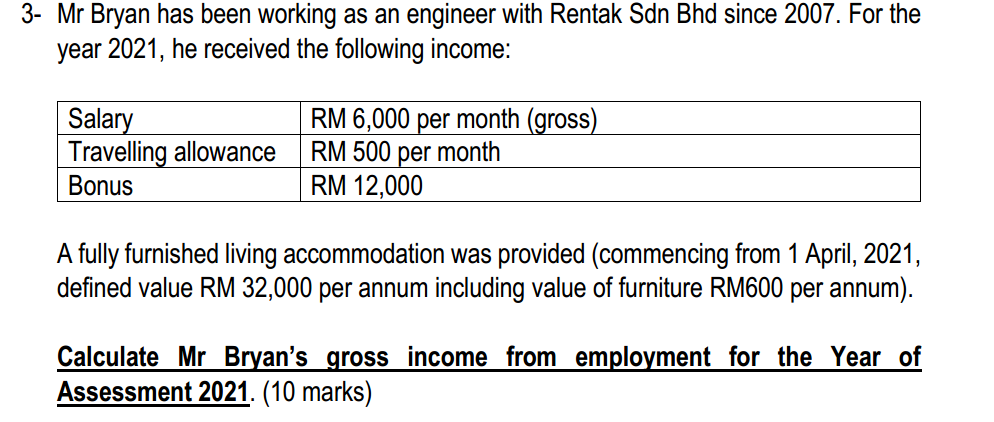

Question: 3- Mr Bryan has been working as an engineer with Rentak Sdn Bhd since 2007. For the year 2021, he received the following income: Salary

3- Mr Bryan has been working as an engineer with Rentak Sdn Bhd since 2007. For the year 2021, he received the following income: Salary Travelling allowance Bonus RM 6,000 per month (gross) RM 500 per month RM 12,000 A fully furnished living accommodation was provided (commencing from 1 April, 2021, defined value RM 32,000 per annum including value of furniture RM600 per annum). Calculate Mr Bryan's gross income from employment for the Year of Assessment 2021. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts