Question: 3 part question Exercise 2-1 (Algo) Compute a Predetermined Overhead Rate [LO2-1] Harris Fabrics computes its plantwide predetermined overhead rate annually on the basis of

![3 part question Exercise 2-1 (Algo) Compute a Predetermined Overhead Rate [LO2-1]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6718cb4125a8a_1446718cb409155a.jpg)

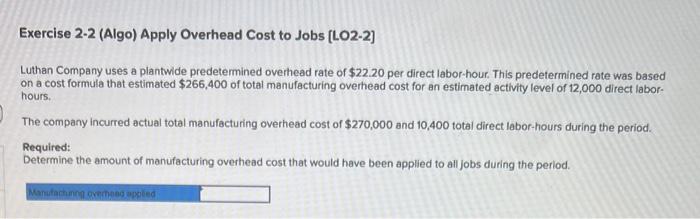

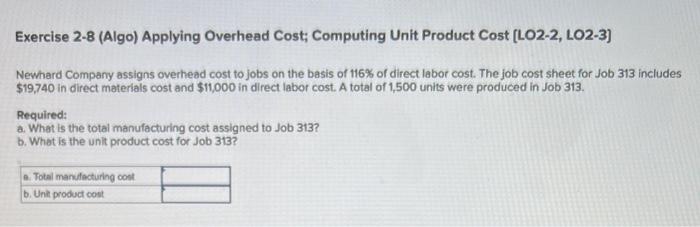

Exercise 2-1 (Algo) Compute a Predetermined Overhead Rate [LO2-1] Harris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 44,000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $526,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. Harris's actual manufacturing overhead cost for the year was $732,227 and its actual total direct labor was 44,500 hours. Required: Compute the company's plantwide predetermined overhead rate for the yeat, (Round your answer to 2 decimal places.) Exercise 2-2 (Algo) Apply Overhead Cost to Jobs [LO2-2] Luthan Company uses a plantwide predetermined overhead rate of $22.20 per direct labor-hour. This predetermined rate was based on a cost formula that estimated $266,400 of total manufacturing overhead cost for an estimated activity level of 12,000 direct laborhours. The company incurred actual total manufacturing overhead cost of $270,000 and 10,400 total direct labor-hours during the period. Required: Determine the amount of manufacturing overhead cost that would have been applied to all jobs during the period. Exercise 2-8 (Algo) Applying Overhead Cost; Computing Unit Product Cost [LO2-2, LO2-3] Newhard Company assigns overhead cost to jobs on the basis of 116% of direct labor cost. The job cost sheet for Job 313 includes $19,740 in direct materials cost and $11,000 in direct labor cost. A total of 1,500 units were produced in Job 313. Required: a. What is the total manufacturing cost assigned to Job 313 ? b. What is the unit product cost for Job 313

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts