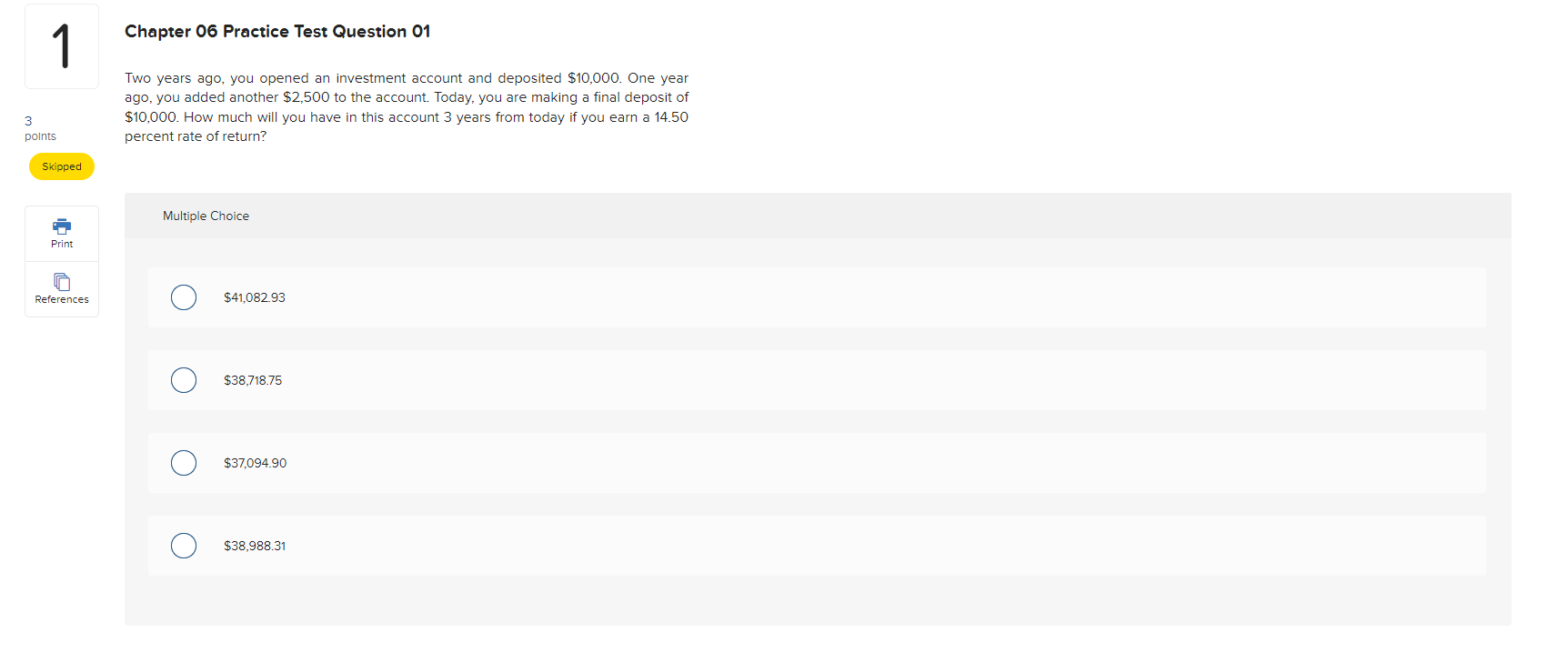

Question: 3 points 1 Skipped Chapter 06 Practice Test Question 01 Two years ago, you opened an investment account and deposited $10,000. One year ago,

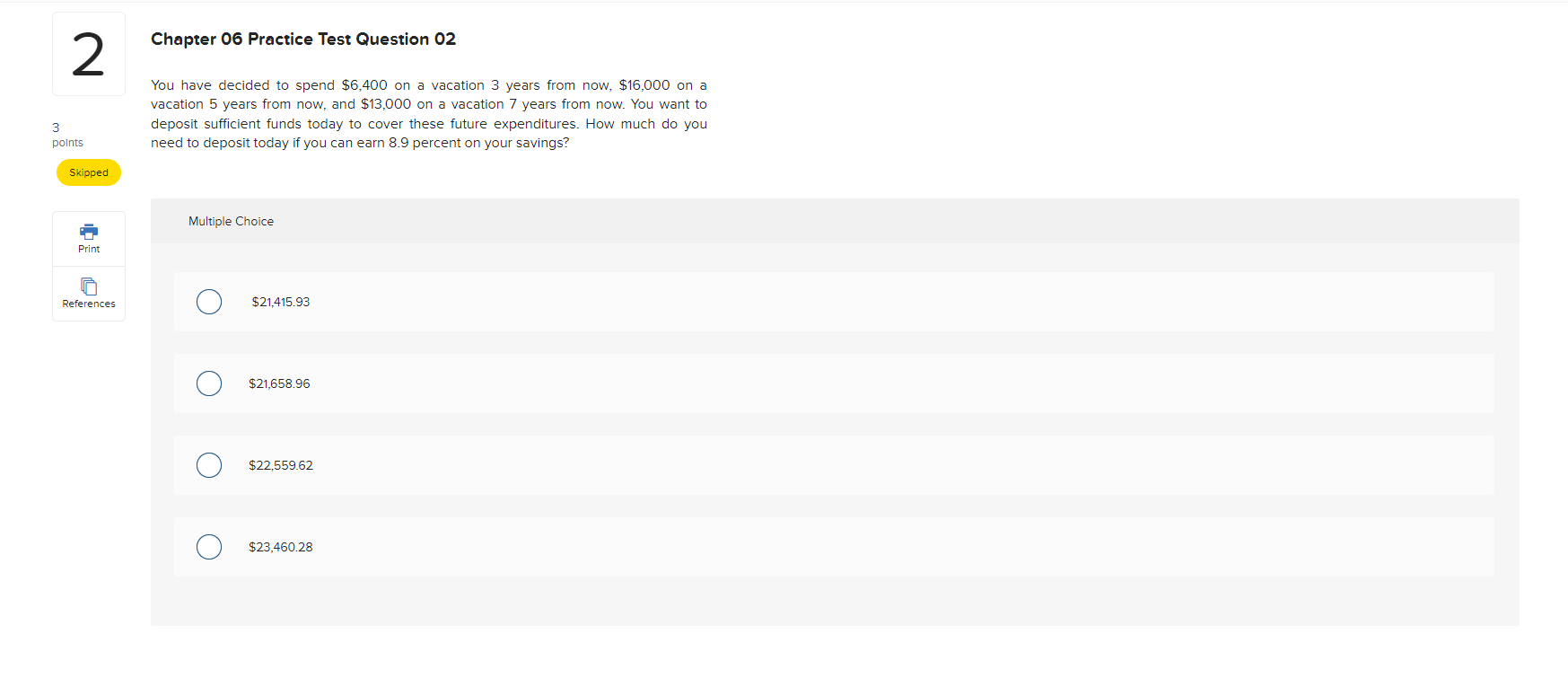

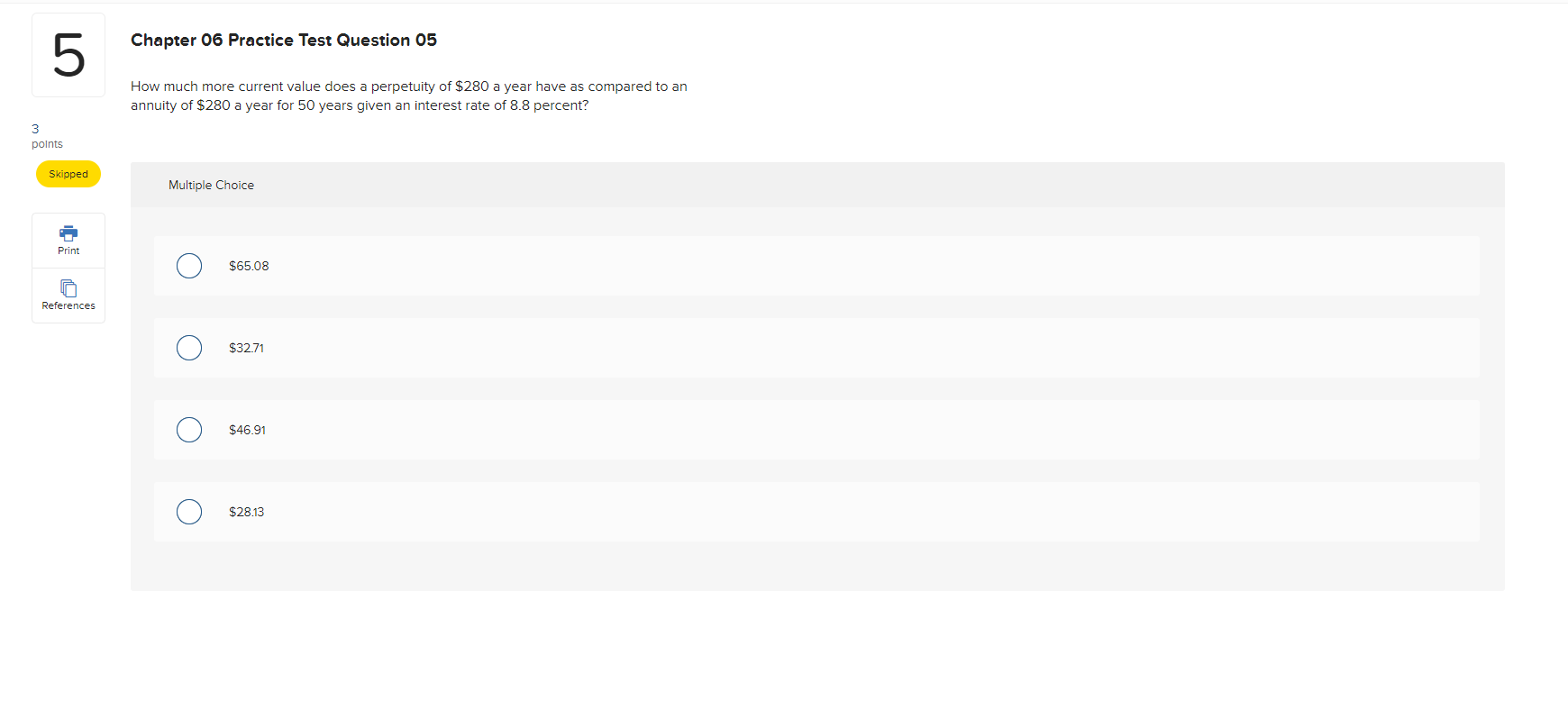

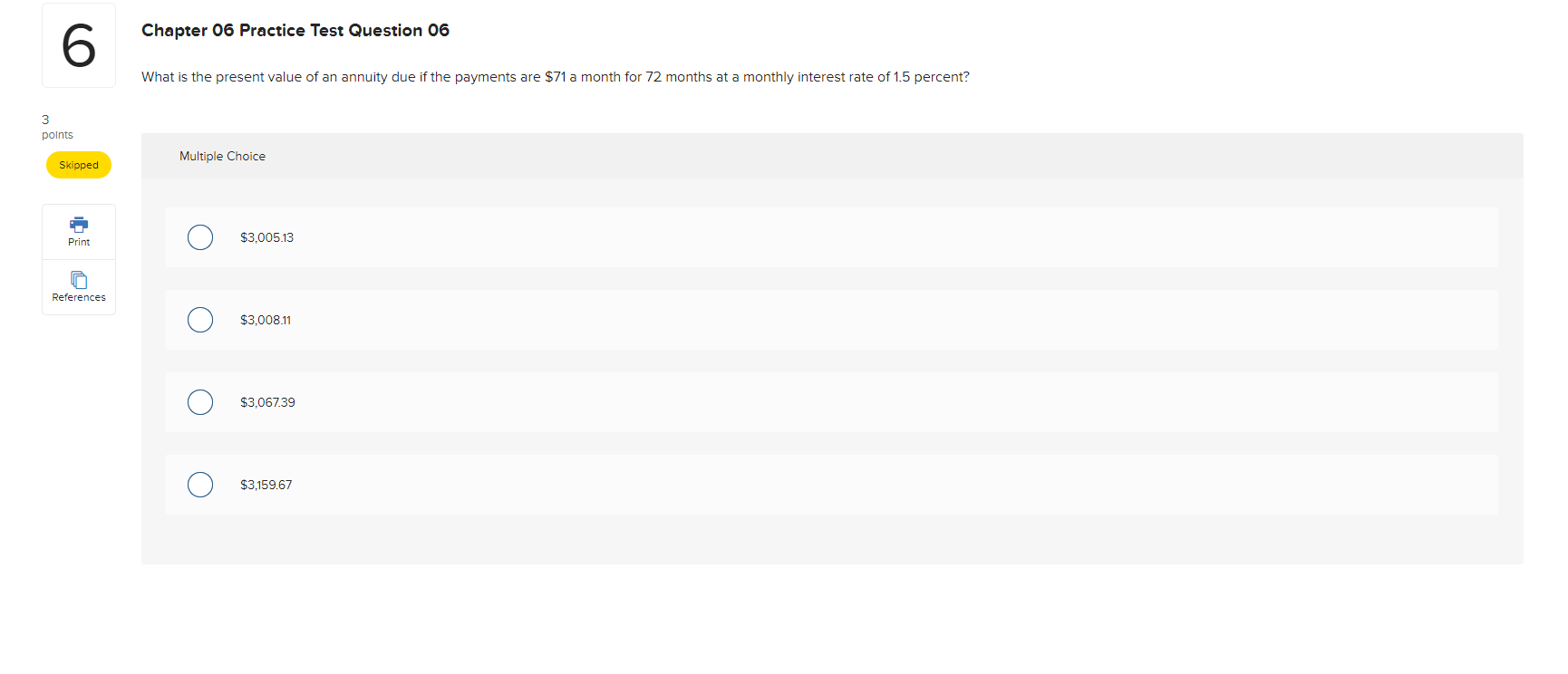

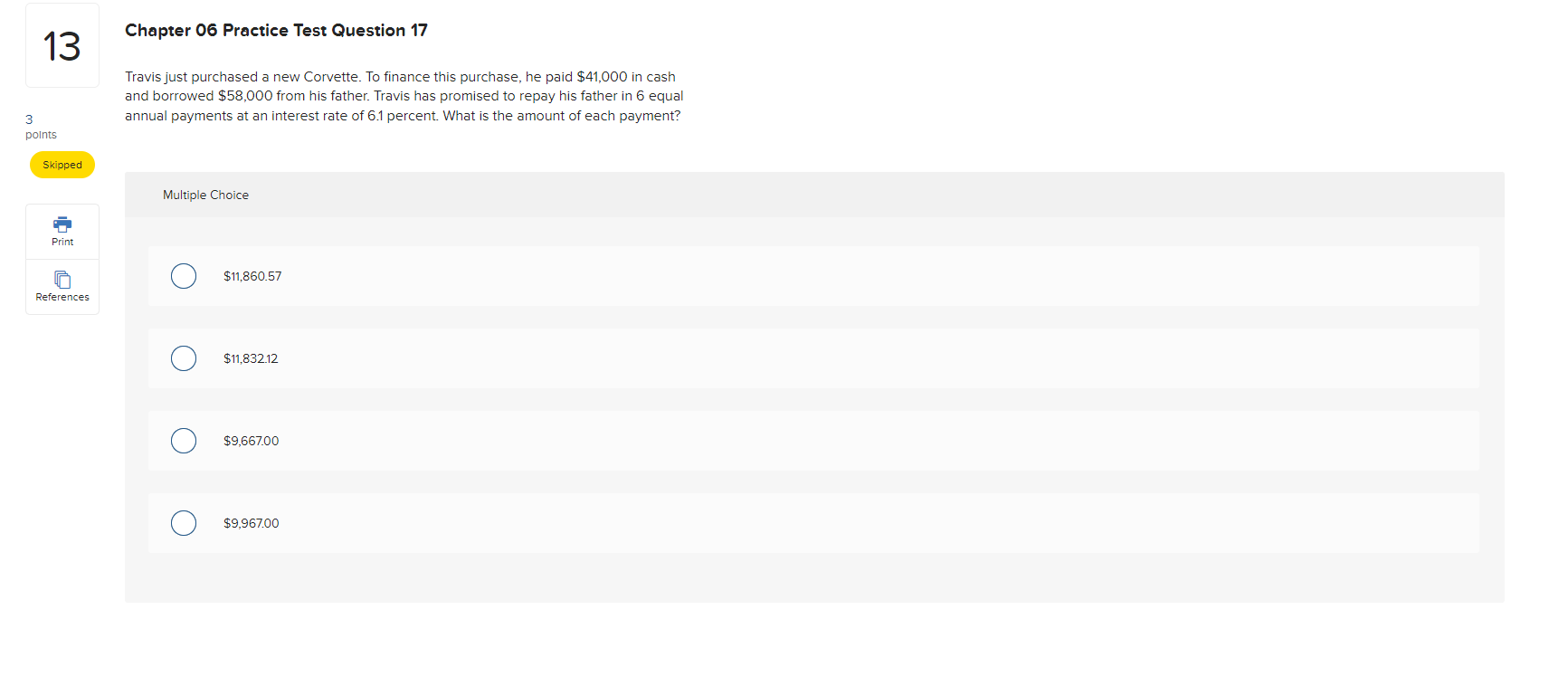

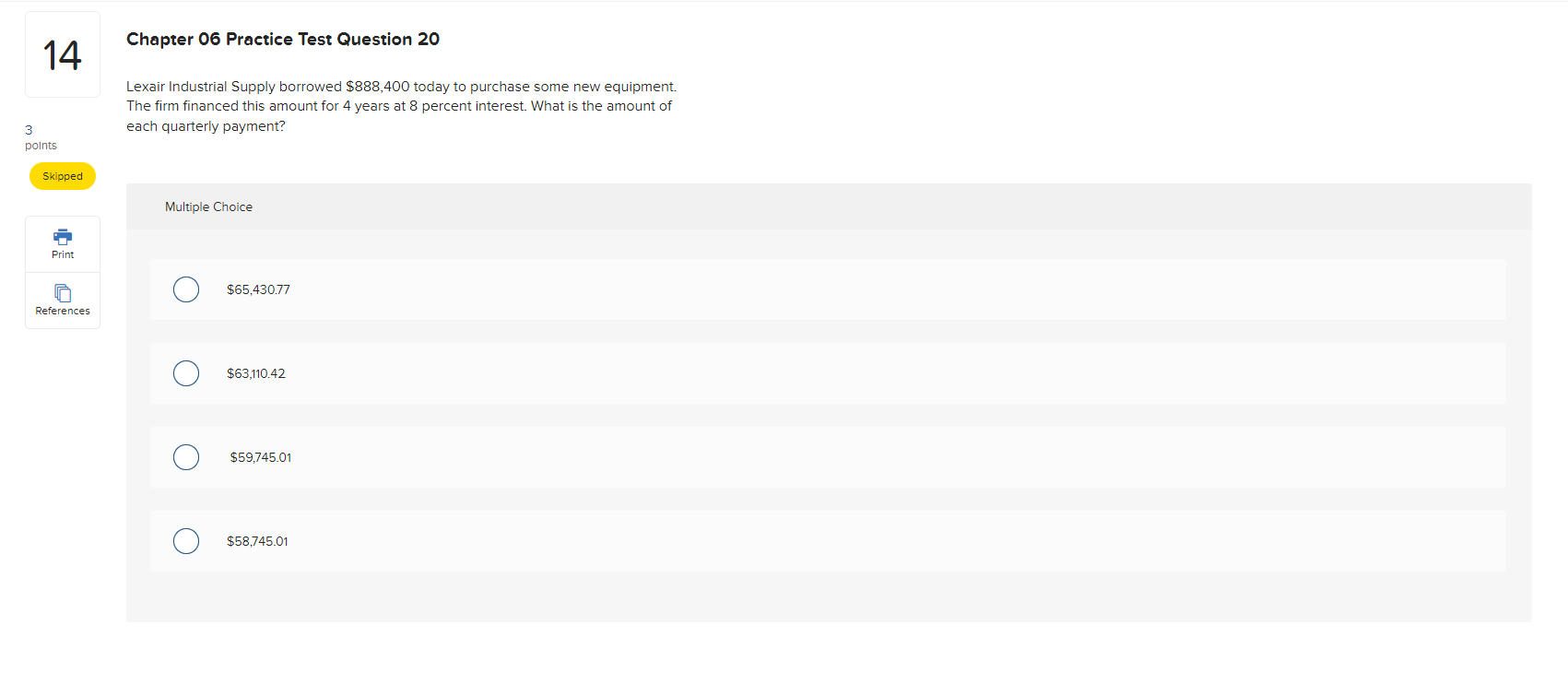

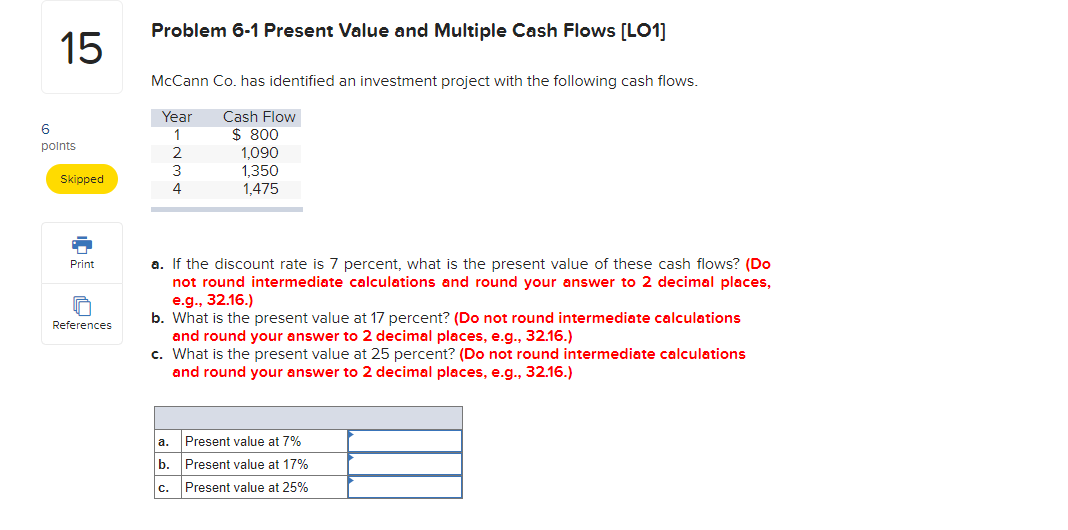

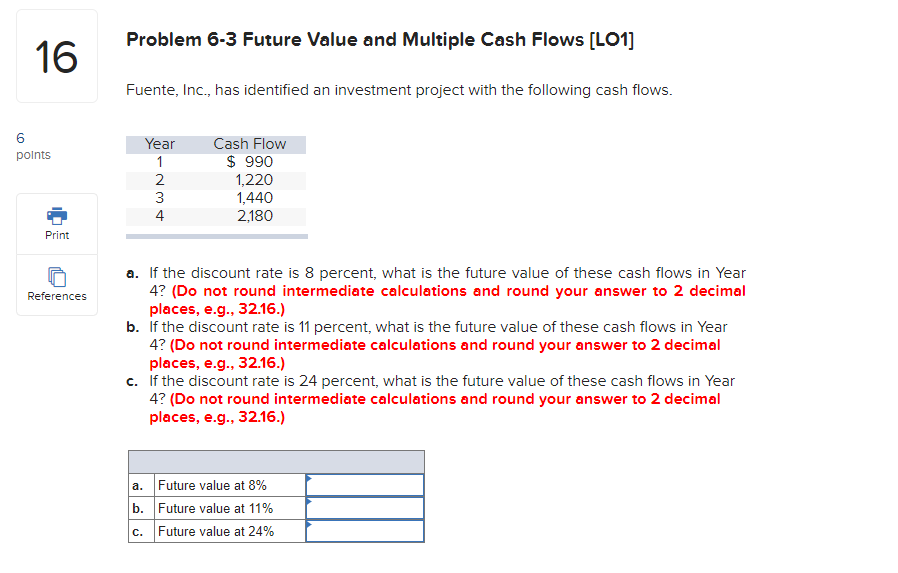

3 points 1 Skipped Chapter 06 Practice Test Question 01 Two years ago, you opened an investment account and deposited $10,000. One year ago, you added another $2,500 to the account. Today, you are making a final deposit of $10,000. How much will you have in this account 3 years from today if you earn a 14.50 percent rate of return? Print Multiple Choice References $41,082.93 $38,718.75 $37,094.90 $38,988.31 3 2 points Skipped Chapter 06 Practice Test Question 02 You have decided to spend $6,400 on a vacation 3 years from now, $16,000 on a vacation 5 years from now, and $13,000 on a vacation 7 years from now. You want to deposit sufficient funds today to cover these future expenditures. How much do you need to deposit today if you can earn 8.9 percent on your savings? Print References Multiple Choice $21,415.93 $21,658.96 $22,559.62 $23,460.28 5 Chapter 06 Practice Test Question 05 How much more current value does a perpetuity of $280 a year have as compared to an annuity of $280 a year for 50 years given an interest rate of 8.8 percent? 3 points Skipped Multiple Choice Print References $65.08 $32.71 $46.91 $28.13 3 6 Chapter 06 Practice Test Question 06 What is the present value of an annuity due if the payments are $71 a month for 72 months at a monthly interest rate of 1.5 percent? points Multiple Choice Skipped Print References $3,005.13 $3,008.11 $3,067.39 $3,159.67 7 Chapter 06 Practice Test Question 07 Christina has been saving $14,500 a year ever since she started to work. She has earned an average return of 10.16 percent and now has a total of $272,629 in her savings account. How many years has it been since Christina first started saving money? 3 points Skipped Multiple Choice Print References 13.00 years 11.04 years 8.01 years 10.19 years 8 00 3 points Skipped Print References Chapter 06 Practice Test Question 08 Wissler, Inc. owes $293,000 to the bank for some improvements made to its office building. The loan is for 60 months and the monthly payment is $6,545.79 What is the interest rate on the loan? Multiple Choice 12.19 percent 12.69 percent 12.94 percent O 11.94 percent 9 points Chapter 06 Practice Test Question 09 Russell owns a preferred stock that pays a constant annual dividend of $21 a share. What is this stock worth to him today if he requires a 15.5 percent rate of return? Skipped Multiple Choice Print References $24.25 $48.51 $135.48 $111.22 3 10 Chapter 06 Practice Test Question 12 Your credit card charges interest of 2.8 percent per month. What is the annual percentage rate? points Multiple Choice Skipped 33.60 percent Print References 28.00 percent 34.59 percent 30.34 percent 3 12 Chapter 06 Practice Test Question 14 What is the effective annual rate of a loan that charges interest at a rate of 6.9 percent, compounded continuously? points Multiple Choice Skipped 7.14 percent Print References 7.36 percent 7.04 percent 7.25 percent 3 13 Chapter 06 Practice Test Question 17 Travis just purchased a new Corvette. To finance this purchase, he paid $41,000 in cash and borrowed $58,000 from his father. Travis has promised to repay his father in 6 equal annual payments at an interest rate of 6.1 percent. What is the amount of each payment? points Skipped Multiple Choice Print References $11,860.57 $11,832.12 $9,667.00 $9,967.00 14 Chapter 06 Practice Test Question 20 Lexair Industrial Supply borrowed $888,400 today to purchase some new equipment. The firm financed this amount for 4 years at 8 percent interest. What is the amount of each quarterly payment? 3 points Skipped Multiple Choice Print o $65,430.77 References $63,110.42 $59,745.01 $58,745.01 15 Problem 6-1 Present Value and Multiple Cash Flows [LO1] McCann Co. has identified an investment project with the following cash flows. Year Cash Flow 6 points 1 $ 800 2 1,090 3 1,350 Skipped 4 1,475 Print References a. If the discount rate is 7 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the present value at 17 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the present value at 25 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Present value at 7% b. Present value at 17% c. Present value at 25% 16 Problem 6-3 Future Value and Multiple Cash Flows [LO1] Fuente, Inc., has identified an investment project with the following cash flows. 6 Year Cash Flow points 1234 $ 990 1,220 1,440 2,180 Print References a. If the discount rate is 8 percent, what is the future value of these cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the discount rate is 11 percent, what is the future value of these cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. If the discount rate is 24 percent, what is the future value of these cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Future value at 