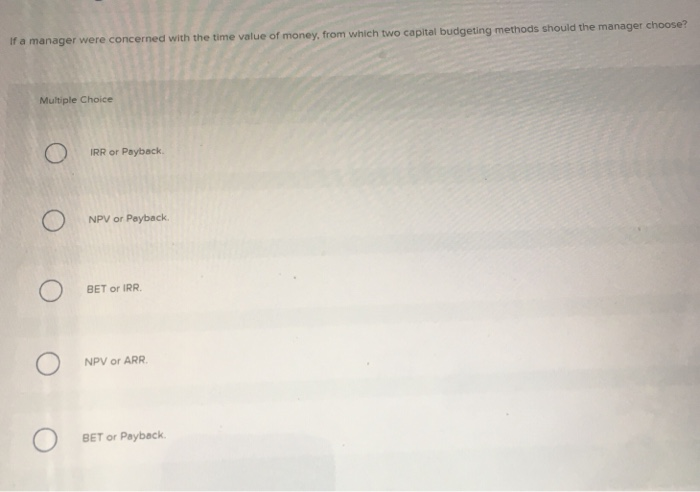

Question: 3 Multiple choice question, Thank You! (33-35) If a manager were concerned with the time value of money, from which two capital budgeting methods should

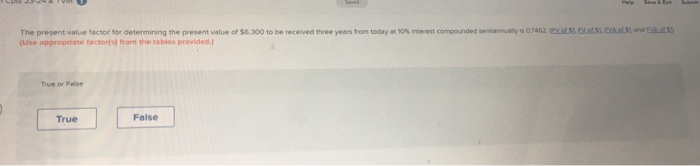

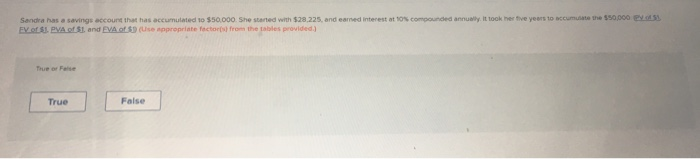

If a manager were concerned with the time value of money, from which two capital budgeting methods should the manager choose? Multiple Choice IRR or Payback NPV or Payback BET or IRR NPV or ARR BET or Payback le The present value factor for determining the present value of $6,300 to be received three years from today at 10% interest compounded semiannualys 0.7462. VEYSIDE (Use appropriate factors) from the tables provided True or False True False Sandra has a savings account that has accumulated 10 $50.000. She started with $28,225, and eamed interest to comoded annually. It took her five years to accumulate the $5000 45 EVO SL PVA of 5, and EVA of Use appropriate factors from the tables provided) The or True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts