Question: #3 Part Il: hand computation practice - 4 points total Please answer the following questions in the space provided. As always, assume semiannual coupon payments.

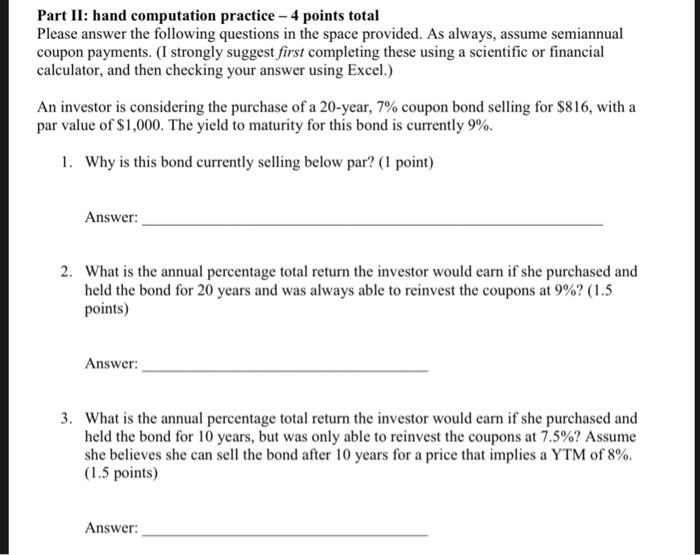

Part Il: hand computation practice - 4 points total Please answer the following questions in the space provided. As always, assume semiannual coupon payments. (I strongly suggest first completing these using a scientific or financial calculator, and then checking your answer using Excel.) An investor is considering the purchase of a 20-year, 7% coupon bond selling for $816, with a par value of $1,000. The yield to maturity for this bond is currently 9%. 1. Why is this bond currently selling below par? (1 point) Answer 2. What is the annual percentage total return the investor would earn if she purchased and held the bond for 20 years and was always able to reinvest the coupons at 9%? (1.5 points) Answer: 3. What is the annual percentage total return the investor would earn if she purchased and held the bond for 10 years, but was only able to reinvest the coupons at 7.5%? Assume she believes she can sell the bond after 10 years for a price that implies a YTM of 8%. (1.5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts