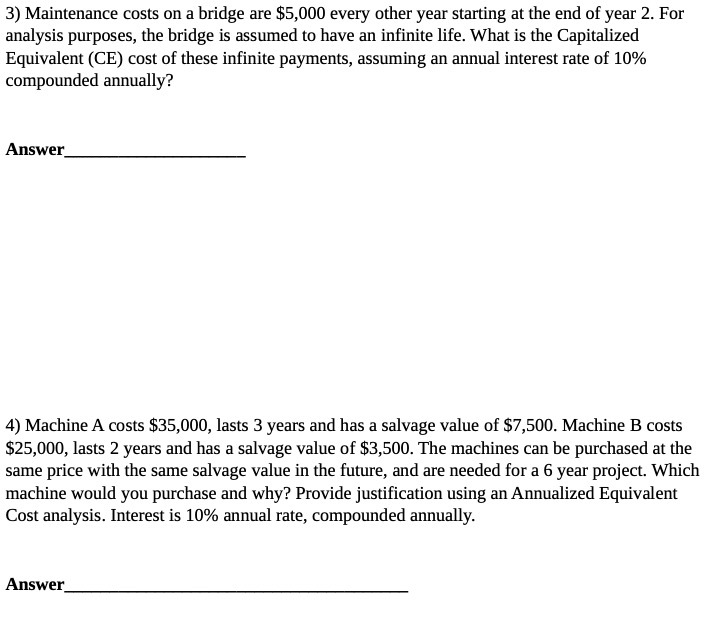

Question: 3) Maintenance costs on a bridge are $5, every ether year starting at the end of year 2. For analysis purposes, the bridge is assumed

3) Maintenance costs on a bridge are $5, every ether year starting at the end of year 2. For analysis purposes, the bridge is assumed to have an infinite life. What is the Capitalized Equivalent {CE} cost of these infinite payments, assuming an annual interest rate of 1% compounded annually? Answer 4) Machine A costs $35,, lasts 3 years and has a salvage value of $150!]. Machine B costs $25,000, lasts 2 years and has a salvage value of $3,5. The machines can he purchased at the same price with the same salvage value in the future, and are needed for a 6 year projecL Which machine would you purchase and why? Provide justification using anAnnualized Equivalent Cost analysis. Interest is 1% annual rate, compounded annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts