Question: Maintenance costs on a bridge are $5,000 every third year starting at the end of year 3. For analysis purposes, the bridge is assumed to

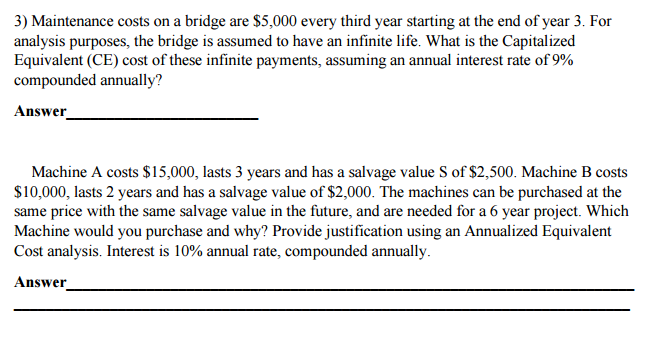

Maintenance costs on a bridge are $5,000 every third year starting at the end of year 3. For analysis purposes, the bridge is assumed to have an infinite life. What is the Capitalized Equivalent (CE) cost of these infinite payments, assuming an annual interest rate of 9% compounded annually? Machine A costs $15,000, lasts 3 years and has a salvage value S of $2, 500. Machine B costs $10,000, lasts 2 years and has a salvage value of $2,000. The machines can be purchased at the same price with the same salvage value in the future, and are needed for a 6 year project. Which Machine would you purchase and why? Provide justification using an Annualized Equivalent Cost analysis. Interest is 10% annual rate, compounded annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts