Question: 3 **NOTE: Q3 & Q4 share the same info** On Jan 1, Year 1, Norwegian Co. signed a 10 year lease for a piece of

3

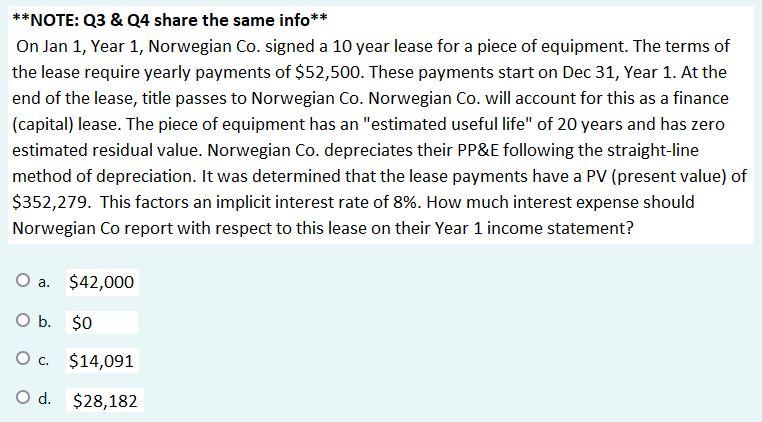

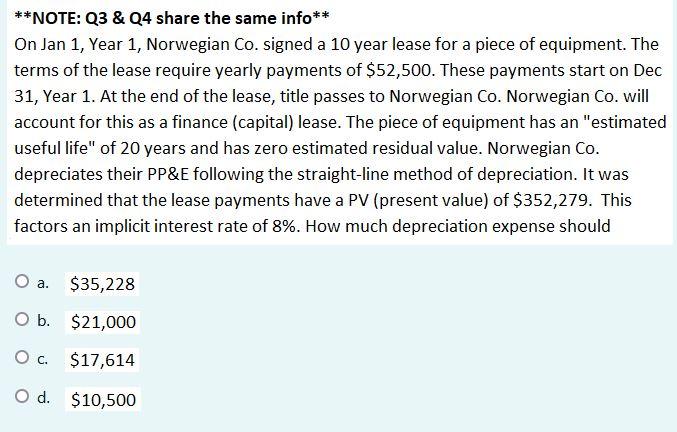

**NOTE: Q3 & Q4 share the same info** On Jan 1, Year 1, Norwegian Co. signed a 10 year lease for a piece of equipment. The terms of the lease require yearly payments of $52,500. These payments start on Dec 31, Year 1. At the end of the lease, title passes to Norwegian Co. Norwegian Co. will account for this as a finance (capital) lease. The piece of equipment has an "estimated useful life" of 20 years and has zero estimated residual value. Norwegian Co. depreciates their PP&E following the straight-line method of depreciation. It was determined that the lease payments have a PV (present value) of $352,279. This factors an implicit interest rate of 8%. How much interest expense should Norwegian Co report with respect to this lease on their Year 1 income statement? O a. $42,000 O b. $0 . $14,091 O d. $28,182 **NOTE: Q3 & Q4 share the same info** On Jan 1, Year 1, Norwegian Co. signed a 10 year lease for a piece of equipment. The terms of the lease require yearly payments of $52,500. These payments start on Dec 31, Year 1. At the end of the lease, title passes to Norwegian Co. Norwegian Co. will account for this as a finance (capital) lease. The piece of equipment has an "estimated useful life" of 20 years and has zero estimated residual value. Norwegian Co. depreciates their PP&E following the straight-line method of depreciation. It was determined that the lease payments have a PV (present value) of $352,279. This factors an implicit interest rate of 8%. How much depreciation expense should O a. $35,228 O b. $21,000 Oc. $17,614 O d. $10,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts