Question: NO MISSING DATA No missing data Flywing Airways Ltd. is a company which manufactures aircraft parts and engines and sells them to large multinational companies

NO MISSING DATA

No missing data

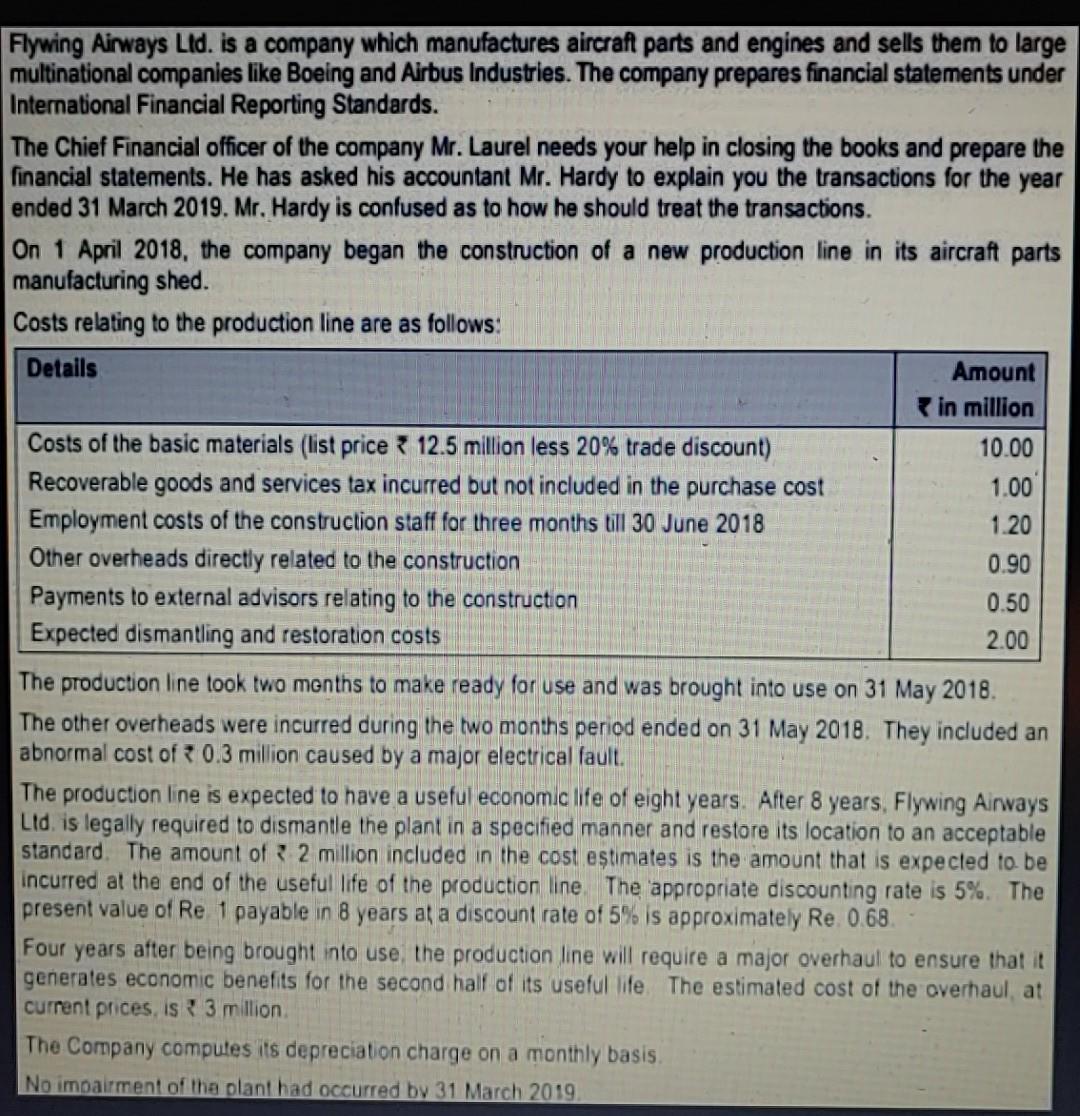

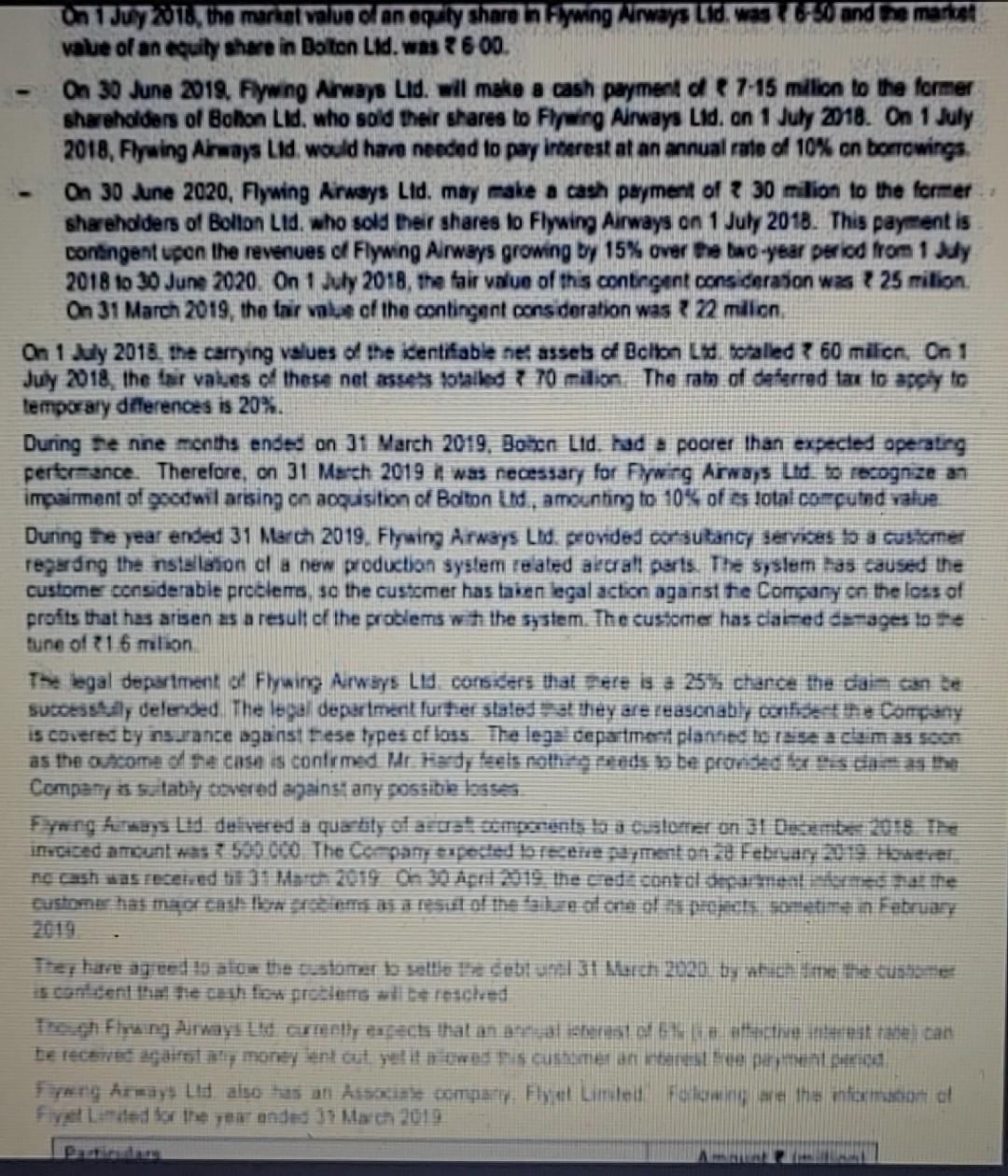

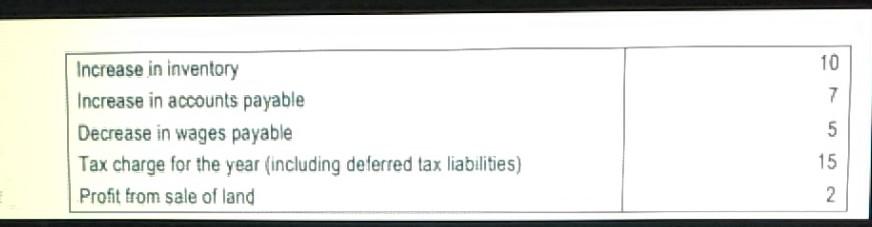

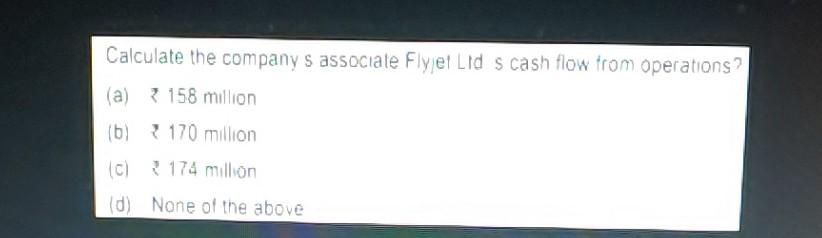

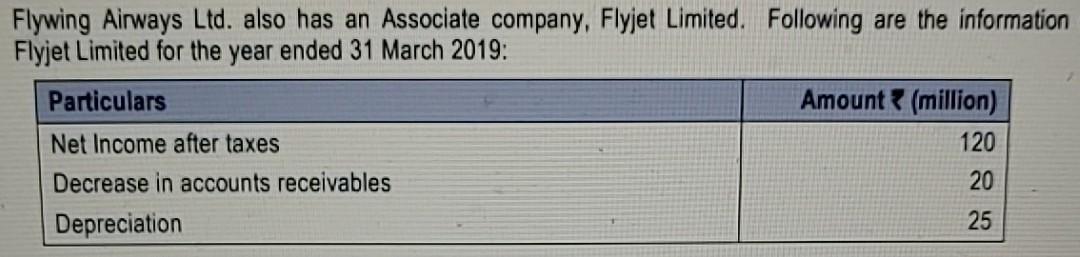

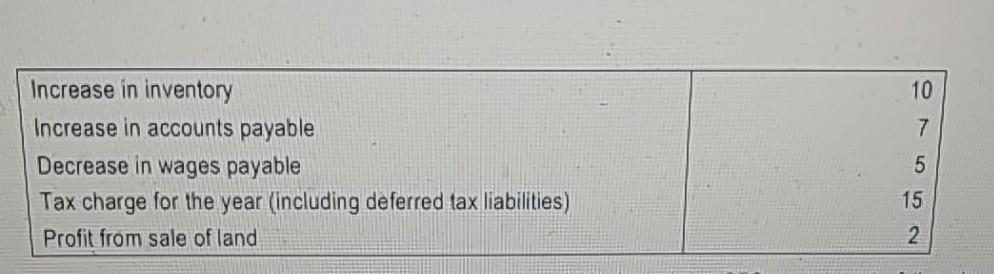

Flywing Airways Ltd. is a company which manufactures aircraft parts and engines and sells them to large multinational companies like Boeing and Airbus Industries. The company prepares financial statements under International Financial Reporting Standards. The Chief Financial officer of the company Mr. Laurel needs your help in closing the books and prepare the financial statements. He has asked his accountant Mr. Hardy to explain you the transactions for the year ended 31 March 2019. Mr. Hardy is confused as to how he should treat the transactions. On 1 April 2018, the company began the construction of a new production line in its aircraft parts manufacturing shed. Costs relating to the production line are as follows: Details Amount in million Costs of the basic materials (list price 12.5 million less 20% trade discount) 10.00 Recoverable goods and services tax incurred but not included in the purchase cost 1.00 Employment costs of the construction staff for three months till 30 June 2018 1.20 Other overheads directly related to the construction 0.90 Payments to external advisors relating to the construction 0.50 Expected dismantling and restoration costs 2.00 The production line took two months to make ready for use and was brought into use on 31 May 2018. The other overheads were incurred during the two months period ended on 31 May 2018. They included an abnormal cost of * 0.3 million caused by a major electrical fault. The production line is expected to have a useful economic life of eight years. After 8 years, Flywing Airways Ltd. is legally required to dismantle the plant in a specified manner and restore its location to an acceptable standard. The amount of 2 million included in the cost estimates is the amount that is expected to be incurred at the end of the useful life of the production line. The appropriate discounting rate is 5%. The present value of Re 1 payable in 8 years at a discount rate of 5% is approximately Re 0.68. Four years