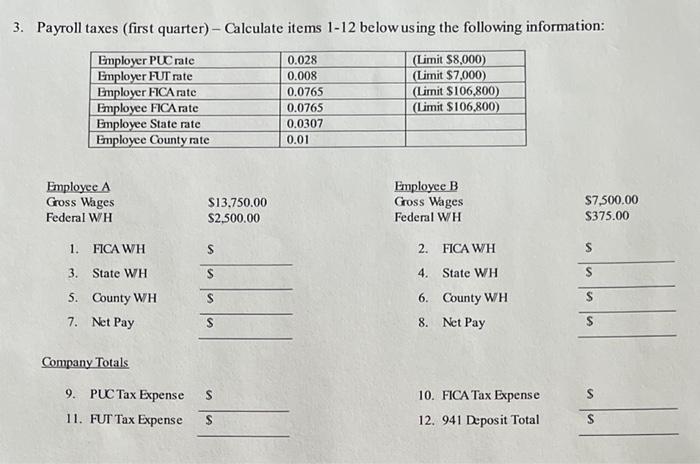

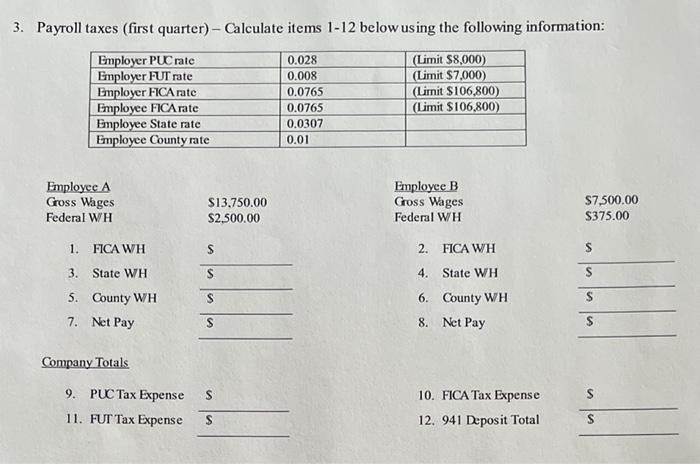

Question: 3. Payroll taxes (first quarter) - Calculate items 1-12 below using the following information: Employer PUC rate 0.028 (Limit $8,000) Employer FUT rate 0.008 (Limit

3. Payroll taxes (first quarter) - Calculate items 1-12 below using the following information: Employer PUC rate 0.028 (Limit $8,000) Employer FUT rate 0.008 (Limit $7.000) Employer FICA rate 0.0765 (Limit $106,800) Employee FICArate 0.0765 (Limit $106.800) Employee State rate 0.0307 Employee County rate 0.01 Employee A Employee B Gross Wages $13.750.00 Gross Wages $7,500.00 Federal WH $2.500.00 Federal WH $375.00 1. FICA WH S 2. FICA WH 3. State WH S 4. State WH 5. County WH S 6. County WH S 7. Net Pay S 8. Net Pay S Company Totals 9. PUC Tax Expense S 10. FICA Tax Expense 11. FUT Tax Expense 12. 941 Deposit Total

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock