Question: #3 Please! L Case Mix Management and Compliance Exercise Objectives: IV.A.1 - Manage the use of clinical data required by various payment and reimbursement systems

#3 Please!

#3 Please!

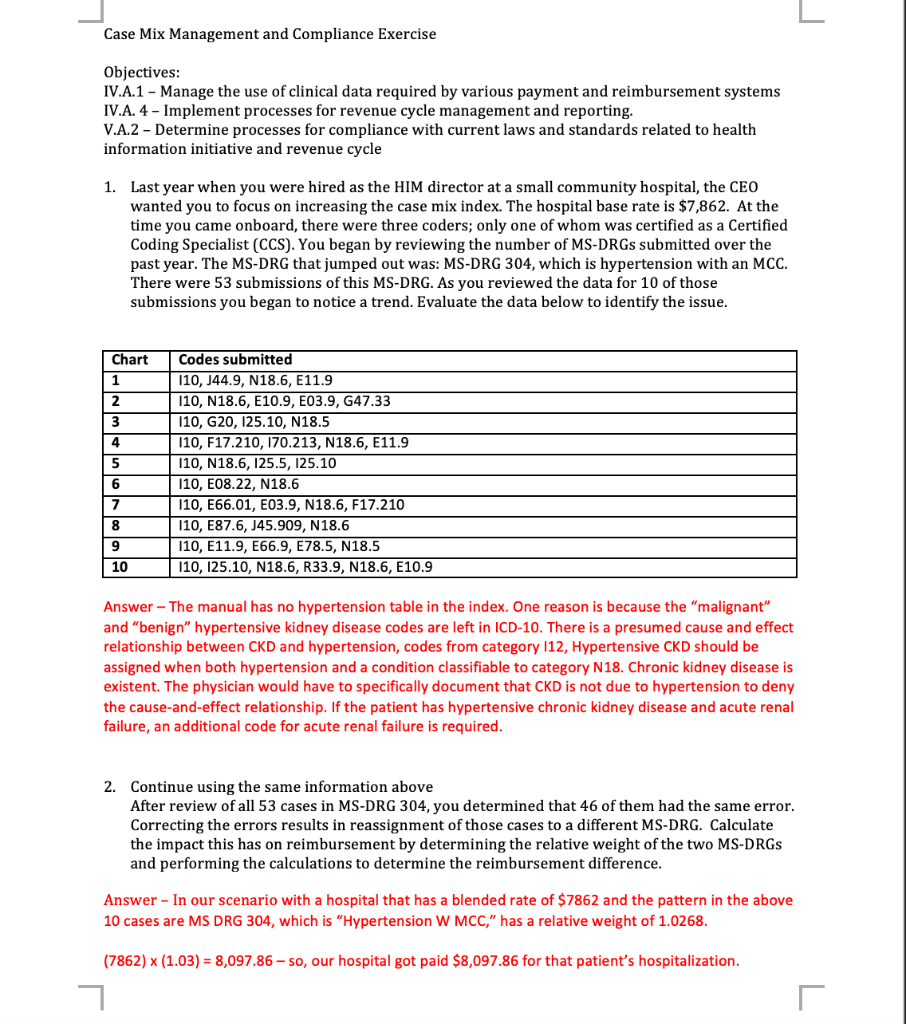

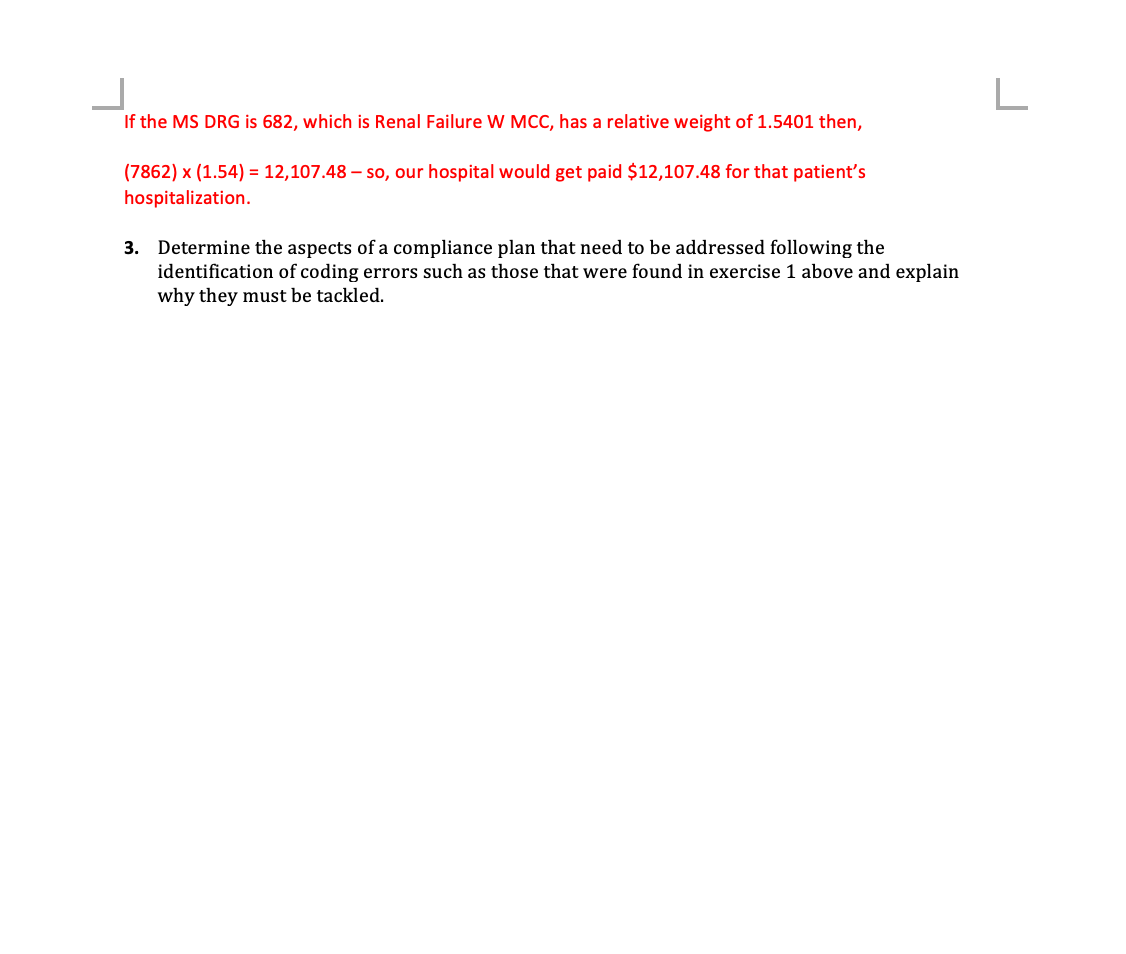

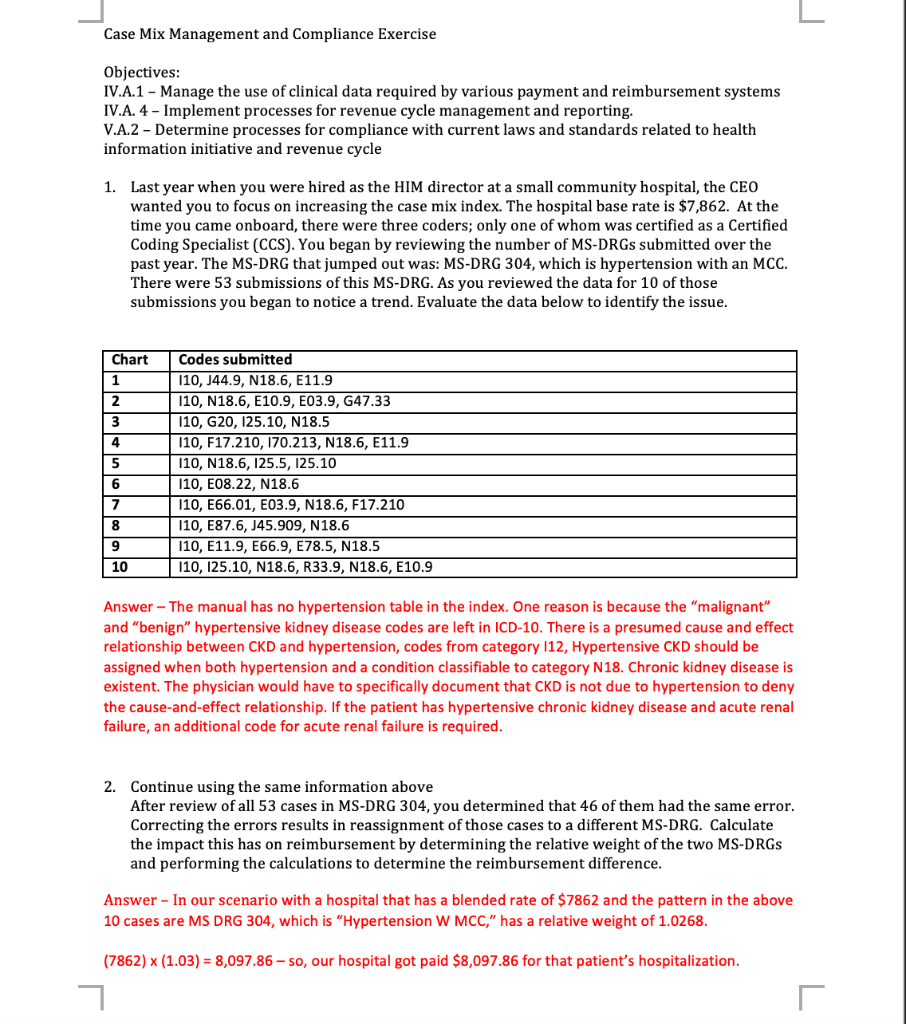

L Case Mix Management and Compliance Exercise Objectives: IV.A.1 - Manage the use of clinical data required by various payment and reimbursement systems IV.A. 4 - Implement processes for revenue cycle management and reporting. V.A.2 - Determine processes for compliance with current laws and standards related to health information initiative and revenue cycle 1. Last year when you were hired as the HIM director at a small community hospital, the CEO wanted you to focus on increasing the case mix index. The hospital base rate is $7,862. At the time you came onboard, there were three coders; only one of whom was certified as a Certified Coding Specialist (CCS). You began by reviewing the number of MS-DRGs submitted over the past year. The MS-DRG that jumped out was: MS-DRG 304, which is hypertension with an MCC. There