8% b. Future value at 11% c. Future value at 24% 12 17 points Print References Problem 6-4 Calculating Annuity Present Value [LO1] An investment offers $7,000 per year, with the first payment occurring one year from now. The required return is 6 percent. a. What would the value be today if the payments occurred for 15 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What would the value be today if the payments occurred for 40 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What would the value be today if the payments occurred for 75 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What would the value be today if the payments occurred forever? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Present value of 15 annual payments b. Present value of 40 annual payments C. Present value of 75 annual payments d. Present value of annual payments forever 3 18 points Problem 6-5 Calculating Annuity Cash Flows [LO1] If you put up $37,000 today in exchange for a 6.25 percent, 15-year annuity, what will the annual cash flow be? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Annual cash flow Print References 6 19 points Problem 6-7 Calculating Annuity Values [LO1] You plan to deposit $5,200 at the end of each of the next 15 years into an account paying 11.3 percent interest. a. How much will you have in your account if you make deposits for 15 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. How much will you have if you make deposits for 30 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Print a. Future value of 15 deposits References b. Future value of 30 deposits 3 20 points Problem 6-10 Calculating Perpetuity Values [LO1] The Maybe Pay Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $34,000 per year forever. If the required return on this investment is 6.3 percent, how much will you pay for the policy? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value Print References 9 21 points Problem 6-14 Calculating EAR [LO4] First National Bank charges 13.7 percent compounded monthly on its business loans. First United Bank charges 14 percent compounded semiannually. Calculate the EAR for First National Bank and First United Bank. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) EAR Print First National First United References % % As a potential borrower, which bank would you go to for a new loan? First United Bank O First National Bank 3 22 points Problem 6-16 Calculating Future Values [LO1] What is the future value of $3,100 in 18 years assuming an interest rate of 8.4 percent compounded semiannually? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Future value Print References 3 23 points Print Problem 6-40 Calculating the Number of Payments [LO2] You're prepared to make monthly payments of $250, beginning at the end of this month, into an account that pays 6.6 percent interest compounded monthly. How many payments will you have made when your account balance reaches $16,000? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Number of payments References 3 24 points Problem 6-54 Calculating Annuities Due [LO1] You want to buy a new sports car from Muscle Motors for $70,000. The contract is in the form of a 60-month annuity due at an APR of 6.85 percent. What will your monthly payment be? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Monthly payment Print References

Step by Step Solution

There are 3 Steps involved in it

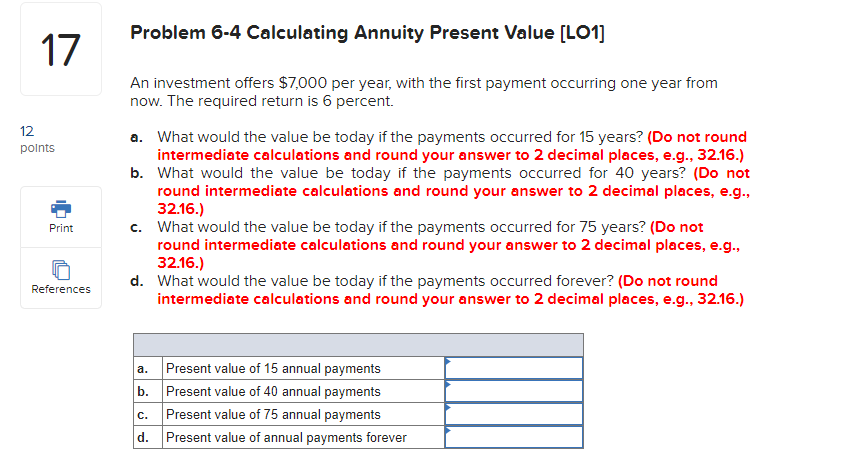

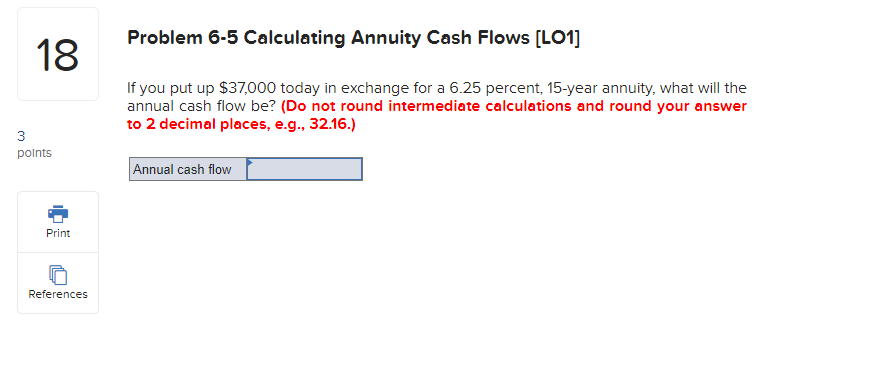

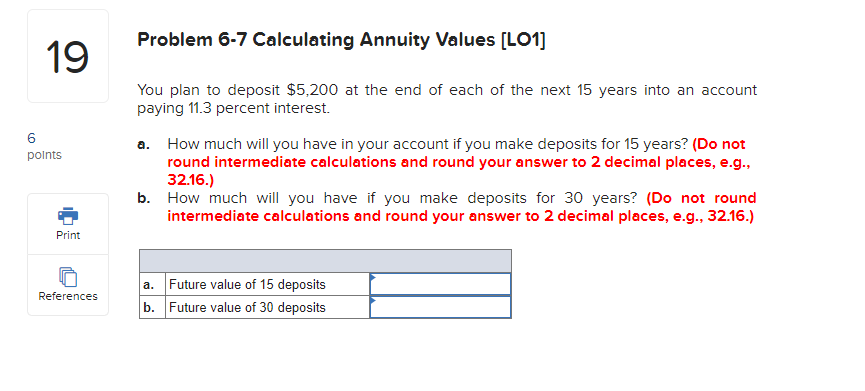

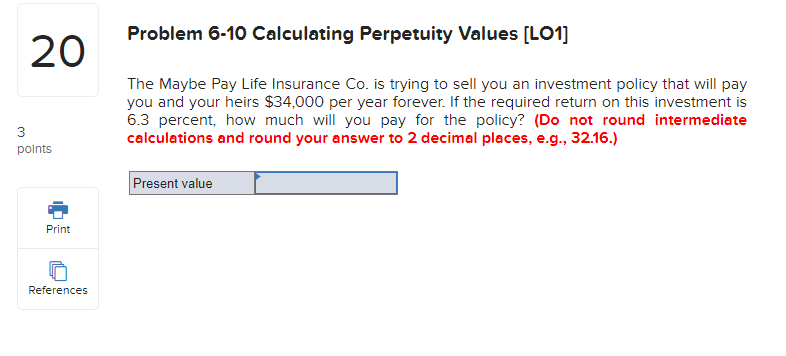

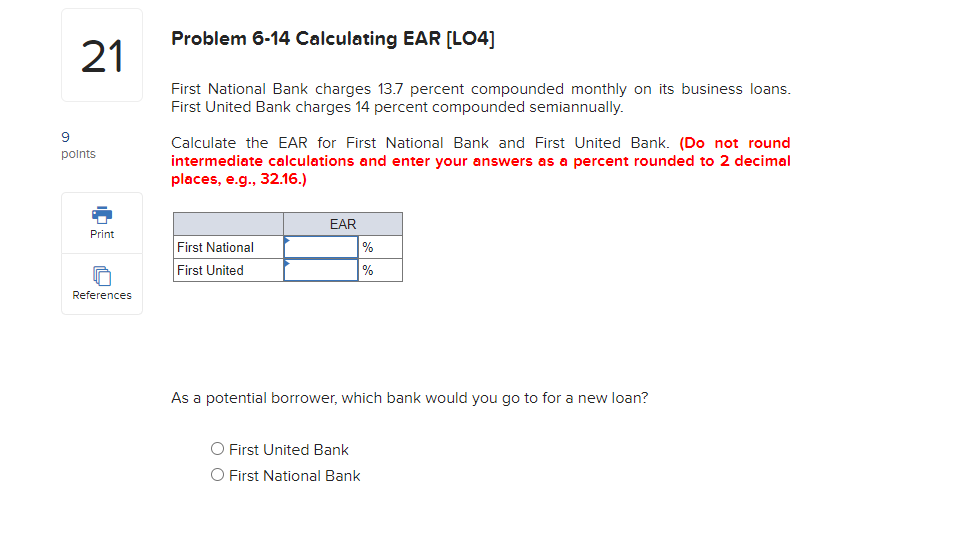

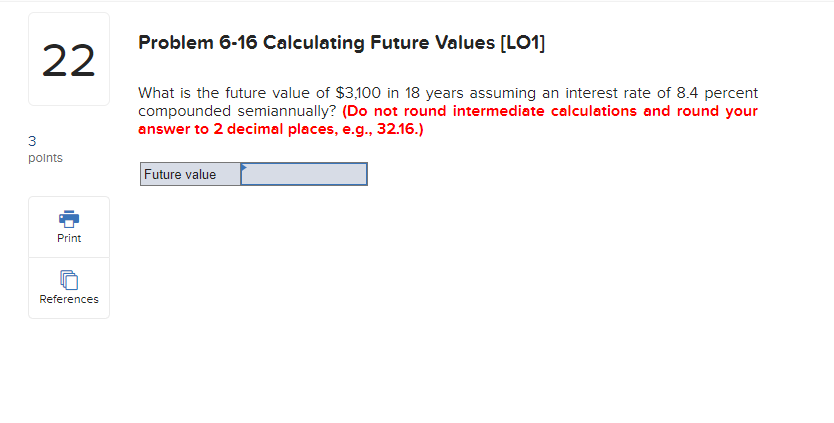

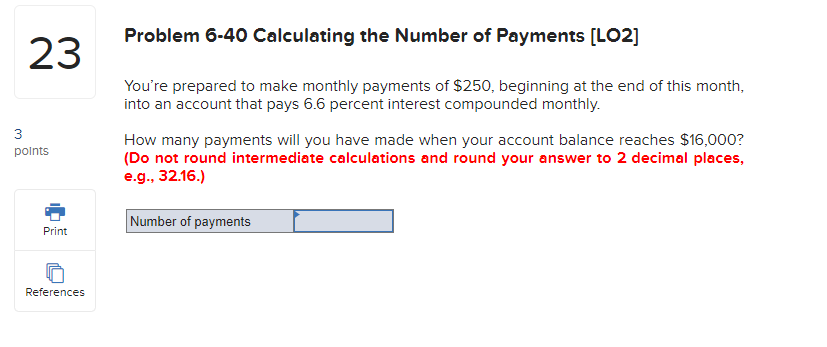

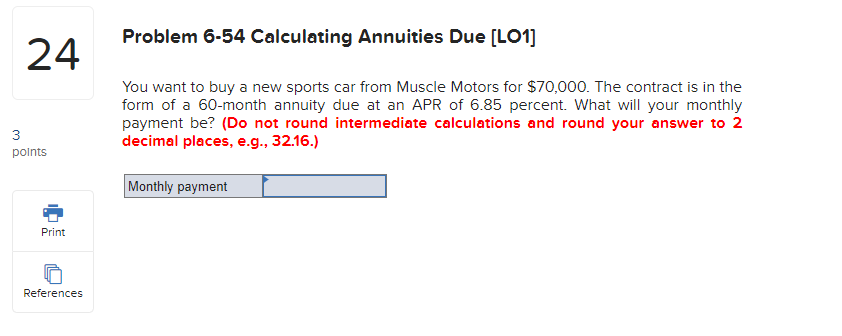

Get step-by-step solutions from verified subject matter experts