after being brought into use the production line will require a major overhaul to ensure that it generates economic benefits for the second half of its useful life. The estimated cost of the overhaul, at current prices, is 3 million The Company computes its depreciation charge on a monthly basis No impairment of the plant had occurred by 31 March 2019 On Juy 2017, the marunt value o an equly share 7-ywing Nirways Lid. value of an equily share in Boten Lid was 600. On 30 June 2019, Fywng Always Lid. will make a cash payment de 7-15 milion to the former shareholders of Bollon Lid who sold their shares to Flywing Alrways Lid. on 1 July 2018. On 1 July 2018, Flywing Aimaya Lid would have needed to pay interest at an annual rate of 10% en borrowings. On 30 June 2020, Flywing Arways Lid. may make a cash payment of ? 30 milion to the former shareholders of Bollon Lid. who sold their shares to Flywing Airways on 1 July 2018. This payment is contingent upon the revenues of Flywing Airways growing by 15% over the two-year period from 1sdy 2018 to 30 June 2020. On 1 July 2018, the fair value of this contingent cons deration was 25 milion On 31 March 2019, the fair vale of the contingent consideration was 22 milion On 1 day 2018 the carrying values of the identifiable ned assets of Bclton Ltd totalied ? 60 milicn. On 1 July 2018, the fair values of these net asset's talles 770 milion The rate of deferred tax to ascy to temporary diferences is 20%. During De nne months ended on 31 March 2019, Born Lid. Kad a poorer than expected operate performance. Therefore, on 31 March 2019 it was necessary for Flywing Airways Ltd. recognze an impairment of otwil arising on acquisition of Bolton En, amounting to 10% of os Jotal computed value During the year ended 31 March 2019. Flying Arways Lid. provided on Sutancy Service 13 a customer regarding the nstellation of a new production system realed arcrall perts. The system has caused the custome considerable problems, so the customer has taien legal action aganst te Company on the loss of profts that has arisen as a result of the problems with the system. The customer has claimed dosages tune of 21.6 milion Tegal department of Forming Arways Lid considers that sere is a 25% chance the data con de SUEESSA, delended The legal department furtzer slaled they are reasonably collis Company is covered by nsance against these types of loss. The lege department planned to reseadamassen as the come of the case is confirmed. Mr Hard, feels nohameds be pronde daha Compeny a stably covered against any possibie lass Fang formays Lid delivered a quably dance prenils ha a Colonel on 31 Des the incited amount 13: 7.500.000 The Company sipeded bredere spent on 22 February 2013 Here! Customer has man call a Sul of the file ata o No time in February Te lure agree: 19 alom the customer baie cebul 31 March 2020. gada Toon Fruing Arway crm, tapecks that an anat abastatas tan te techd against any money lant out yet it cushier aan Fang array d also has an incin's company Fl Limit Fencing are the internacional Five Limited for the ended 31 March 2019 10 7 Increase in inventory Increase in accounts payable Decrease in wages payable Tax charge for the year (including deferred tax liabilities) Profit from sale of land 5 15 2 2 Calculate the company s associate Flyet Lid s cash flow from operations? (a) 158 million (b) 170 million 10 174 million (d) None of the above Flywing Airways Ltd. also has an Associate company, Flyjet Limited. Following are the information Flyjet Limited for the year ended 31 March 2019: Particulars Amount (million) Net Income after taxes 120 Decrease in accounts receivables 20 Depreciation 25 10 7 Increase in inventory Increase in accounts payable Decrease in wages payable Tax charge for the year (including deferred tax liabilities) Profit from sale of land 5 15 2 Flywing Airways Ltd. is a company which manufactures aircraft parts and engines and sells them to large multinational companies like Boeing and Airbus Industries. The company prepares financial statements under International Financial Reporting Standards. The Chief Financial officer of the company Mr. Laurel needs your help in closing the books and prepare the financial statements. He has asked his accountant Mr. Hardy to explain you the transactions for the year ended 31 March 2019. Mr. Hardy is confused as to how he should treat the transactions. On 1 April 2018, the company began the construction of a new production line in its aircraft parts manufacturing shed. Costs relating to the production line are as follows: Details Amount in million Costs of the basic materials (list price 12.5 million less 20% trade discount) 10.00 Recoverable goods and services tax incurred but not included in the purchase cost 1.00 Employment costs of the construction staff for three months till 30 June 2018 1.20 Other overheads directly related to the construction 0.90 Payments to external advisors relating to the construction 0.50 Expected dismantling and restoration costs 2.00 The production line took two months to make ready for use and was brought into use on 31 May 2018. The other overheads were incurred during the two months period ended on 31 May 2018. They included an abnormal cost of * 0.3 million caused by a major electrical fault. The production line is expected to have a useful economic life of eight years. After 8 years, Flywing Airways Ltd. is legally required to dismantle the plant in a specified manner and restore its location to an acceptable standard. The amount of 2 million included in the cost estimates is the amount that is expected to be incurred at the end of the useful life of the production line. The appropriate discounting rate is 5%. The present value of Re 1 payable in 8 years at a discount rate of 5% is approximately Re 0.68. Four years after being brought into use the production line will require a major overhaul to ensure that it generates economic benefits for the second half of its useful life. The estimated cost of the overhaul, at current prices, is 3 million The Company computes its depreciation charge on a monthly basis No impairment of the plant had occurred by 31 March 2019 On Juy 2017, the marunt value o an equly share 7-ywing Nirways Lid. value of an equily share in Boten Lid was 600. On 30 June 2019, Fywng Always Lid. will make a cash payment de 7-15 milion to the former shareholders of Bollon Lid who sold their shares to Flywing Alrways Lid. on 1 July 2018. On 1 July 2018, Flywing Aimaya Lid would have needed to pay interest at an annual rate of 10% en borrowings. On 30 June 2020, Flywing Arways Lid. may make a cash payment of ? 30 milion to the former shareholders of Bollon Lid. who sold their shares to Flywing Airways on 1 July 2018. This payment is contingent upon the revenues of Flywing Airways growing by 15% over the two-year period from 1sdy 2018 to 30 June 2020. On 1 July 2018, the fair value of this contingent cons deration was 25 milion On 31 March 2019, the fair vale of the contingent consideration was 22 milion On 1 day 2018 the carrying values of the identifiable ned assets of Bclton Ltd totalied ? 