were 53 submissions of this MS-DRG. As you reviewed the data for 10 of those submissions you began to notice a trend. Evaluate the data below to identify the issue. Chart 1 2 3 4 5 6 7 Codes submitted 110, J44.9, N18.6, E11.9 110, N18.6, E10.9, E03.9, G47.33 110, G20, 125.10, N18.5 110, F17.210, 170.213, N18.6, E11.9 110, N18.6, 125.5, 125.10 110, E08.22, N18.6 110, E66.01, E03.9, N18.6, F17.210 110, E87.6, J45.909, N18.6 110, E11.9, E66.9, E78.5, N18.5 110, 125.10, N18.6, R33.9, N18.6, E10.9 8 9 10 Answer - The manual has no hypertension table in the index. One reason is because the "malignant" and "benign" hypertensive kidney disease codes are left in ICD-10. There is a presumed cause and effect relationship between CKD and hypertension, codes from category 112, Hypertensive CKD should be assigned when both hypertension and a condition classifiable to category N18. Chronic kidney disease is existent. The physician would have to specifically document that CKD is not due to hypertension to deny the cause-and-effect relationship. If the patient has hypertensive chronic kidney disease and acute renal failure, an additional code for acute renal failure is required. 2. Continue using the same information above After review of all 53 cases in MS-DRG 304, you determined that 46 of them had the same error. Correcting the errors results in reassignment of those cases to a different MS-DRG. Calculate the impact this has on reimbursement by determining the relative weight of the two MS-DRGS and performing the calculations to determine the reimbursement difference. Answer - In our scenario with a hospital that has a blended rate of $7862 and the pattern in the above 10 cases are MS DRG 304, which is "Hypertension W MCC," has a relative weight of 1.0268. (7862) x (1.03) = 8,097.86 - so, our hospital got paid $8,097.86 for that patient's hospitalization. r L If the MS DRG is 682, which is Renal Failure W MCC, has a relative weight of 1.5401 then, (7862) x (1.54) = 12,107.48 - so, our hospital would get paid $12,107.48 for that patient's hospitalization. 3. Determine the aspects of a compliance plan that need to be addressed following the identification of coding errors such as those that were found in exercise 1 above and explain why they must be tackled

#3 Please!

#3 Please!