Question: 3. Ms Lei is a sole practitioner accountant. Her practice also acts as an agent for a local energy supplier accepting payments. The income

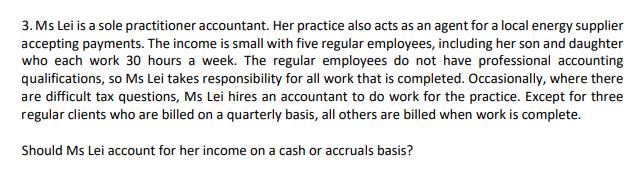

3. Ms Lei is a sole practitioner accountant. Her practice also acts as an agent for a local energy supplier accepting payments. The income is small with five regular employees, including her son and daughter who each work 30 hours a week. The regular employees do not have professional accounting qualifications, so Ms Lei takes responsibility for all work that is completed. Occasionally, where there are difficult tax questions, Ms Lei hires an accountant to do work for the practice. Except for three regular clients who are billed on a quarterly basis, all others are billed when work is complete. Should Ms Lei account for her income on a cash or accruals basis?

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provide... View full answer

Get step-by-step solutions from verified subject matter experts