60 milicn. On 1 July 2018, the fair values of these net asset's talles 770 milion The rate of deferred tax to ascy to temporary diferences is 20%. During De nne months ended on 31 March 2019, Born Lid. Kad a poorer than expected operate performance. Therefore, on 31 March 2019 it was necessary for Flywing Airways Ltd. recognze an impairment of otwil arising on acquisition of Bolton En, amounting to 10% of os Jotal computed value During the year ended 31 March 2019. Flying Arways Lid. provided on Sutancy Service 13 a customer regarding the nstellation of a new production system realed arcrall perts. The system has caused the custome considerable problems, so the customer has taien legal action aganst te Company on the loss of profts that has arisen as a result of the problems with the system. The customer has claimed dosages tune of 21.6 milion Tegal department of Forming Arways Lid considers that sere is a 25% chance the data con de SUEESSA, delended The legal department furtzer slaled they are reasonably collis Company is covered by nsance against these types of loss. The lege department planned to reseadamassen as the come of the case is confirmed. Mr Hard, feels nohameds be pronde daha Compeny a stably covered against any possibie lass Fang formays Lid delivered a quably dance prenils ha a Colonel on 31 Des the incited amount 13: 7.500.000 The Company sipeded bredere spent on 22 February 2013 Here! Customer has man call a Sul of the file ata o No time in February Te lure agree: 19 alom the customer baie cebul 31 March 2020. gada Toon Fruing Arway crm, tapecks that an anat abastatas tan te techd against any money lant out yet it cushier aan Fang array d also has an incin's company Fl Limit Fencing are the internacional Five Limited for the ended 31 March 2019 10 7 Increase in inventory Increase in accounts payable Decrease in wages payable Tax charge for the year (including deferred tax liabilities) Profit from sale of land 5 15 2 2 Calculate the company s associate Flyet Lid s cash flow from operations? (a) 158 million (b) 170 million 10 174 million (d) None of the above Flywing Airways Ltd. also has an Associate company, Flyjet Limited. Following are the information Flyjet Limited for the year ended 31 March 2019: Particulars Amount (million) Net Income after taxes 120 Decrease in accounts receivables 20 Depreciation 25 10 7 Increase in inventory Increase in accounts payable Decrease in wages payable Tax charge for the year (including deferred tax liabilities) Profit from sale of land 5 15 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts