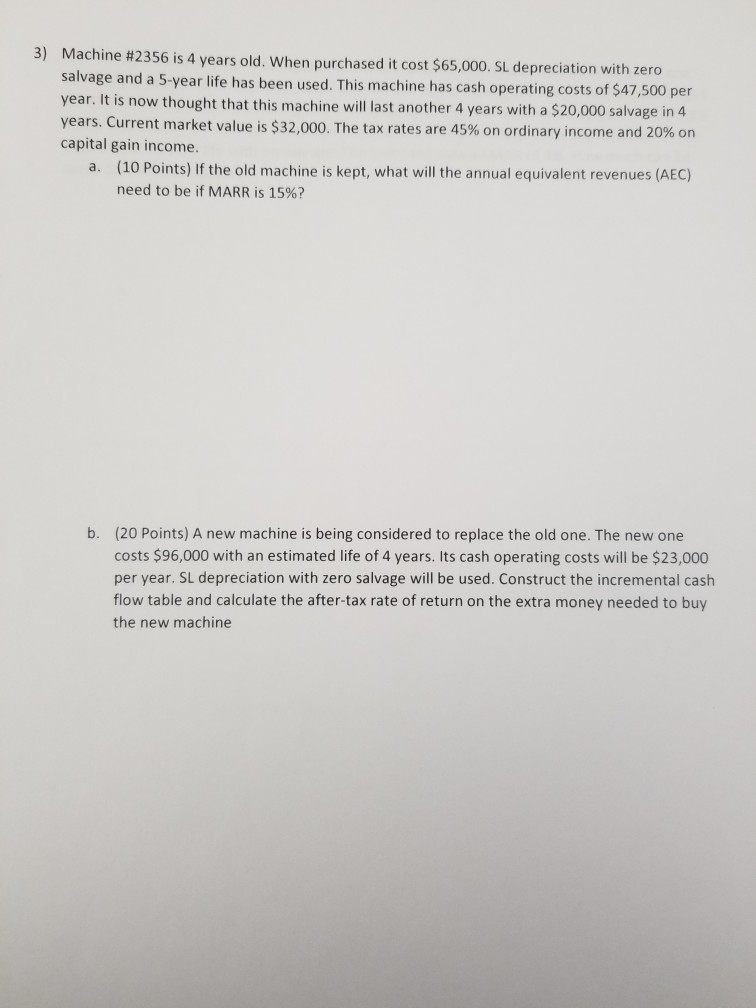

Question: 3) Machine #2356 is 4 years old, when purchased it cost $65,000. SL depreciation with zero salvage and a 5-year life has been used. This

3) Machine #2356 is 4 years old, when purchased it cost $65,000. SL depreciation with zero salvage and a 5-year life has been used. This machine has cash operating costs of $47,500 per year. It is now thought that this machine will last another 4 years with a$ years. Current market value is $32,000. The tax rates are 45% on ordinary income and 20% on capital gain income. (10 Points) If the old machine is kept, what will the annual equivalent revenues (AEC) need to be if MARR is 15%? a. b. (20 Points) A new machine is being considered to replace the old one. The new one costs $96,000 with an estimated life of 4 years. Its cash operating costs will be $23,000 per year. SL depreciation with zero salvage will be used. Construct the incremental cash flow table and calculate the after-tax rate of return on the extra money needed to buy the new machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts