Question: 3) Net Present Value (NPV). 4) Recalculate the NPV assuming BBSs cost of capital is 13 percent. PA11-1 Calculating Accounting Rate of Return, Payback Period,

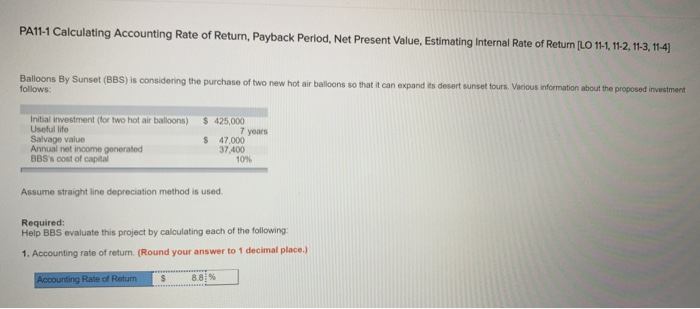

PA11-1 Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Interna Rate of Return /LO 1-1,112. 1-3, 114) Balloons By Sunset (BBS) is considering the purchase of two new hot ar balons so that t can expand ts decert sunset tours Various information about the proposed investment follows: Initial investment (for two hot air balloons) 425.,000 Useful life Salvage value Annual net income gonerated BBS's 0ost of capital 7 years S 47,000 37,400 10% Assume straight line depreciation method is used Required: Help BBS evaluate this project by calculating each of the following 1. Accounting rate of return.(Round your answer to 1 decimal place.) g Rate of Return S 8.81%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts