Question: (3 points) Both a call option and a put option are currently traded on stock AXT. Both options have a strike price of $90 and

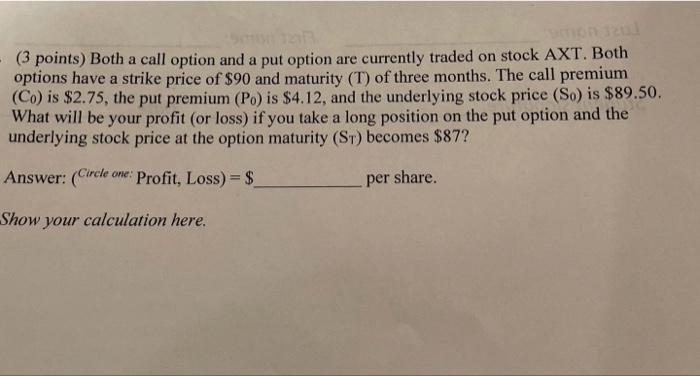

(3 points) Both a call option and a put option are currently traded on stock AXT. Both options have a strike price of $90 and maturity (T) of three months. The call premium (C0) is $2.75, the put premium (P0) is $4.12, and the underlying stock price (S0) is $89.50. What will be your profit (or loss) if you take a long position on the put option and the underlying stock price at the option maturity (ST) becomes $87? Answer: (Circle ane: Profit, Loss) =$ per share. Show your calculation here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts