Question: 3. On 1 July 2014, Izquierdo Ltd issued a 1 million corporate bond in 5-year debentures that pay interest each 6 months at an annual

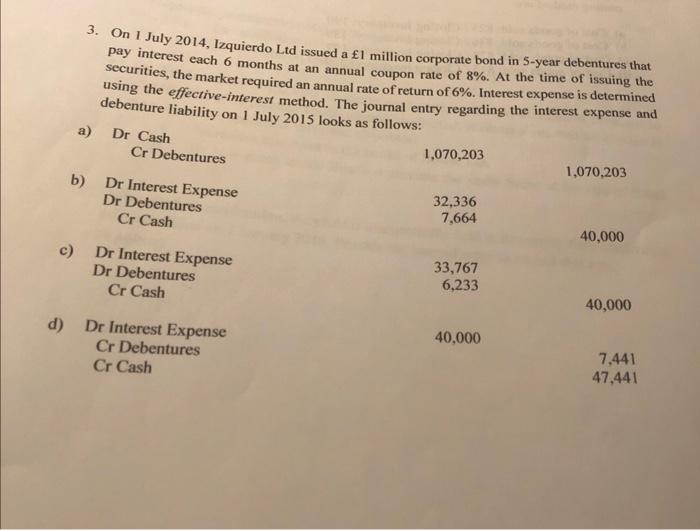

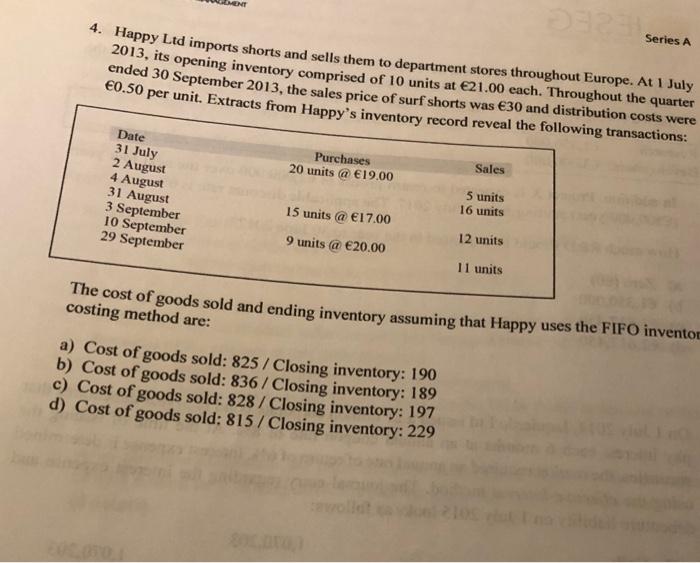

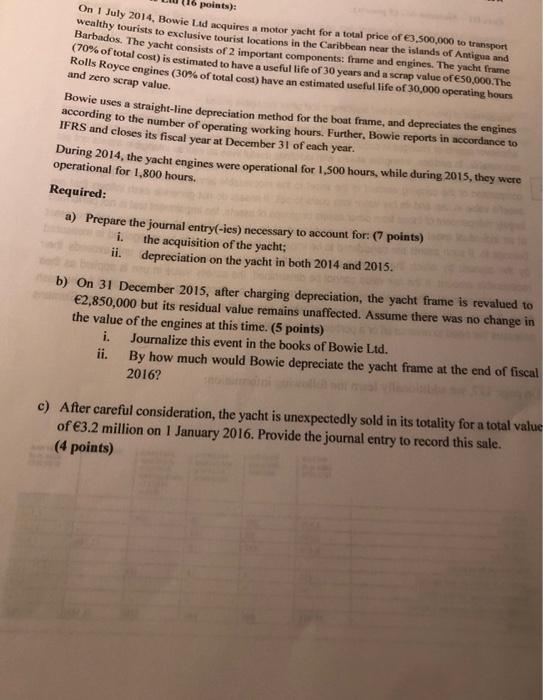

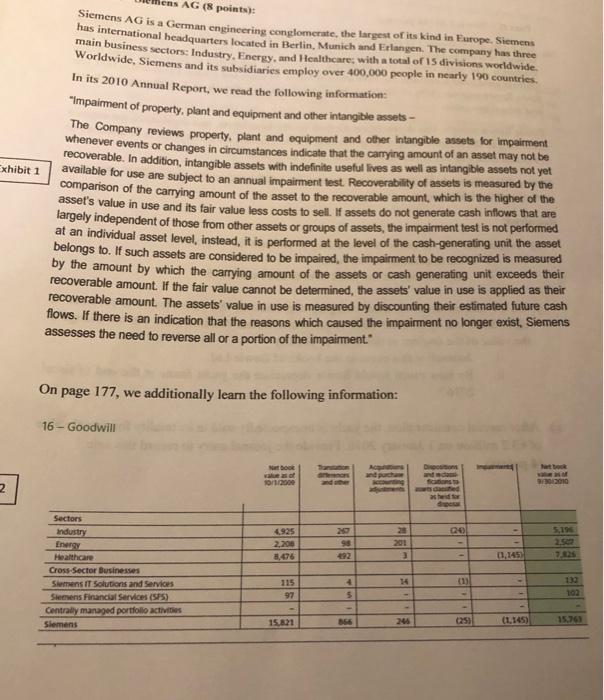

3. On 1 July 2014, Izquierdo Ltd issued a 1 million corporate bond in 5-year debentures that pay interest each 6 months at an annual coupon rate of 8%. At the time of issuing the securities, the market required an annual rate of return of 6%. Interest expense is determined using the effective-interest method. The journal entry regarding the interest expense and debenture liability on 1 July 2015 looks as follows: a) Dr Cash Cr Debentures 1,070,203 1,070,203 b) Dr Interest Expense Dr Debentures Cr Cash 32,336 7,664 40,000 c) Dr Interest Expense Dr Debentures Cr Cash 33,767 6,233 40,000 d) Dr Interest Expense Cr Debentures Cr Cash 40,000 7.441 47.441 5 series Series A 4. Happy Ltd imports shorts and sells them to department stores throughout Europe. At 1 July 2013, its opening inventory comprised of 10 units at 21.00 each. Throughout the quarter ended 30 September 2013, the sales price of surf shorts was 30 and distribution costs were 0.50 per unit. Extracts from Happy's inventory record reveal the following transactions: Purchases 20 units @ 19.00 Sales Date 31 July 2 August 4 August 31 August 3 September 10 September 29 September 5 units 16 units 15 units @ 17.00 9 units @ 20.00 12 units 11 units The cost of goods sold and ending inventory assuming that Happy uses the FIFO inventor costing method are: a) Cost of goods sold: 825 / Closing inventory: 190 b) Cost of goods sold: 836 / Closing inventory: 189 c) Cost of goods sold: 828 / Closing inventory: 197 d) Cost of goods sold: 815 / Closing inventory: 229 points): On July 2014, Bowie Lid nequires a motor yacht for a total price of 3,500,000 to transport wealthy tourists to exclusive tourist locations in the Caribbean near the islands of Antigua and Barbados. The yacht consists of 2 important components: frame and engines. The yacht frame (70% of total cost) is estimated to have a useful life of 30 years and a scrap value of 50,000. The Rolls Royce engines (30% of total cost) have an estimated useful life of 30,000 operating hours and zero scrap value, Bowie uses a straight-line depreciation method for the boat frame, and depreciates the engines according to the number of operating working hours. Further, Bowie reports in accordance to IFRS and closes its fiscal year at December 31 of each year. During 2014, the yacht engines were operational for 1,500 hours, while during 2015, they were operational for 1,800 hours. Required: a) Prepare the journal entry(-ies) necessary to account for: (7 points) the acquisition of the yacht; ii. depreciation on the yacht in both 2014 and 2015. i. b) On 31 December 2015, after charging depreciation, the yacht frame is revalued to 2,850,000 but its residual value remains unaffected. Assume there was no change in the value of the engines at this time. (5 points) i. Journalize this event in the books of Bowie Ltd. ii. By how much would Bowie depreciate the yacht frame at the end of fiscal 2016? c) After careful consideration, the yacht is unexpectedly sold in its totality for a total value of 3.2 million on 1 January 2016. Provide the journal entry to record this sale. (4 points) Exhibit 1 ms AG (8 points): Siemens AG is a German engineering conglomerate, the largest of its kind in Europe. Siemens hus international headquarters located in Berlin, Munich und Erlangen. The company has three main business sectors: Industry, Energy, and Healthcare, with a total of 15 divisions worldwide. Worldwide, Siemens and its subsidiaries employ over 400,000 people in nearly 190 countries. In its 2010 Annual Report, we read the following information "Impaiment of property, plant and equipment and other intangible assets - The Company reviews property, plant and equipment and other intangible assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. In addition, intangible assets with indefinite useful lives as well as intangible assets not yet available for use are subject to an annual impairment test Recoverability of assets is measured by the comparison of the carrying amount of the asset to the recoverable amount, which is the higher of the asset's value in use and its fair value less costs to sell. If assets do not generate cash inflows that are largely independent of those from other assets or groups of assets, the impairment test is not performed at an individual asset level, instead, it is performed at the level of the cash-generating unit the asset belongs to. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets or cash generating unit exceeds their recoverable amount If the fair value cannot be determined, the assets' value in use is applied as their recoverable amount. The assets' value in use is measured by discounting their estimated future cash flows. If there is an indication that the reasons which caused the impairment no longer exist, Siemens assesses the need to reverse all or a portion of the impairment On page 177, we additionally learn the following information: 16 - Goodwill cars Tarto Nebook values of sor Diction and fins wed 2010 2. dre 20 5.194 4.925 2,200 06 201 1,145 Sectors industry Energy Healthcare Cross-Sector Businesses Siemens IT Solutions and Services Siemens Financial Services (SPS) Centrally managed portfolio activities Siemens 4 115 97 TER 5 102 15.821 356 24 025) 15.76 (1.145)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts